RBSE Solutions for Class 11 Accountancy Chapter 3 Recording of Transactions-I

Rajasthan Board RBSE Solutions for Class 11 Accountancy Chapter 3 Recording of Transactions-I Textbook Exercise Questions and Answers.

RBSE Class 11 Accountancy Solutions Chapter 3 Recording of Transactions-I

RBSE Class 11 Accountancy Recording of Transactions-I Textbook Questions and Answers

Test Your Understanding I.

Question 1.

Double entry accounting requires that:

(i) All transactions that create debits to asset accounts must create credits to liability or capital accounts;

(ii) A transaction that requires a debit to a liability account require a credit to an asset account;

(iii) Every transaction must be recorded with equal debits equal total credits.

Answer:

(iii) Every transaction must be recorded with equal debits equal total credits.

Question 2.

State different kinds of transactions that increase and decrease capital.

Answer:

(Capital increases by net profit and firesh capital introduced, decreases by drawings and net loss)

Question 3.

Does debit always mean increase and credit always mean decrease?

Answer:

No

Question 4.

Which of the following answers properly classifies these commonly used accounts:

(1) Building

(2) Wages

(3) Credit sales

(4) Credit purchases

(5) Electricity charges due but not yet paid (outstanding electricity bills

(6) Godown rent paid in advance (prepaid godown rent)

(7) Sales

(8) Fresh capital introduced

(9) Drawings

(10) Discount paid Assets Liabilities Capital Revenue Expense

(i) 5,4, 3, 9, 6 2, 10 8,7

(ii) 1,64,5 87,32,9,10

(iii) 2,10,44,687,5 1,3,9

Answer:

(ii) 1,64,5 87,32,9,10

Test Your Understanding II.

l. State the title of the accounts affected, type of account and the account to be debited and account to be credited :

1. Bhanu commenced business with cash 1,00,000

2. Purchased goods on credit from Ramesh 40,000

3. Sold goods for cash 30,000

4. Paid salaries 3,000

5. Furniture purchased for cash 10,000

Answers:

1. Cash account and capital account, Assets and Liabilities, Assest increase and capital increase.

2. Purchase account and Ramesh account, Expenses and Liabilities, Expenses and Liabilities increases.

3. Cash account and sales account, Assets and Revenues, Assets and Revenues increases.

4. Salaries account and cash account, Expense and Assets, Expenses increases Assets decreases.

5. Furniture account and Cash account, Asset increases Asset decreases.

6. Loan account and Bank, Liability and Asset, Liabilities increases Asset decreases.

7. Sarita account and Sales account, Asset and Revenue, Assets decreases Revenue decreases.

8. Ramesh account and Cash, liabilities and Assets, Liabilities decreases Assets increases.

9. Rent account and Cash account, Expense and Assets, Expenses increases Assets decreases.

Test Your Understanding III.

Choose the Correct Answer :

Question 1.

The ledger folio column of journal is used to:

(a) Record the date on which amount posted to a ledger account.

(b) Record the number of ledger account to which information is posted.

(c) Record the number of amounts posted to the ledger account.

(d) Record the page number of the ledger account.

Answer:

(d) Record the page number of the ledger account.

Question 2.

The journal entry to record the sale of services on credit should include:

(a) Debit to debtors and credit to capital.

(b) Debit to cash and Credit to debtors.

(c) Debit to fees income and Credit to debtors.

(d) Debit to debtors and Credit to fees income.

Answer:

(d) Debit to debtors and Credit to fees income.

Question 3.

The journal entry to record purchase of equipment for ₹ 2,00,000 cash and a balance of ₹ 8,00,000 due in 30 days include:

(a) Debit equipment for ₹ 2,00,000 and Credit cash 2,00,000.

(b) Debit equipment for ₹ 10,00,000 and Credit cash ₹ 2,00,000 and creditors ₹ 8,00,000.

(c) Debit equipment ₹ 2,00,000 and Credit debtors ₹ 8,00,000.

(d) Debit equipment ₹ 10,00,000 and Credit cash ₹ 10,00,000.

Answer:

(b) Debit equipment for ₹ 10,00,000 and Credit cash ₹ 2,00,000 and creditors ₹ 8,00,000.

Question 4.

When a entry is made in journal:

(a) Assets are listed first.

(b) Accounts to be debited listed first.

(c) Accounts to be credited listed first.

(d) Accounts may be listed in any order.

Answer:

(b) Accounts to be debited listed first.

Question 5.

If a transaction is properly analysed and recorded:

(a) Only two accounts will be used to record the transaction. -

(b) One account will be used to record transaction.

(c) One account balance will increase and another will decrease.

(d) Total amount debited will equals total amount credited.

Answer:

(d) Total amount debited will equals total amount credited.

Question 6.

The journal entry to record payment of monthly bill will include:

(a) Debit monthly bill and Credit capital.

(b) Debit capital and Credit cash.

(c) Debit monthly bill and Credit cash.

(d) Debit monthly bill and Credit creditors.

Answer:

(c) Debit monthly bill and Credit cash.

Question 7.

Journal entry to record salaries will include:

(a) Debit salaries Credit cash.

(b) Debit capital Credit cash.

(c) Debit cash Credit salary.

(d) Debit salary Credit creditors.

Answer:

(a) Debit salaries Credit cash.

Test Your Understanding IV.

Fill in the blanks:

1.Issued a cheque for ₹ 8,000 to pay rent. The account to be debited is ................

2. Collected ₹ 35,000 from debtors. The account to be credited is ................

3. Purchased office stationery for ₹ 18,000. The account to be credited is ................

4. Purchased new machine for ₹ 1,70,000 and issued cheque for the same. The account to be debited is ................

5. Issued cheque for ₹ 70,000 to pay off on of the creditors. The account to be debited is ................

6. Returned damaged office stationary and received ₹ 50,000. The account to be credited is ................

7. Provided services for ₹ 65,000 on credit. The account to be debited is ................

Answers:

1. Rent

2. Debtors

3. Cash

4. Machine

5. Creditors

6. Office stationary

7. Debtors

Test Your Understanding V.

Select Right Answer:

Question 1.

Voucher is prepared for:

(i) Cash received and paid

(ii) Cash/Credit sales

(iii) Cash/Credit purchase

(iv) All of the above

Answer:

(iv) All of the above

Question 2.

Voucher is prepared from:

(i) Documentary evidence

(ii) Journal entry

(iii) Ledger account

(iv) All of the above

Answer:

(i) Documentary evidence

Question 3.

How many sides does an account have?

(i) Two

(ii) Three

(iii) One

(iv) None of these

Answer:

(i) Two

Question 4.

A purchase of machine for cash should be debited to:

(i) Cash account

(ii) Machine account

(iii) Purchase account

(iv) None of these

Answer:

(ii) Machine account

Question 5.

Which of the following is correct?

(i) Liabilities = Assets + Capital

(ii) Assets = Liabilities - Capital

(iii) Capital = Assets - Liabilities

(iv) Capital = Assets + Liabilities

Answer:

(iii) Capital = Assets - Liabilities

Question 6.

Cash withdrawn by the Proprietor should be credited to:

(i) Drawings account

(ii) Capital account

(iii) Profit and loss account

(iv) Cash account

Answer:

(iv) Cash account

Question 7.

Find the correct statement:

(i) Credit a decrease in assets

(ii) Credit the increase in expenses

(iii) Debit the increase in revenue

(iv) Credit the increase in capital

Answer:

(iv) Credit the increase in capital

Question 8.

The book in which all accounts are maintained is known as:

(i) Cash Book

(ii) Journal

(iii) Purchases Book

(iv) Ledger

Answer:

(iv) Ledger

Question 9.

Recording of transaction in the Journal is called:

(i) Casting

(ii) Posting

(iii) Journalising

(iv) Recording

Answer:

(iii) Journalising

Short Answer Type Questions

Question 1.

State the three fundamental steps in the accounting process.

Answer:

Three fundamental steps in the accounting process are:

(1) Analysing: Analysing the transaction to see the impact in the accounts

(2) Recording: Recording the transaction in the journal book

(3) Posting: Posting the transaction in the concerned accounts in the principal book, ledger

Question 2.

Why is the evidence provided by source documents important to accounting?

Answer:

Documents on the basis of which entries are recorded in the books of accounts are named as “source documents”. According to the verifiable objective principle of accounting, each transaction recorded in the books of account should have adequate proof to support it. These documents are written and authentic proof of the correctness of the recorded transactions.

Example:

(1) Cash memo

(2) Invoice and bill

(3) Receipt

Source documents are also prepared for recording internal events such as depreciation and valuation of stock. Thus, there must be a source document for each transaction recorded in the books of accounts.

Question 3.

Should a transaction be first recorded in a journal or ledger? Why?

Answer:

Yes, a transactions are firstly recorded in Journal. Journal is the book of original entry containing the record of business transactions in a chronological order from which posting to ledger is made. The recording of transactions in the Journal is done according to the nature of transactions. This process of recording transactions in a journal is known as “Journalising”

Question 4.

Are debits or credits listed first in journal entries? Are debits or credits indented?

Answer:

The entries in the journal books are posted on the basis of dual aspect principle. In the journal book, the accounts) which are debited, are written first and the accounts) which are credited, are written below the accounts) debited.' Indentation means leaving space. The account which is credited is written after leaving some space to distinguish from the account debited. The symbol ‘Dr’ is written after the account which is debited but the symbol ‘Cr’ is not written anywhere with the account credited.

Question 5.

Why are some accounting systems called double accounting systems?

Answer:

Modem system of recording transactions in the books is called double entry system. Double entry means every transaction is recorded twice - in the debit side and in the credit side of two different accounts at the same time. This is so because every transaction has a two-fold aspect i.e., the receiving of benefit and giving of the benefit. The double aspect, has been termed as the ‘debit aspect’ and the ‘credit aspect’. Every debit effect, has a corresponding and simultaneous credit effect.

Question 6.

Give a specimen of an account.

Answer:

Name of the Account

|

Dr. |

Particulars |

J.F |

Amount ₹ |

Date |

Particulars |

J.F |

Cr |

|

|

|

|

|

|

|

|

|

Question 7.

Why are the rules of debit and credit same for both liability and capital?

Answer:

Every business has two types of funds, internal and external. Internal funds are raised from the owner(s) and external funds are raised from the banks, creditors and money lenders. Both funds constitute liabilities for a business, one is internal liability and other is external liability. The business is not only liable to external liability holders but it is equally liable to owner towards the capital contribution due to separate legal entity concept.

Both types of liabilities have same nature for a business and have credit balance. To increase any liability, it is credited and to decrease, liability is debited. This is the main reason, the rules of debit and credit are same for capital and liability.

Question 8.

What is the purpose of posting J.F numbers that are entered in the journal at the time entries are posted to the accounts?

Answer:

There are two main reasons of posting J.F. numbers in the accounts:

(a) J.F. number in the accounts helps in locating the accounts in the journal book.

(b) J.F. number in the accounts ensures that entries have been posted in their respective accounts.

Question 9.

What entry (debit or credit) would you make to:

(a) increase revenue

(b) decrease in expense,

(c) record drawings

(d) record the fresh capital introduced by the owner.

Answer:

The accounts would be debited or credited as follows:

(a) Increase in Revenue: Revenue account will be credited as revenue account has credit balance.

(b) Decrease in Expense: Expense account will be credited as expense account has debit balance.

(c) Record Drawings: Drawings account will be debited as drawings have debit balance.

(d) Record of Fresh Capital: Capital account will be credited as capital has credit balance.

Question 10.

If a transaction has the effect of decreasing an asset, is the decrease recorded as a debit or as a credit? If the transaction has the effect of decreasing a liability, is the decrease recorded as a debit or as a credit?

Answer:

(i) Where there is an increase in amount of an asset, amount is debited and if there is decrease in amount, account will be credited.

(ii) Where the amount of liability increases, the increased amount will be credited in liability account. If amount of liability decreases, the decreases amount will be debited in liability A/c.

Long Answer Type Questions

Question 1.

Describe the events recorded in accounting systems and the importance of source documents in those systems?

Answer:

The transactions in accounting are recorded on the basis of give and take. When the funds are introduced, the business firm is taker and owner or outsider is the give. When we buy any asset, the vendor is giver and we are taker. When wages are salaries are paid, the recipient is taker and business is giver. Thus, the business transactions are recorded on the basis of exchange of asset or service against payment of cash or otherwise.

All business transactions are recorded with certain evidence of happening of an event or transaction. Such evidences are in the form of cash memo, invoice, bill, pay in slip, debit note, credit note etc. these evidence are known as source documents and such documents become the basis to prepare accounting vouchers.

Importance of Source Voucher:

(a) It provides evidence of happening of a transaction.

(b) It provides complete details regarding date, parties and accounts involved.

(c) It can act as evidence in the court of law.

(d) It helps in verifying the transaction while auditing the accounts.

Question 2.

Describe how debits and credits are used to analyse transactions.

Answer:

Accountancy is based on dual aspect principle which means every financial transaction is bound to have double effect in the accounts, on the debit side of one account and on the credit side of another account involved. Every transaction has at least two accounts involved but the sum of the accounts debited is always equal to the sum of die accounts credited. Amount of every account is shown at two places and this ensures mathematical accuracy of accounting information which helps to tally trial balance and then balance sheet. Duality of transaction also helps in verification and auditing of accounts.

Question 3.

Describe how accounts are used to record information about the effects of transactions?

Answer:

Refer the topic, Rules of debit and credit’ with example.

Question 4.

What is a journal? Give a specimen of journal showing at least five entries.

Answer:

Refer the topic, Books of original entry.

Question 5.

Differentiate between source documents and vouchers.

Answer:

Source documents. Source of document are prepared for recording internal events such as depreciation and valuation of stock, document on the basis of which entries are recorded in the books of account are named as source documents.

Example: (1) Cash Memo (2) Invoice and Bill (3) Receipt

Vouchers. Accounting Vouchers also serves as source document. These are arranged in a chronological manner. Accounting of vouchers may be classified as cash voucher (debit voucher & credit voucher) and transfer voucher. Voucher which records a transaction that include multiple debits/credits is called compound vouchers.

Difference between source document and voucher

|

Basis |

Source document |

Accounting voucher |

|

Meaning |

It is an evidence of happening of a transaction |

It is prepared to record transactions based on source documents. |

|

Purpose |

It is used to prepare accounting vouchers. |

It is prepared to record transactions based on source documents. |

|

Recording |

It is prepared by at the time of happening of transaction. |

It is prepared at the time of recording of transaction. |

|

Authenticity |

It can be used as an legal evidence. |

It is used to authenticate the transactions for arithmetical accuracy of accounts. |

|

Examples |

Cash memo, pay-in-slip, invoice, receipt etc. |

Debit voucher, credit voucher, transfer voucher and compound voucher. |

Question 6.

Accounting equation remains intact under all circumstances. Justify the statement with the help of an example.

Answer:

Recording of transactions is based on accounting equation. To run a business, resources are required which have to be supplied by someone. The resources of the business are called assets. In the beginning such resources are supplied by the proprietor himself. The total amount invested by proprietor in the business is known as capital or owner’s equity.

Dual concept may be stated as “For every debit, there is a credit”. Every transaction should have two sided effect to the extent of same amount. This concept has resulted in accounting equation which states that at any point of the time, assets of any entity must be equal to the total of owner’s equity and outsider’s liabilities. This may be expressed in form of equation.

Assets = Capital + Liabilities

Suppose a businessman purchases machinery. He will have to face one of the following situation:

(a) If he purchases this asset on credit, he will have to pay this amount in future.

(b) If he purchases this asset in cash, he will have to pay cash.

(c) If he receives this asset as a donation, this will be the profit of the business and will raise owner’s equity.

(d) If he himself contributes this asset to the business, this will enhance his capital.

Thus, we conclude from the above that

Asset = Equities or

Assets = Outsiders’ Equities + Owners’ Equity

Assets = External Liabilities + Internal Liability

Assets = Liabilities + Capital

In other words, we can say that accounting equation remains intact under all circumstances.

Question 7.

Explain the double entry mechanism with an illustrative example.

Answer:

As the name suggest, this system involves a ‘double entry’, which means that every transaction is recorded twice in the debit side and in the credit side of two different accounts at the same time. This is so because every transaction involving money or money’s worth has two fold aspect, the receiving of a value on the one hand and giving of the same value on the other. This two-fold nature in all transactions must be recorded in the books and this gives rise to the term Double Entry Bookkeeping.”

The double aspect has been termed as the ‘debit aspect’ and the ‘credit aspect’. Every debit effect has a corresponding and simultaneous credit effect. In the Double Entry system, this duality has been achieved by dividing every account into two sides the left side being named as the debit side and the right side as the credit side.

The debit aspect of a transaction is reflected by making entry in the debit side of the affected account and similarly the credit effect is shown by an entry in the credit side of the other affected account. On any date the total amount entered on the debit sides of various accounts is always equal to the total amount entered on the credit sides. This also serves as a ready check on the arithmetical accuracy of the entries.

Example: From the following transactions, let’s find out the nature of account and also state which account should be debited and which account should be credited:

(a) Proprietor introduced capital into the business.

(b) Proprietor withdrew cash for personal use.

(c) Proprietor paid school fees of his children.

(d) Proprietor paid shop rent.

(e) Proprietor opened bank account and deposited cash.

|

Transaction |

Accounts involved |

Nature of account |

Debit or Credit |

|

(a) |

Cash A/c |

Asset |

Dr |

|

|

Capital A/c |

Capital (Liability) |

Cr |

|

(b) |

Drawings A/c |

Asset |

Dr |

|

|

Cash A/c |

Asset |

Cr |

|

(c) |

Drawings A/c |

Asset |

Dr |

|

|

Cash A/c |

Asset |

Cr |

|

(d) |

Rent A/C |

Expense |

Dr |

|

|

Cash A/c |

Asset |

Cr |

|

(e) |

Bank A/c |

Asset |

Dr |

|

|

Cash A/c |

Asset |

Cr |

Numerical Questions

1. Prepare accounting equation on the basis of the following:

(a) Harsha started business with cash ₹ 2,00,000

(b) Purchased goods from Naman for cash ₹ 40,000

(c) Sold goods to Bhanu costing ₹ 10,000/- ₹12,000

(d) Bought furniture on credit ₹ 7,000

Solution:

Accounting Equation

|

S. No. |

Capital |

Liabilities |

Assets |

|||

|

Creditors |

Cash |

Goods |

Debtors |

Furniture |

||

|

1. |

2,00,000 |

|

2,00,000 |

|

|

|

|

2. |

|

|

(40,000) |

40,000 |

|

|

|

New equation |

2,00,000 |

|

1,60,000 |

40,000 |

|

|

|

3. |

2,000 |

|

|

(10,000) |

12,000 |

|

|

New equation |

2,02,000 |

|

1,60,000 |

30,000 |

12,000 |

|

|

4. |

|

7,000 |

|

|

|

7,000 |

|

Total |

2,02,000 |

7,000 |

1,60,000 |

30,000 |

12,000 |

7,000 |

Question 2.

Prepare accounting equation from the following:

(a) Kunal started business with cash ₹ 2,50000

(b) He purchased furniture for cash ₹ 35,000

(c) He paid commission ₹ 2,000

(d) He purchases goods on credit ₹ 40,000

(e) He sold goods (Costing ₹ 20,000) for cash ₹ 26,000

Solution: Accounting Equation:

|

S. No. |

Capital |

Liabilities |

Assets |

||

|

Creditors |

Cash |

Furniture |

Goods |

||

|

1. |

2,50,000 |

|

2,50,000 |

|

|

|

2. |

|

|

(35,000) |

35,000 |

|

|

New equation |

2,50,000 |

|

2,15,000 |

35,000 |

|

|

3. |

(2,000) |

|

(2,000) |

|

|

|

New equation |

2,48,000 |

|

2,13,000 |

35,000 |

|

|

4. |

|

40,000 |

|

|

40,000 |

|

New equation |

2,48,000 |

|

2,13,000 |

35,000 |

40,000 |

|

5. |

6,000 |

|

26,000 |

|

(20,000) |

|

|

2,54,000 |

40,000 |

2,39,000 |

35,000 |

20,000 |

Question 3.

Mohit has the following transactions, prepare accounting equation:

(a) Business started with cash ₹ 1,75,000

(b) Purchased goods from Rohit ₹ 50,000

(c) Sales goods on credit to Manish (Costing ₹ 17,500) ₹ 20,000

(d) Purchased furniture for office use ₹ 10,000

(e) Cash paid to Rohit in full settlement ₹ 48,500

(f) Cash received from Manish ₹ 20,000

(g) Rent paid ₹ 1,000 (A) Cash withdrew for personal use ₹ 3,000

Solution:

Accounting Equation:

|

S. No. |

Capital |

Liabilities |

Assets |

|||

|

Creditors |

Cash |

Debtors |

Goods |

Furniture |

||

|

1. |

1,75,000 |

|

1,75,000 |

|

|

|

|

2. |

|

50,000 |

|

|

50,000 |

|

|

New equation |

1,75,000 |

50,000 |

1,75,000 |

|

50,000 |

|

|

3. |

2500 |

|

|

20,000 |

(17,500) |

|

|

New equation |

1,77,500 |

50,000 |

175,000 |

20,000 |

32,500 |

|

|

4. |

|

|

(10,000) |

|

|

10,000 |

|

New equation |

1,77,500 |

50,000 |

1,65,000 |

20,000 |

32,500 |

10,000 |

|

5. |

1500 |

(50,000) |

(48,500) |

|

|

|

|

New equation |

1,79,000 |

|

1,16,500 |

20,000 |

32,500 |

10,000 |

|

6. |

|

|

20,000 |

(20,000) |

|

|

|

New equation |

1,79,000 |

|

1,36,500 |

|

32,500 |

10,000 |

|

7. |

(1,000) |

|

(1,000) |

|

|

|

|

New equation |

178,000 |

|

1,35,500 |

|

32,500 |

10,000 |

|

8. |

(3,000) |

|

(3,000) |

|

|

|

|

New equation |

1,75,000 |

|

1,32,500 |

|

32,500 |

10,000 |

Question 4.

Rohit has the following transactions:

(a) Commenced business with cash ₹1,50,000

(b) Purchased machinery on credit ₹ 40,000

(c) Purchased goods for cash ₹ 20,000

(d) Purchased car for personal use ₹ 80,000

(e) Paid to creditors in full settlement ₹ 38,000

(f) Sold goods for cash costing ₹5,000 ₹4,500

(g) Paid rent ₹1,000

(h) Commission received in advance ₹ 2,000

Prepare the Accounting Equation to show the effect of the above transactions on the assets, liabilities and capital.

Solution:

Accounting Equation:

|

S. No. |

Capital |

Liabilities |

Assets |

|||

|

Creditors |

Advance Income |

Cash |

Machinery |

Goods |

||

|

1. |

1,50,000 |

|

|

1,50,000 |

|

|

|

2. |

|

40,000 |

|

|

40,000 |

|

|

New equation |

1,50,000 |

40,000 |

|

1,50,000 |

40,000 |

|

|

3. |

|

|

|

(20,000) |

|

20,000 |

|

New equation |

1,50,000 |

40,000 |

|

1,30,000 |

40,000 |

20,000 |

|

4. |

(80,000) |

|

|

(80,000) |

|

|

|

New equation |

70,000 |

40,000 |

|

50,000 |

40,000 |

20,000 |

|

5. |

|

(40,000) |

|

(40,000) |

|

|

|

New equation |

70,000 |

|

|

10,000 |

40,000 |

20,000 |

|

6. |

(500) |

|

|

4,500 |

|

(5,000) |

|

New equation |

69,500 |

|

|

14,500 |

40,000 |

15,000 |

|

7. |

(1,000) |

|

|

(1,000) |

|

|

|

New equation |

68,500 |

|

|

13,500 |

40,000 |

15,000 |

|

8. |

|

|

2,000 |

2,000 |

|

|

|

New equation |

68,500 |

|

2,000 |

15,500 |

40,000 |

15,000 |

Question 5.

Use accounting equation to show the effect of the following transactions of M/s Royal Traders:

(a) Started business with cash ₹ 1,20,000

(b) Purchased goods for cash ₹ 10,000

(c) Rent received ₹ 5,000

(d) Salary outstanding ₹ 2,000

(e) Prepaid Insurance ₹ 1,000

(f) Received interest ₹ 700

(g) Sold goods for cash (Costing ₹ 5,000) ₹ 7,000

(h) Goods destroyed by fire ₹ 500

(Ans. Assets = Cash ₹ 1,22,700 + Goods ₹ 4,500 + Prepaid insurance ₹ 1,000; Liabilities = Outstanding salary ₹ 2,000 +Capital ₹ 1,26,200)

Solution:

Accounting Equation

|

S. No. |

Capital |

Outstanding expenses |

Assets |

||

|

Cash |

Prepaid expenses |

Goods |

|||

|

1. |

1,20,000 |

|

1,20,000 |

|

|

|

2. |

|

|

(10,000) |

|

10,000 |

|

New equation |

1,20,000 |

|

1,10,000 |

|

10,000 |

|

3- |

5,000 |

|

5,000 |

|

|

|

New equation |

1,25,000 |

|

1,15,000 |

|

10,000 |

|

4. |

(2,000) |

2,000 |

|

|

|

|

New equation |

1,23,000 |

2,000 |

1,15,000 |

|

10,000 |

|

5. |

|

|

(1,000) |

1,000 |

|

|

New equation |

1,23,000 |

2,000 |

1,14,000 |

1,000 |

10,000 |

|

6. |

700 |

|

700 |

|

|

|

New equation |

1,23,700 |

2,000 |

1,14,700 |

1,000 |

10,000 |

|

7. |

2,000 |

|

7,000 |

|

(5,000) |

|

New equation |

1,25,700 |

2,000 |

1,21,700 |

1,000 |

5,000 |

|

8. |

(500) |

|

|

|

(500) |

|

New equation |

1,25,200 |

2,000 |

1,21,700 |

1,000 |

4,500 |

Question 6.

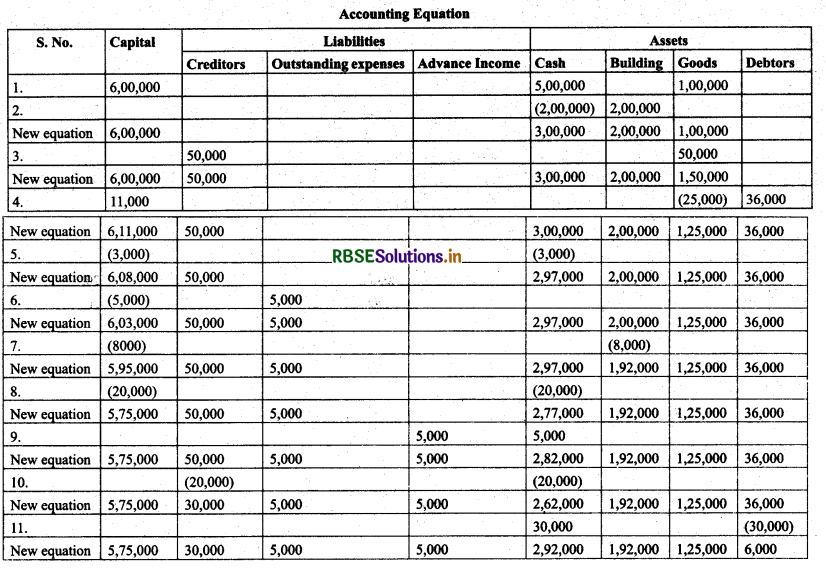

Show the accounting equation on the basis of the following transaction:

(a) Udit started business with:

(i) Cash ₹ 5,00,000

(ii) Goods ₹ 1,00,000

(b) Purchased building for cash ₹ 2,00,000

(c) Purchased goods from Himani ₹ 50,000

(d) Sold goods to Ashu (Cost ₹ 25,000) ₹ 36,000

(e) Paid insurance premium ₹ 3,000

(f) Rent outstanding ₹ 5,000

(g) Depreciation on building ₹ 8,000

(h) Cash with drawn for personal use ₹ 20,000

(i) Rent received in advance ₹ 5,000

(f) Cash paid to Himani on account ₹ 20,000

(k) Cash received from Ashu ₹ 30,000

Solution:

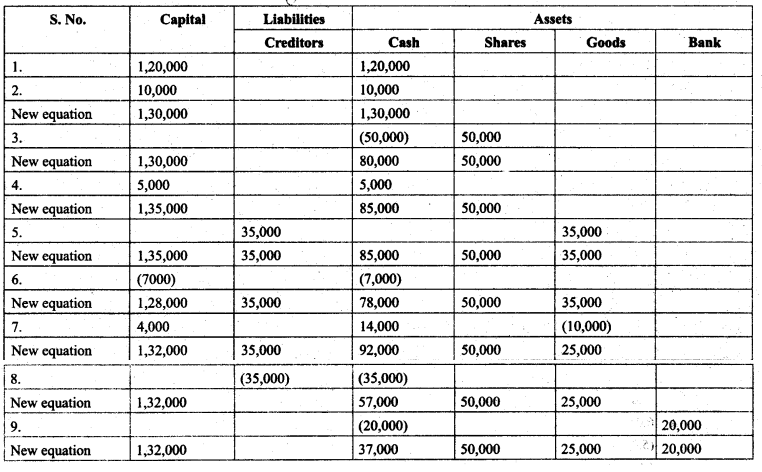

Question 7.

Show the effect of the following transactions on Assets, Liabilities and Capital through accounting equation:

(a) Started business with cash ₹ 1,20,000

(b) Rent received ₹ 10,000

(e) Invested in shares ₹ 50,000

(d) Received dividend ₹ 5,000

(e) Purchase goods on credit from Ragani ₹ 35,000

(f) Paid cash for house hold Expenses ₹ 7,000

(g) Sold goods for cash (costing 10,000) ₹ 14,000

(h) Cash paid to Ragani ₹ 35,000

(i) Deposited into bank ₹ 20,000

Solution:

.Question 8.

Show the effect of following transaction on the accounting equation:

(a) Manoj started business with

(i) Cash ₹ 2,30,000

(ii) Goods ₹ 1,00,000

(iii) Building ₹ 2,00,000

(b) He purchased goods for cash ₹ 50,000

(e) He sold goods (costing 20,000) ₹ 35,000

(d) He purchased goods from Rahul ₹ 55,000

(e) He sold goods to Varun (Costing 52,000) ₹ 60,000

(f) He paid cash to Rahul in full settlement ₹ 53,000

(g) Salary paid by him ₹ 20,000

(h) Received cash from Varun in full settlement ₹ 59,000

(I) Rent outstanding ₹ 3,000

(j) Prepaid Insurance ₹ 2,000

(k) Commission received by him ₹13,000

(l) Amount withdrawn by him for personal use ₹ 20,000

(m) Depreciation charge on building ₹ 10,000

(n) Fresh capital invested ₹ 50,000

(o) Purchased goods from Rakhi ₹ 6,000

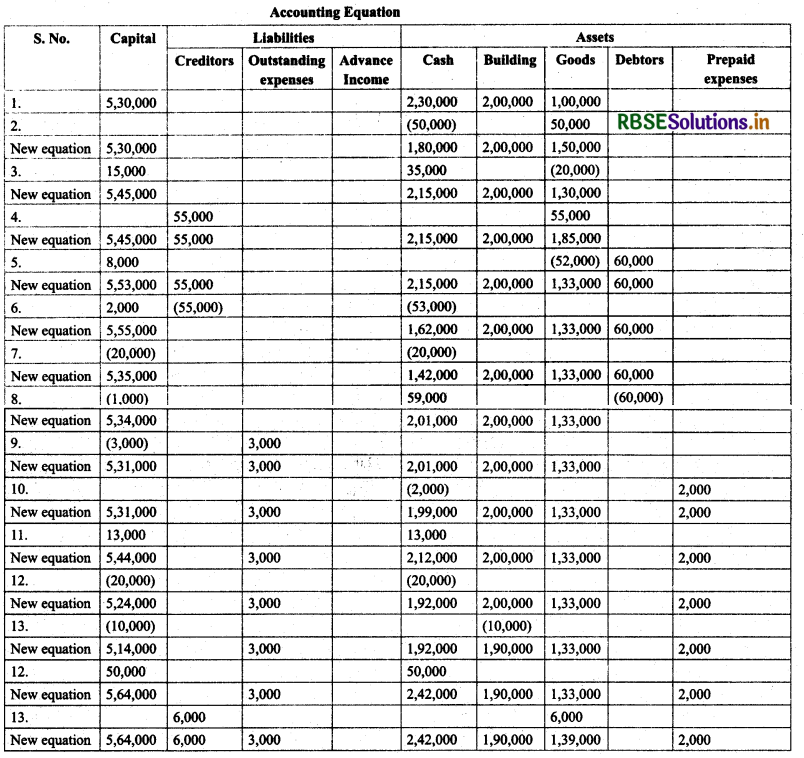

Solution:

Question 9.

Transactions of M/sVipin Traders are given below. Show the effects on Assets, Liabilities and Capital with the help of accounting Equation.

(a) Business started with cash₹ 1,25,000

(b) Purchased goods for cash ₹ 50,000

(c) Purchase furniture from R.K. Furniture₹ 10,000

(d) Sold goods to Parul Traders (Costing ₹ 7,000 vide ₹9,000 bill no. 5674)

(e) Paid cartage ₹ 100

(f) Cash Paid to R.K. furniture in full settlement ₹ 9,700

(g) Cash sales (costing₹ 10,000)₹ 12,000

(h) Rent received ₹ 4,000

(i) Cash withdrew for personal use ₹ 3,000

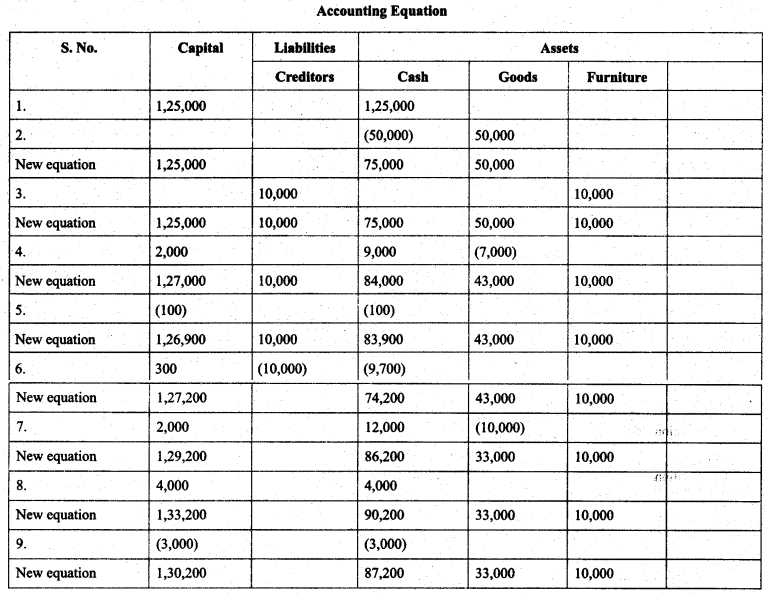

(Ans. Asset=cash₹ 78,200+Goods₹ 33,000+Furniture₹ 10,000 Debtors₹ 9,000= ₹ 1,30,200; Liabilities=Capital₹ 1,30,200)

Solution:

Question 10.

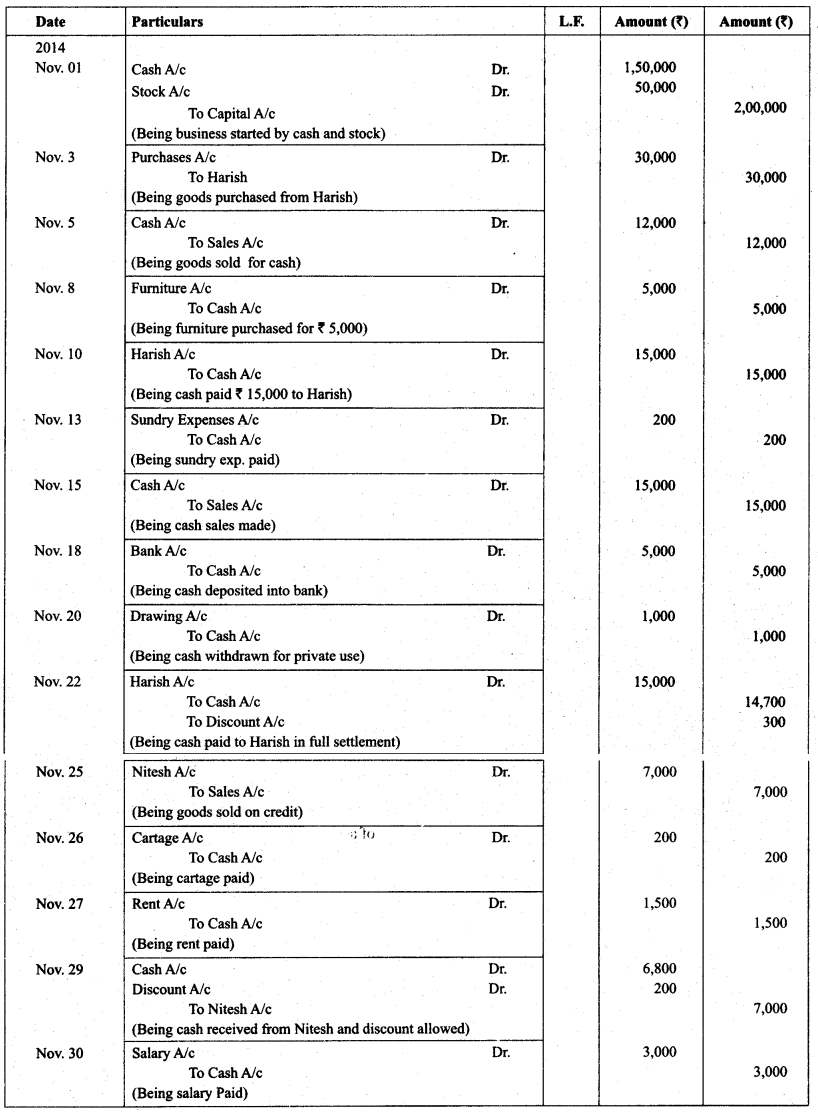

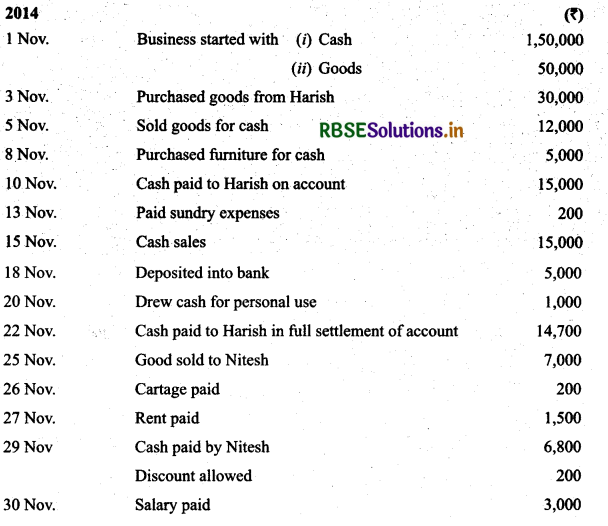

Bobby opened a consulting line and completed these transactions during November, 2014:

(a) Invested ₹ 4,00,000 cash and office equipment with ₹ 1,50,000 in a business called Bobbie Consulting.

(b) Purchased land and a small office building. The land was worth ₹ 1,50,000 and the building worth ₹ 3,50,000. The purchase price was price was paid with ₹ 2,00,000 cash and a long term note payable for ₹ 3,00,000.

(c) Purchased office supplies on credit for ₹ 12,000.

(d) Bobbie transferred title of motor car to the business. The motor car was worth ₹ 90,000.

(e) Purchased for ₹ 30,000 additional office equipment on credit.

(f) Paid ₹ 7,500 salary to the office manager.

(g) Provided services to a client and collected ₹ 30,000

(h) Paid ₹ 4,000 for the month’s utilities.

(i) Paid supplier created in transaction c.

(j) Purchase new office equipment by paying ₹ 93,000 cash and trading in Old equipment with a recorded cost of ₹ 7,000.

(k) Completed services of a client for ₹ 26,000. This amount is to be paid within 30 days.

(l) Received ₹ 19,000 payment from the client created in transaction k.

(m) Bobby withdrew ₹ 20,000 from the business.

Analyse the above stated transactions and open the following T-accounts: Cash, client, office supplies, motor car, building, land, long term payables, capital, withdrawals, salary, expense and utilities expense.

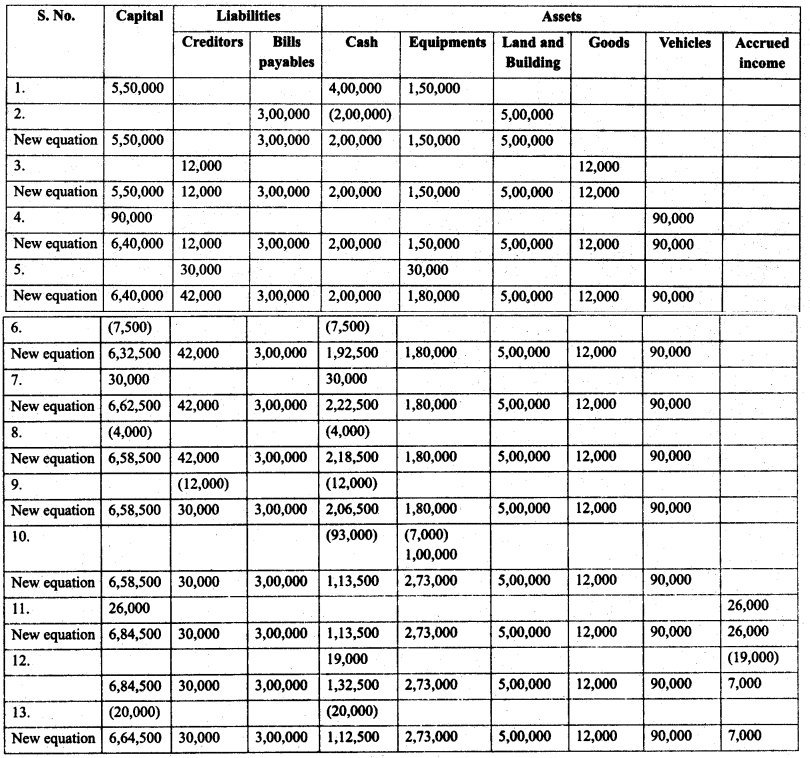

Solution:

Accounting Equation

Question 11.

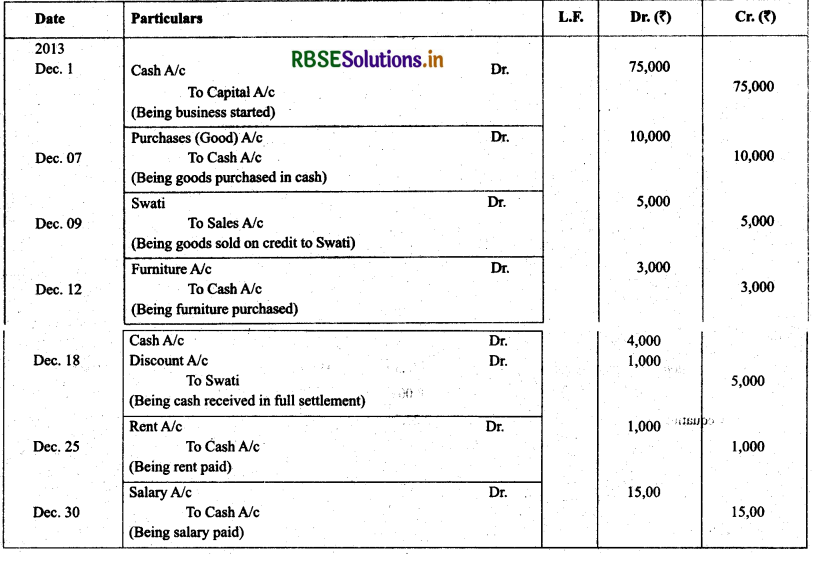

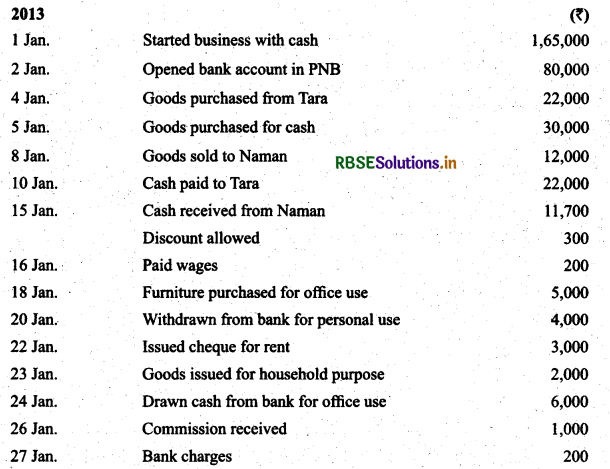

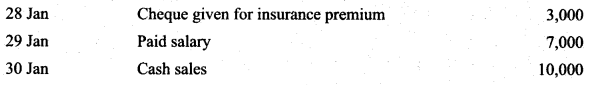

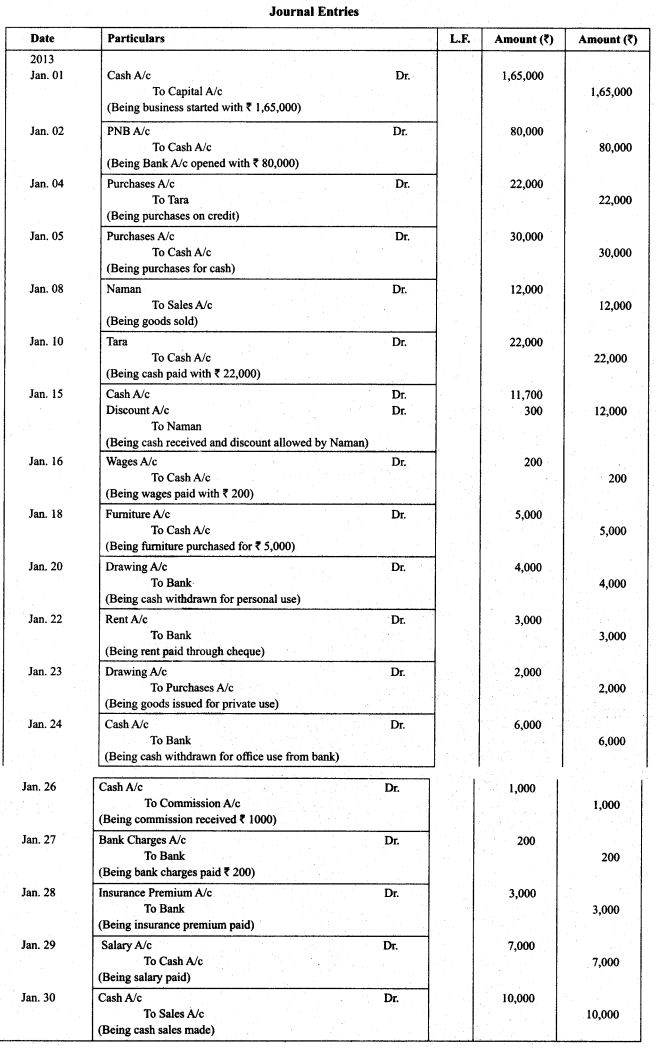

Journalise the following transactions of 2013 in the books of Himanshu:

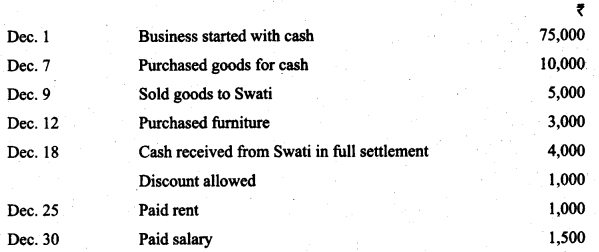

Solution:

Question 12.

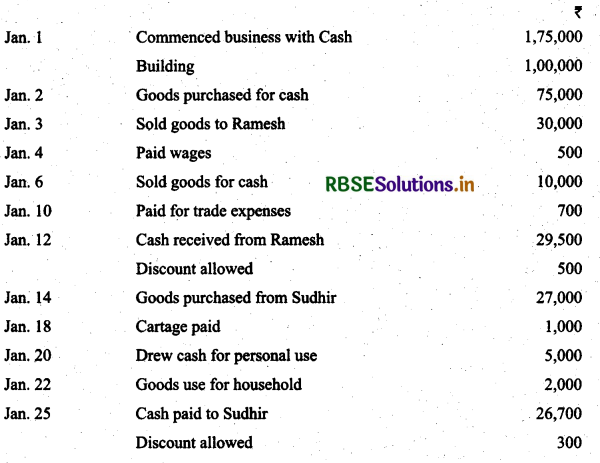

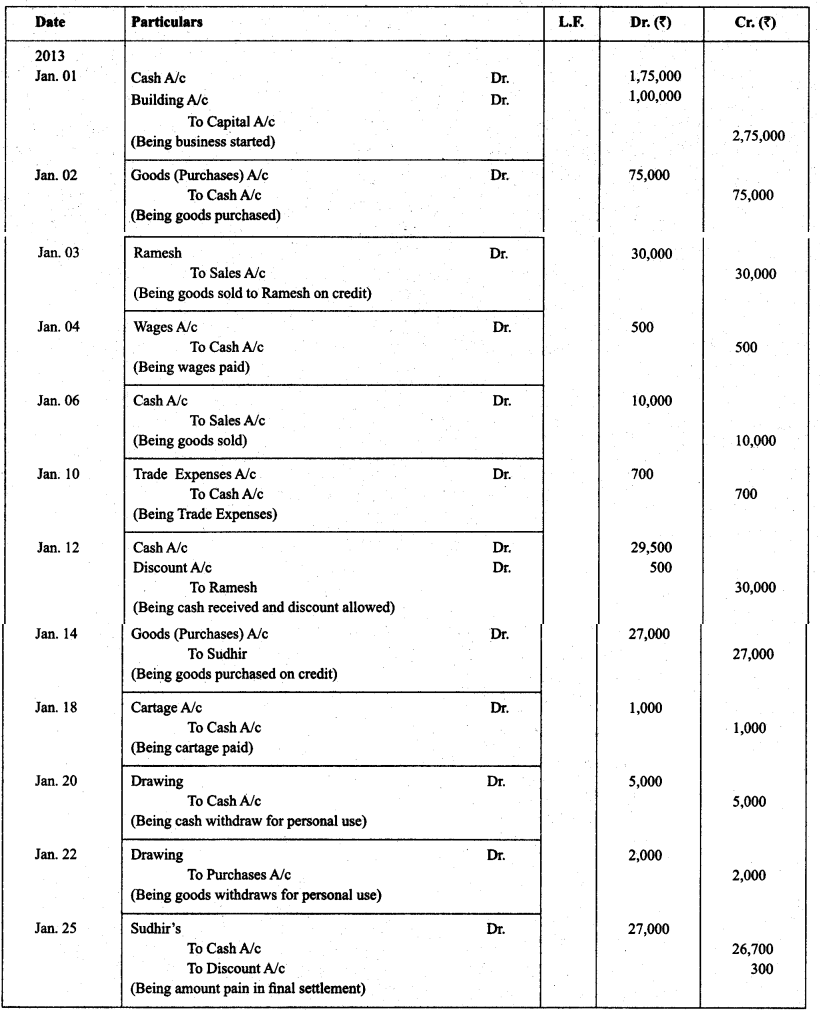

Enter the following transactions in the Journal of Mudit:

Solution:

Question 13.

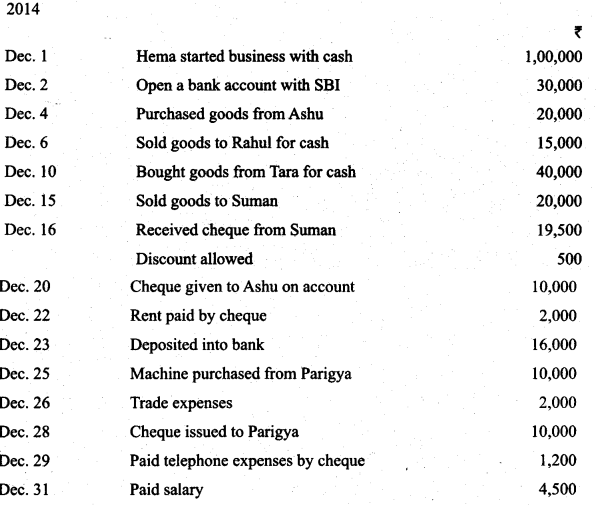

Journalism the following transactions:

Solution:

Solution:

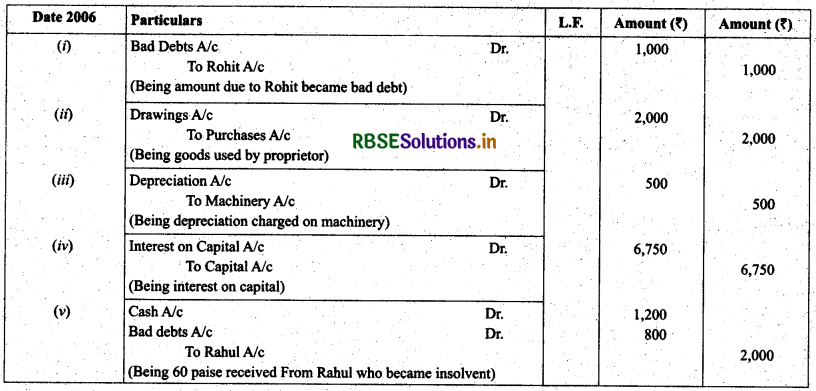

Question 14.

Journalise the following transactions in the books of Harpreet Bros:

(i) ₹ 1,000 due from Rohit are now bad debts

(ii) Goods worth ₹ 2,000 were used by the proprietor

(iii) Charge depreciation @ 10% pa. for two month on machine costing 30,000

(iv) Provide interest on capital of ₹ 1,50,000 at 6% pa. for 9 months

(v) Rahul become insolvent, who owed us 2,000 a final dividend of 60 paise in a rupee is received from his estate.

Solution:

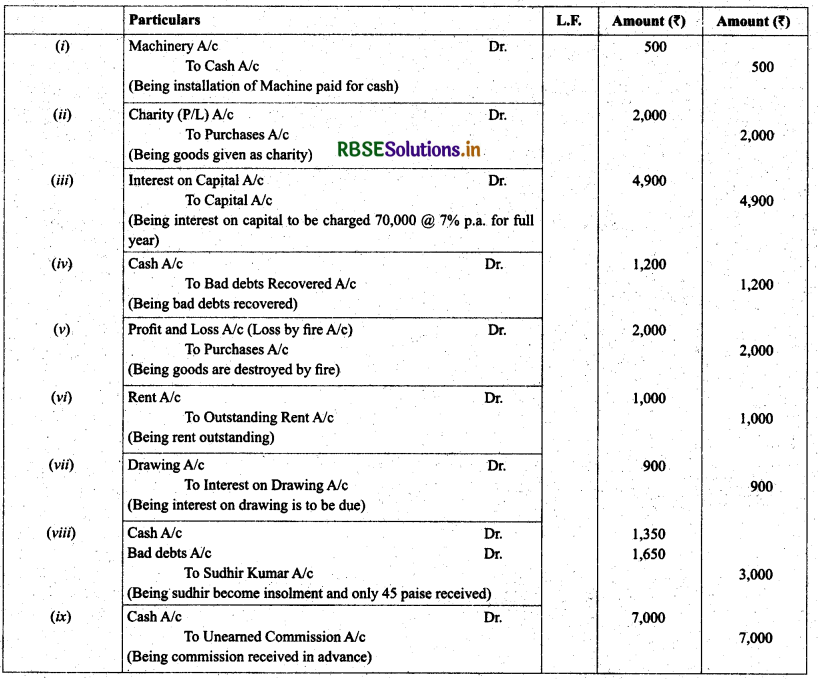

Question 15.

Prepare Journal from the transactions given below:

(i) Cash paid for installation of machine -- 500

(ii) Goods given as charity -- 2,000

(iii) Interest charge on capital @ 7% p.a. when total capital were -- 70,000

(iv) Received 1,200 of a bad debts written-off last year

(v) Goods destroyed by fire -- 2,000

(vi) Rent outstanding -- 1,000

(vii) Interest on drawings -- 900

(viii) Sudhir Kuniar who owed us 3,000 has failed to pay the amount

He pays us a compensation of 45 paise in a rupee

(xi) Commission received in advance -- 7,000

Solution:

Question 16.

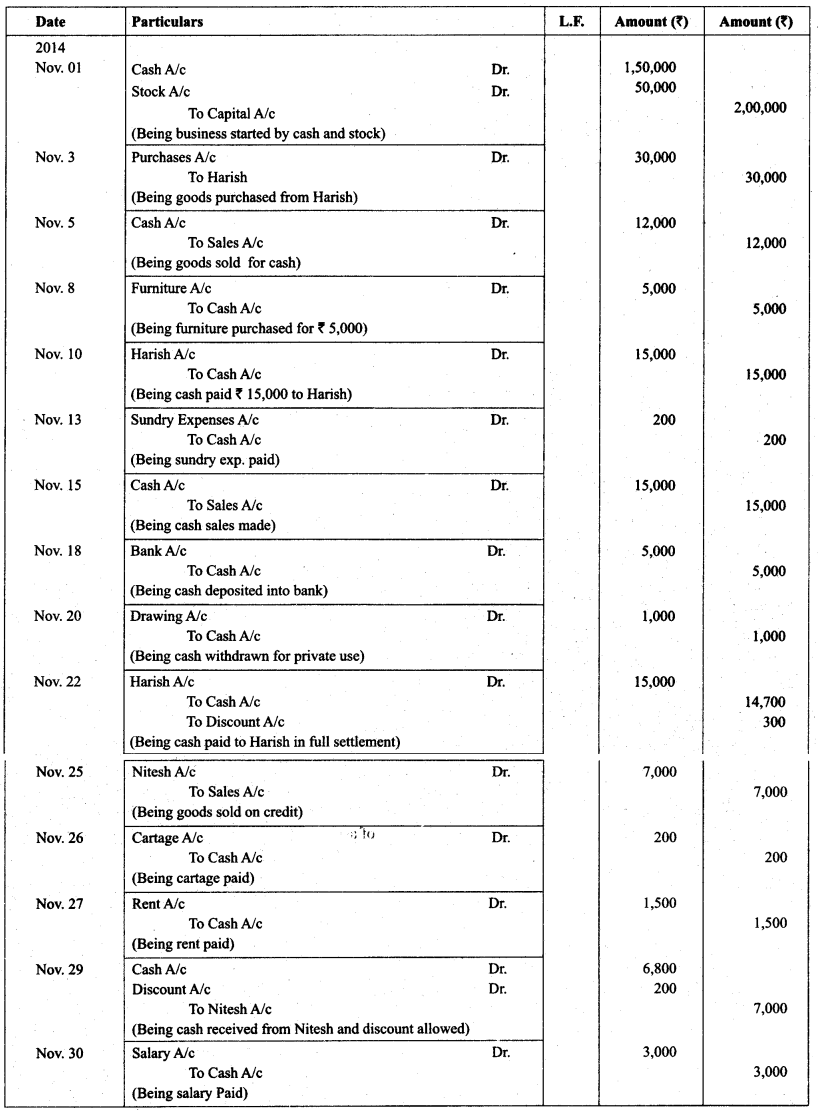

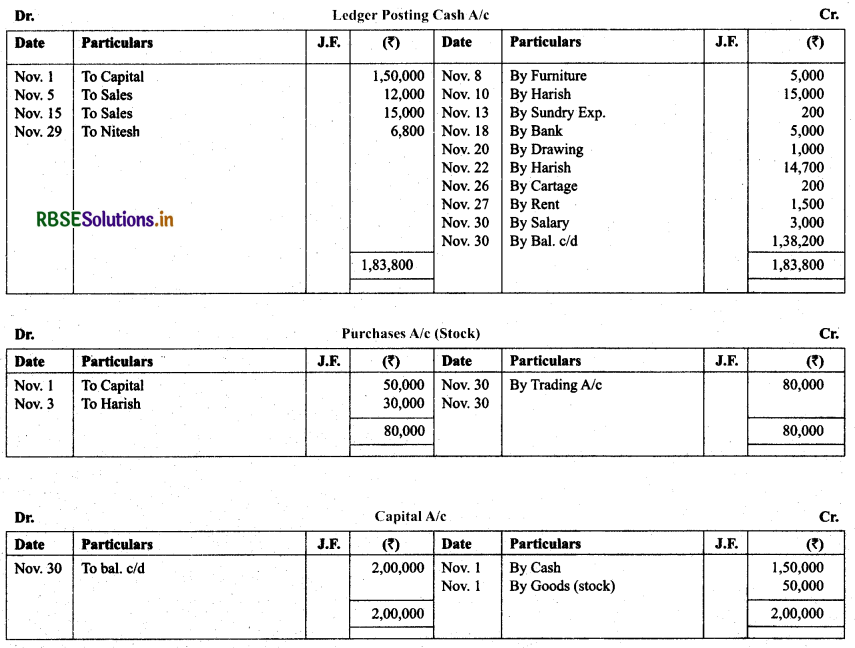

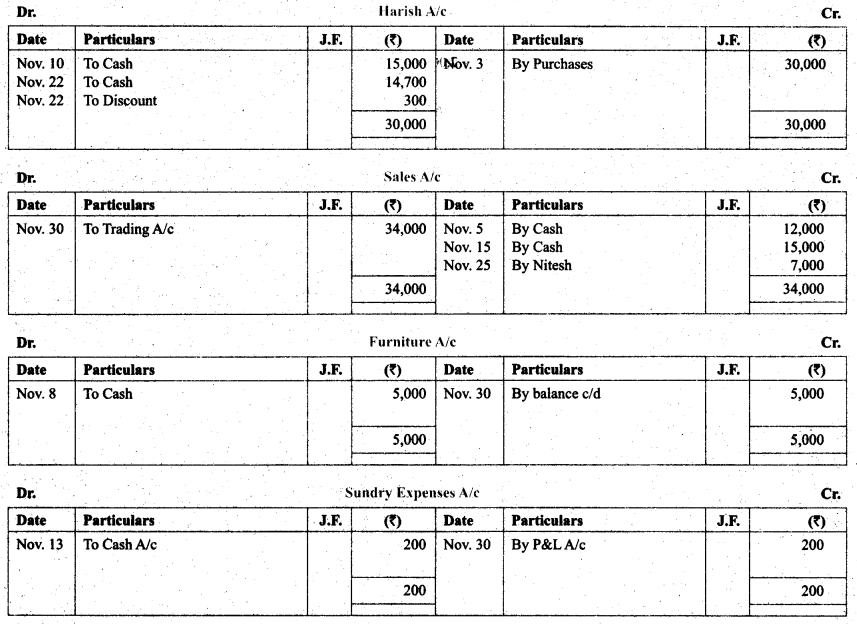

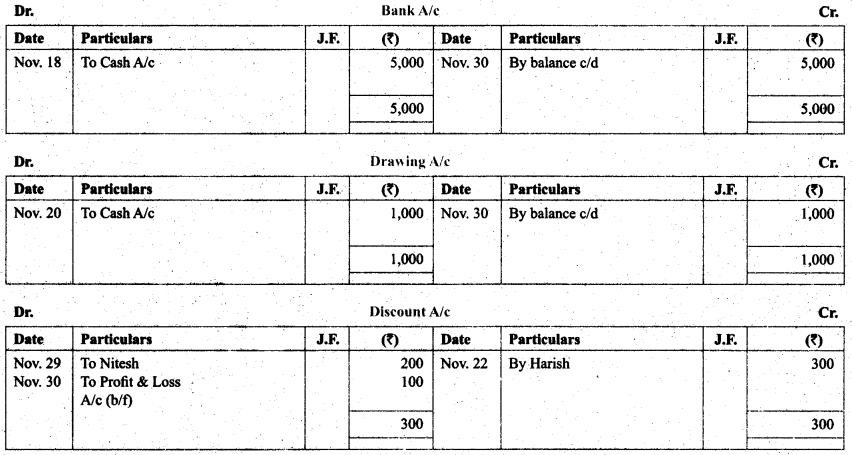

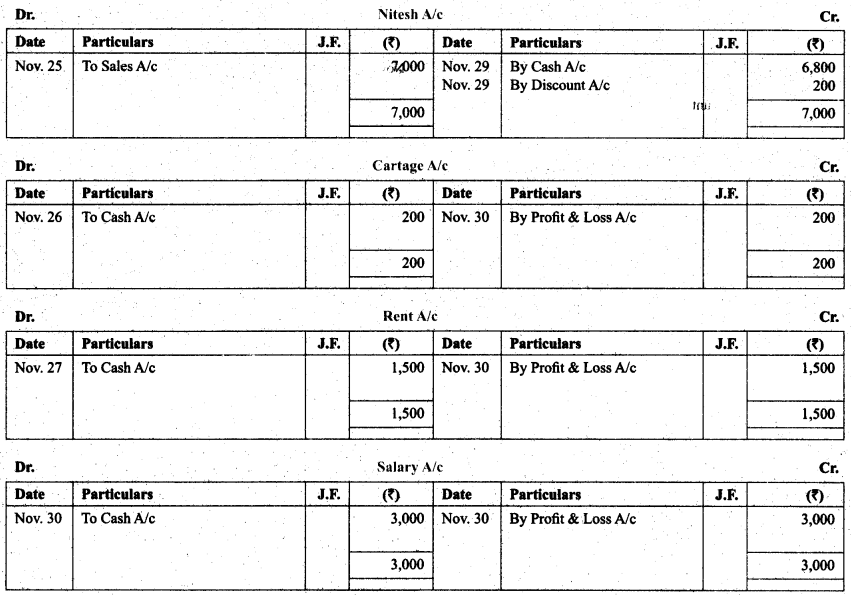

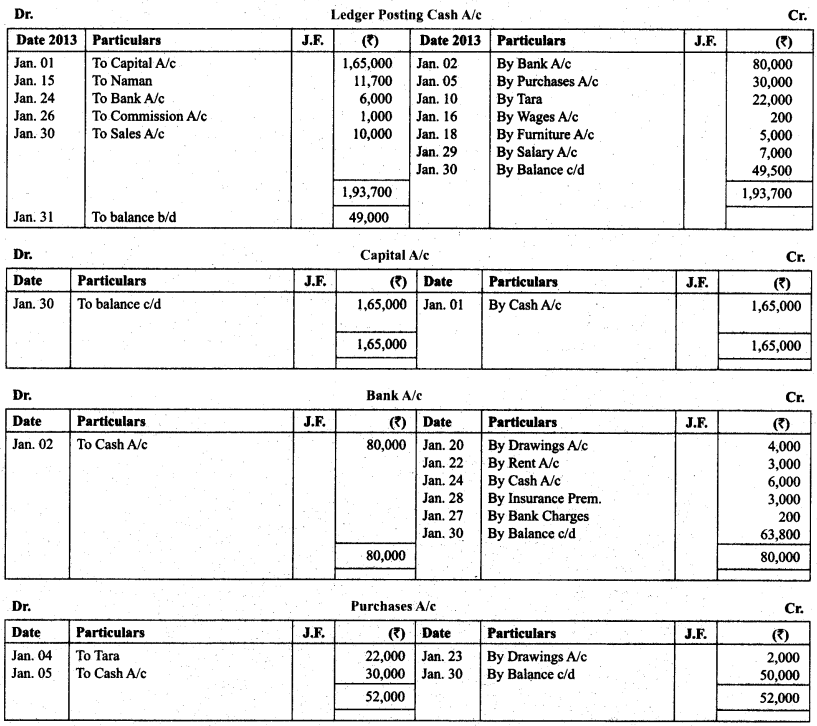

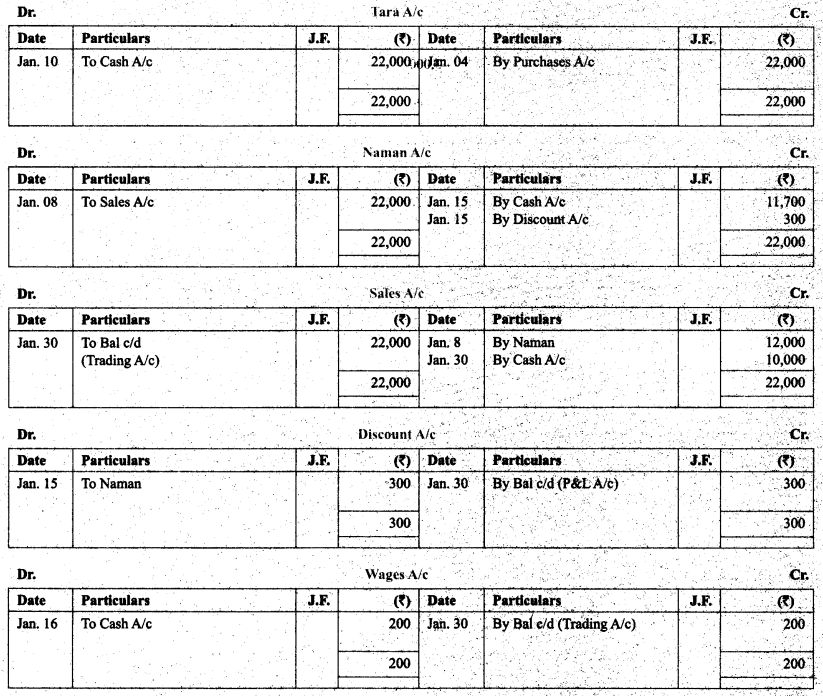

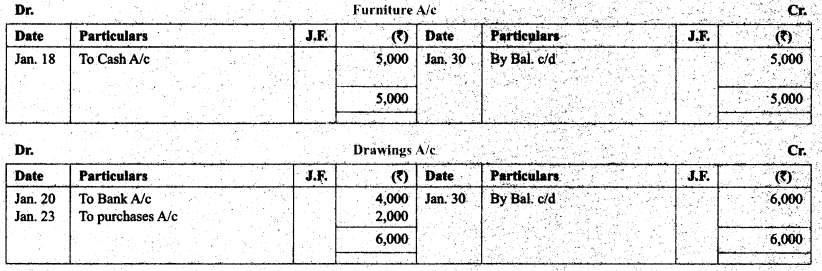

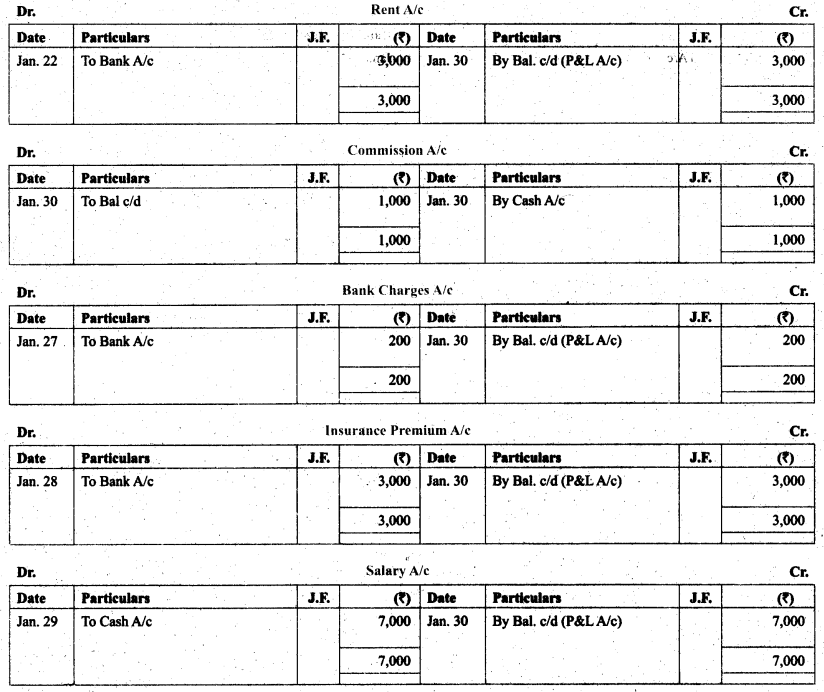

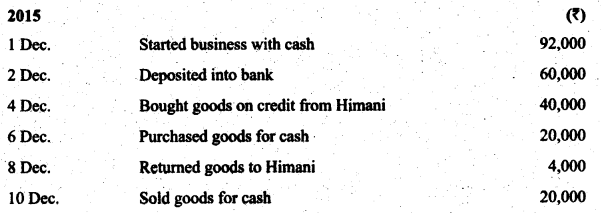

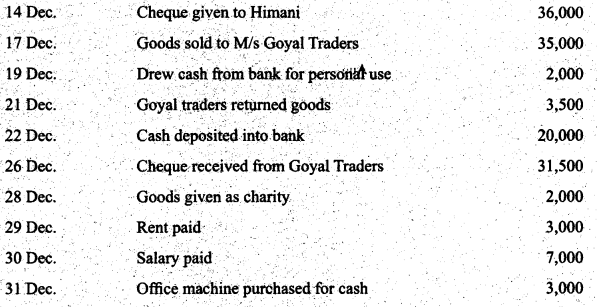

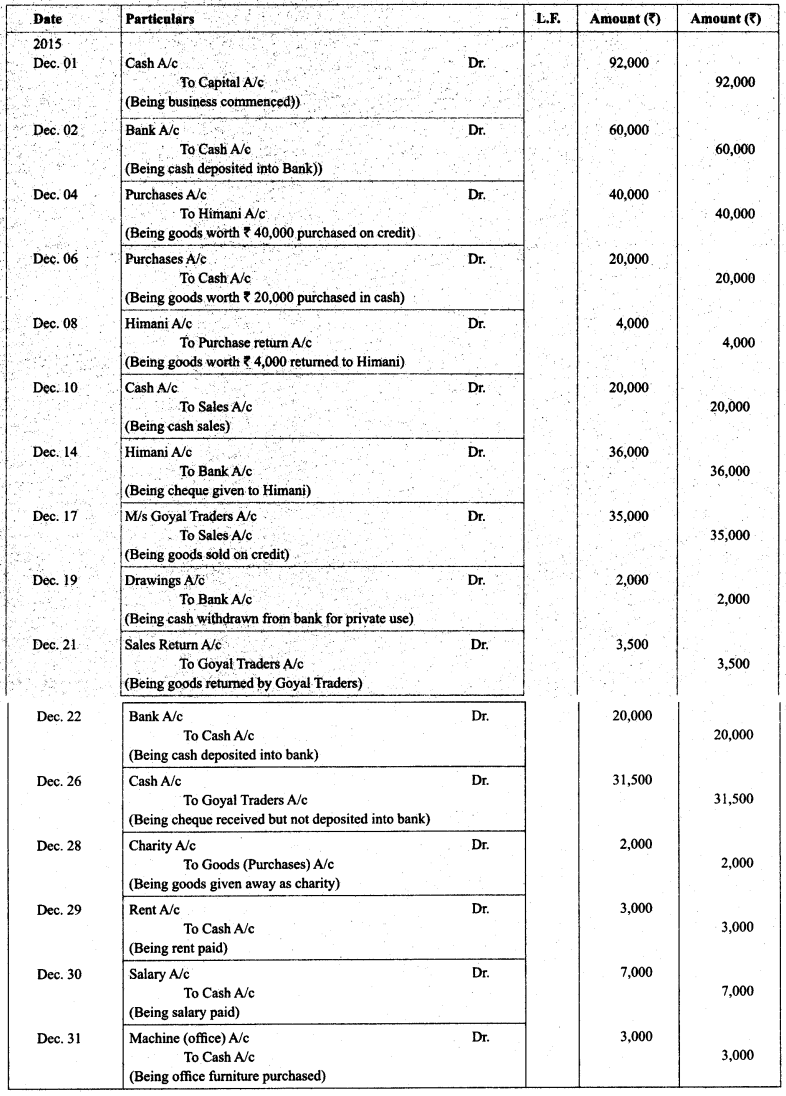

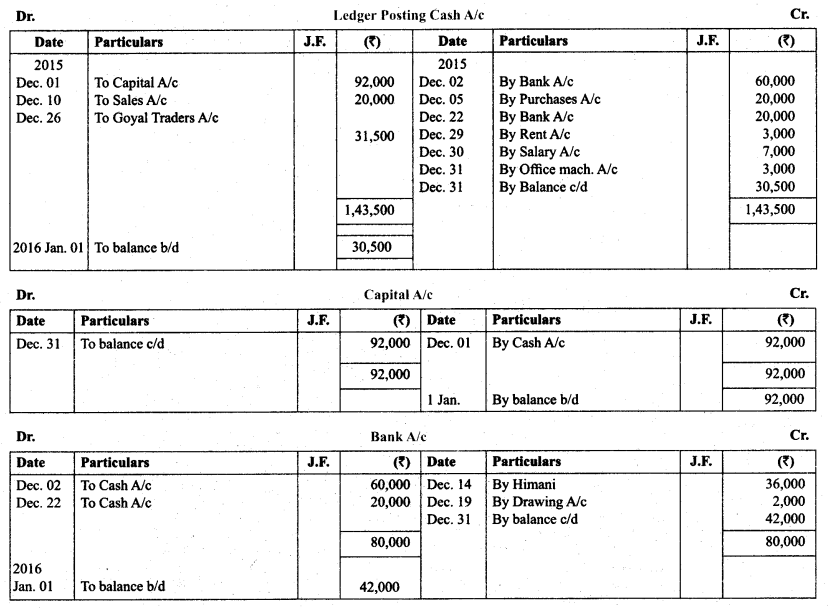

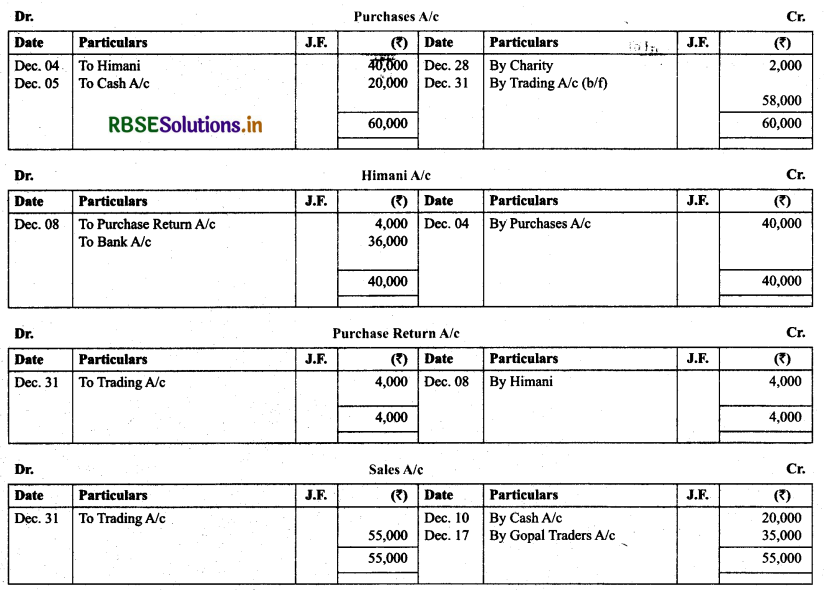

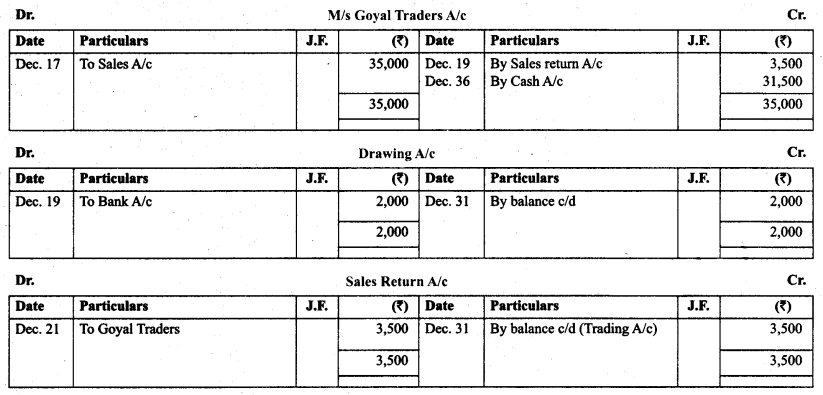

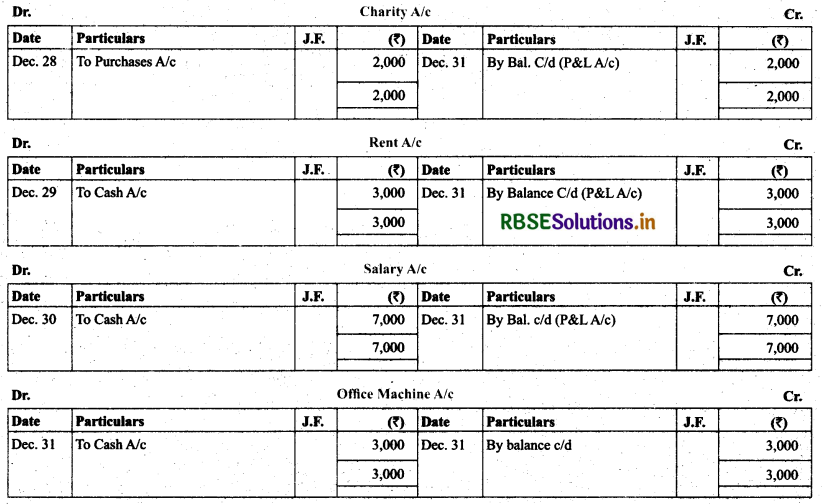

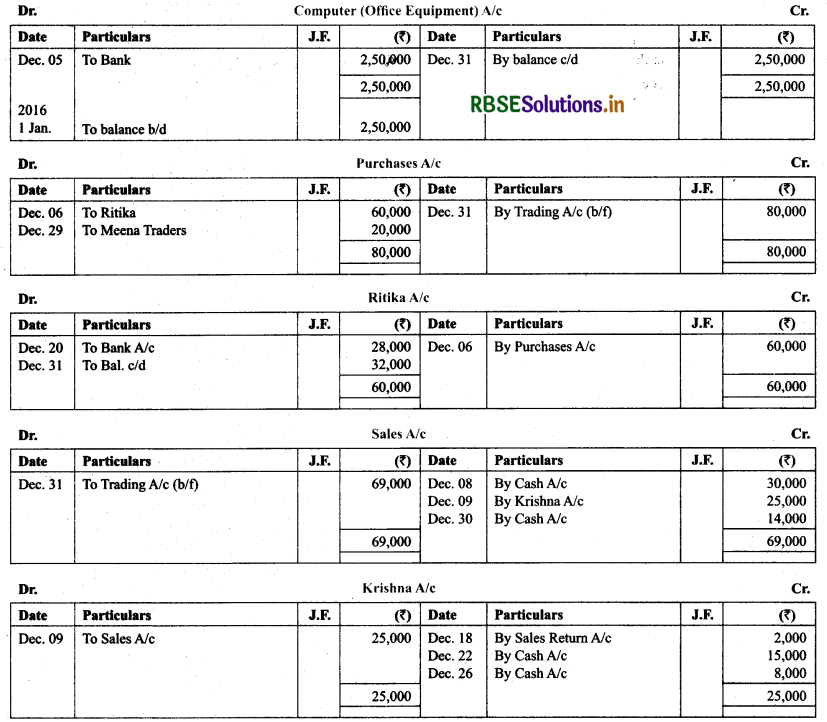

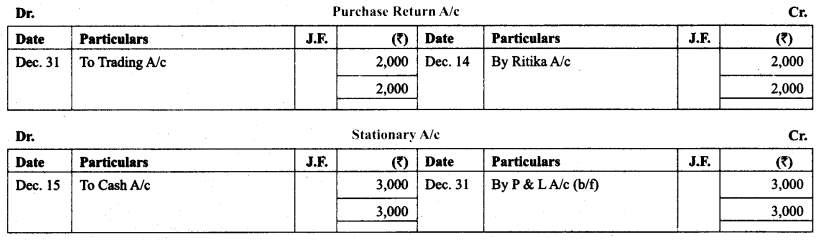

Journalise the following transactions, post them into the ledger:

Solution :

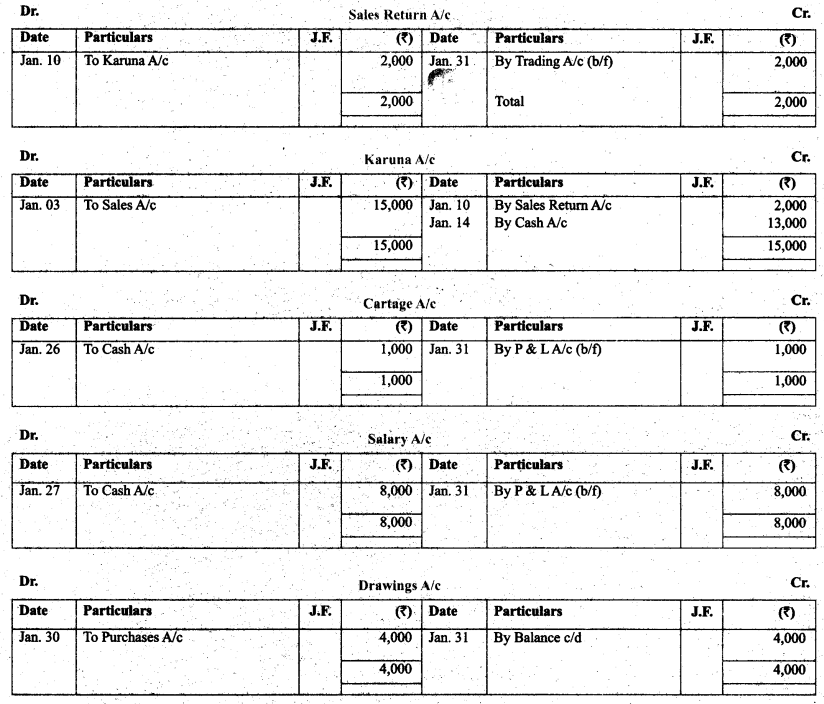

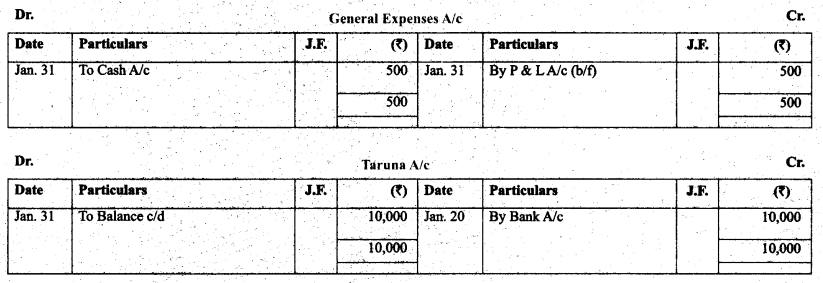

Question 17.

Journalise the following transactions in the journal of M/s God Brother’s and post them into the ledger.

Solution:

Question 18.

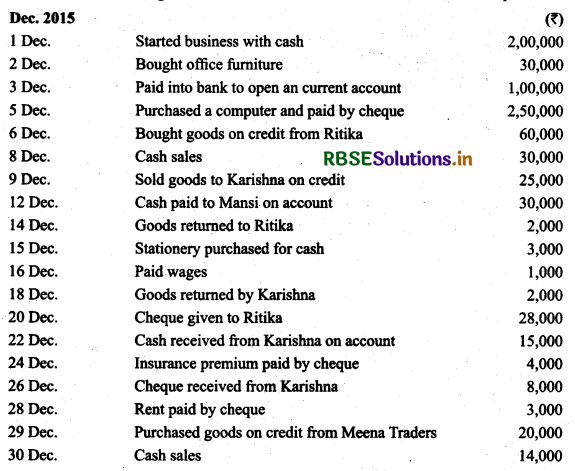

Give journal entries of M/s Mohit traders, Post them in lo the Ledger from the following transactions:

Solution :

Question 19.

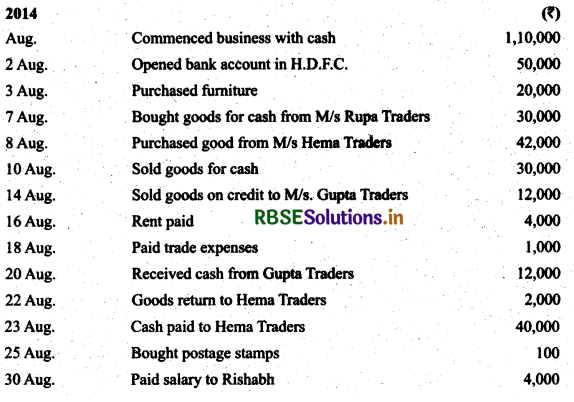

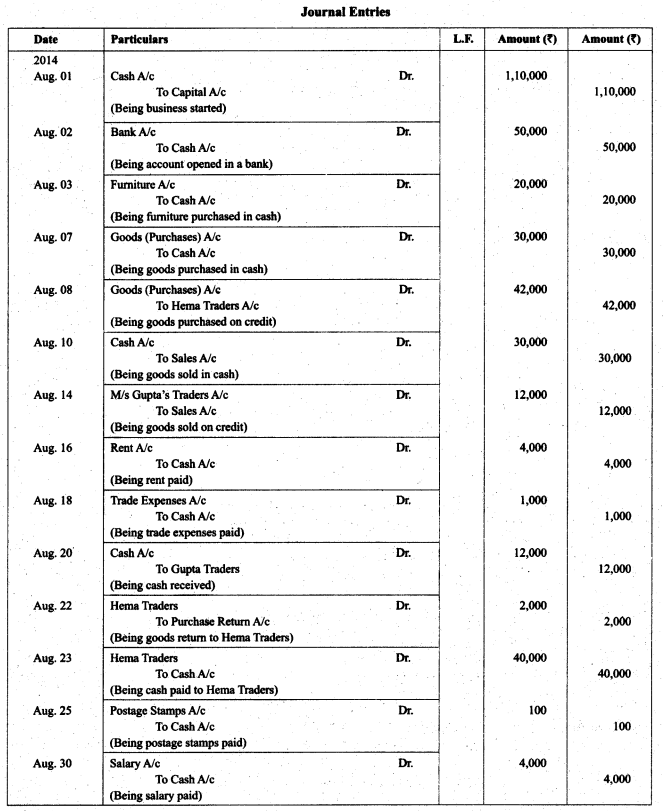

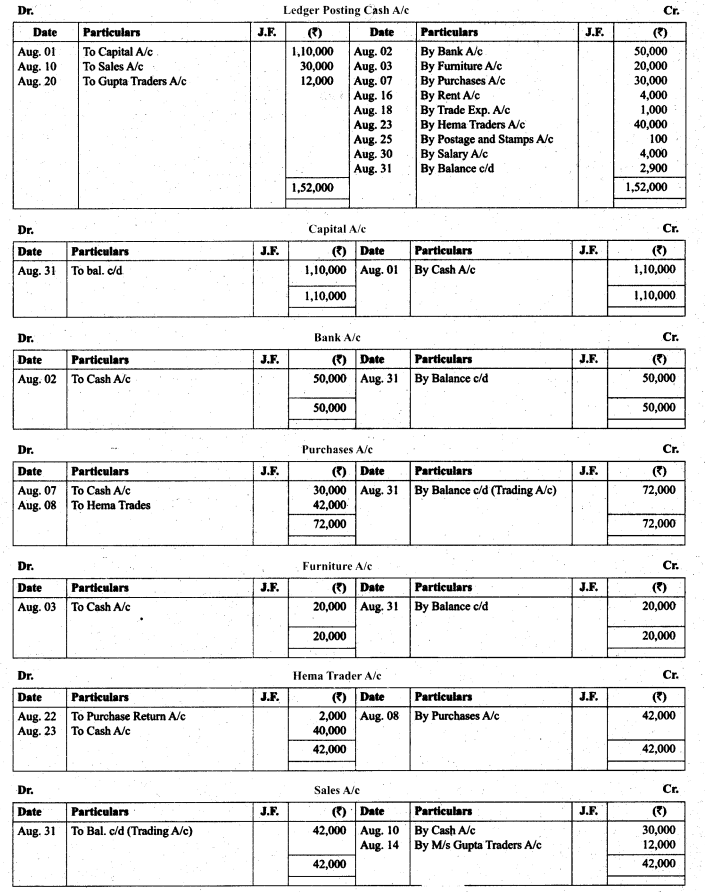

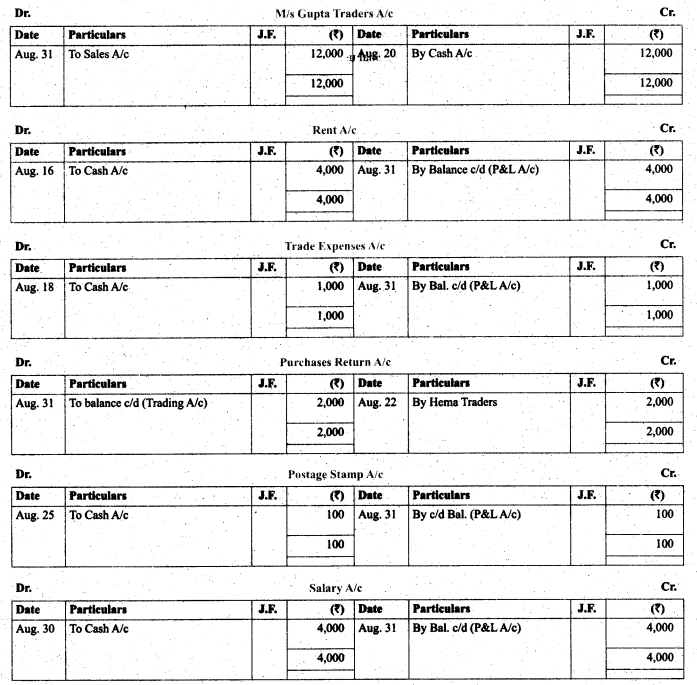

Journalise the following transactions in the books of the Mis Bhanu Traders and Post them into the Ledger

Solution:

Question 20.

Journalise the following transactions in the book of M/s Beauti traders. Also post them into the ledger:

Solution:

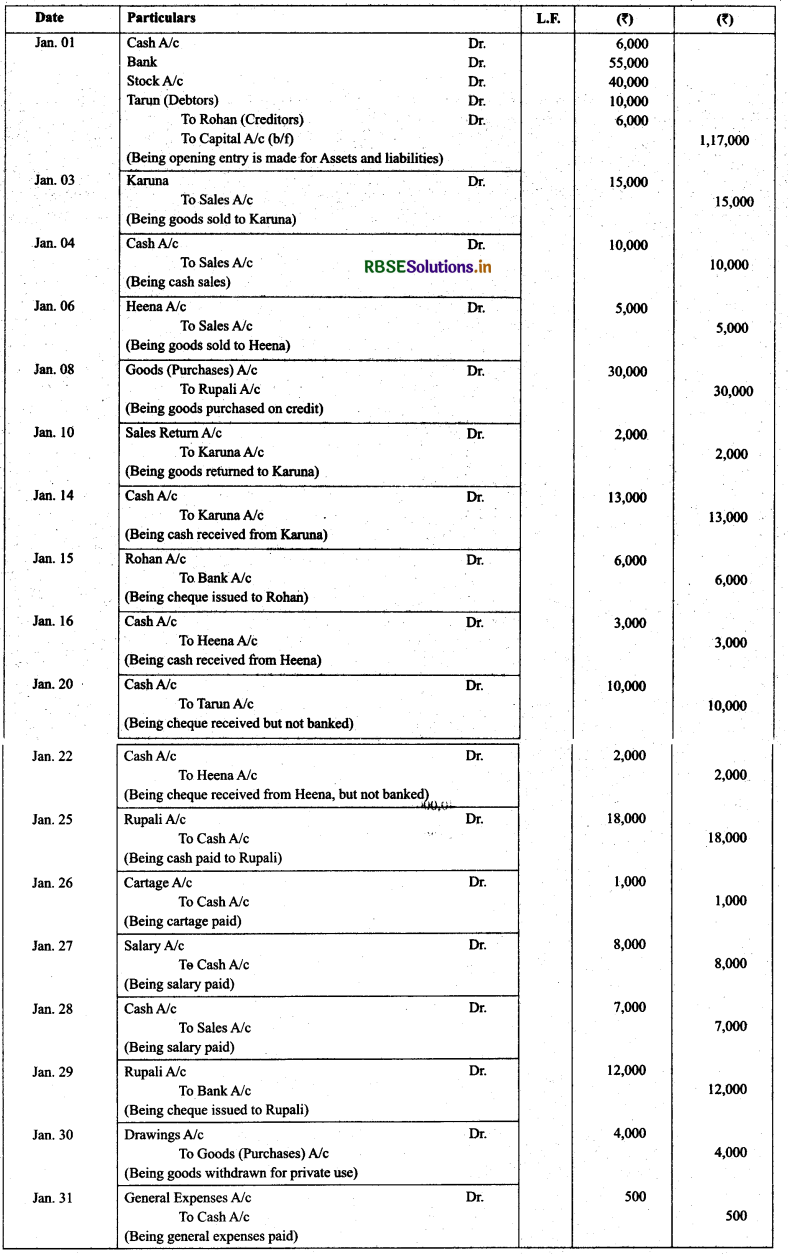

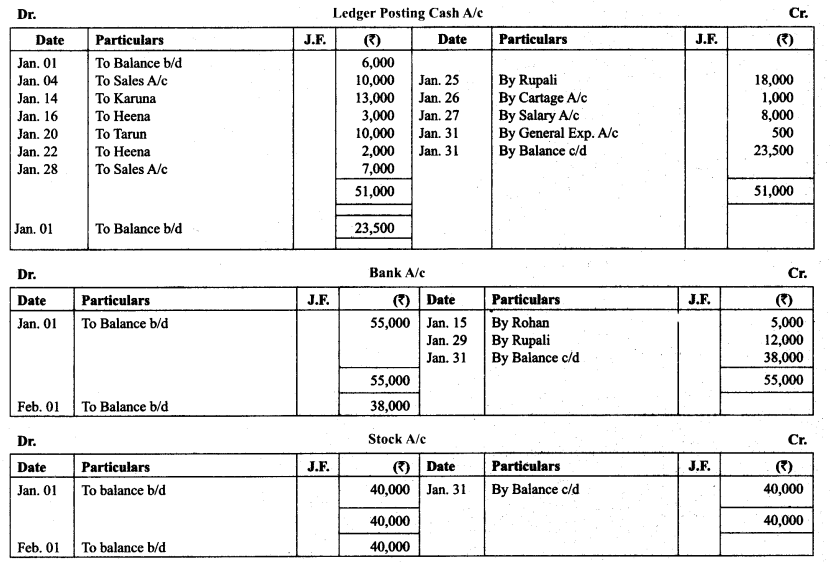

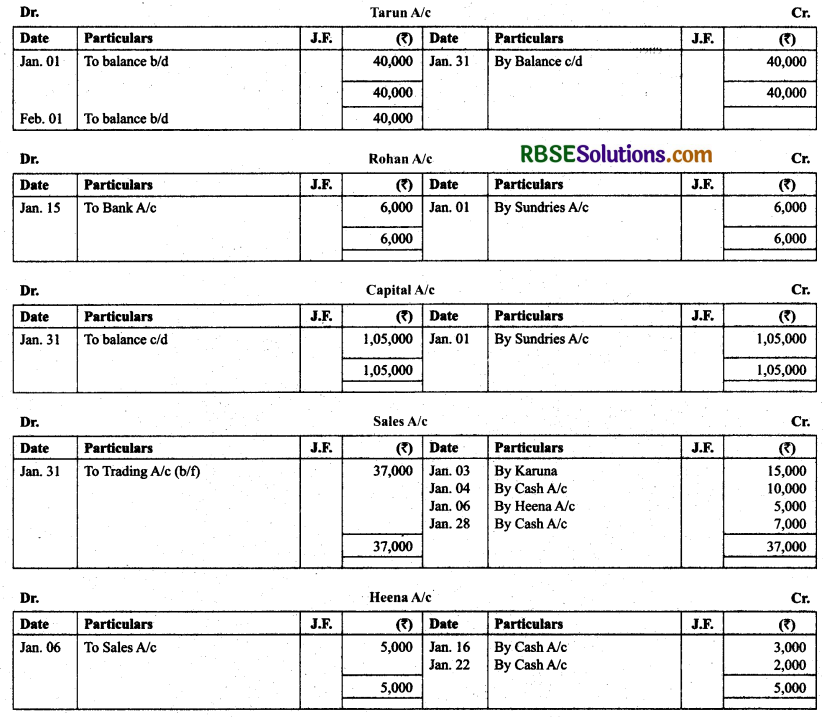

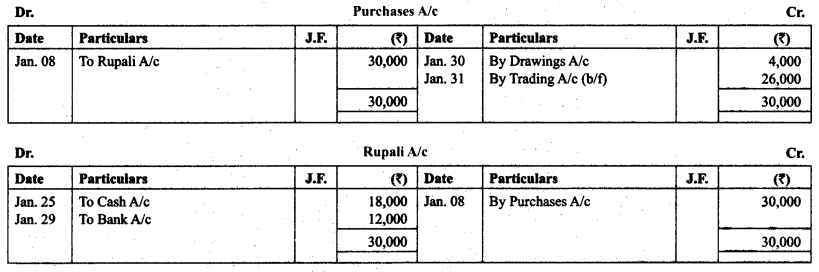

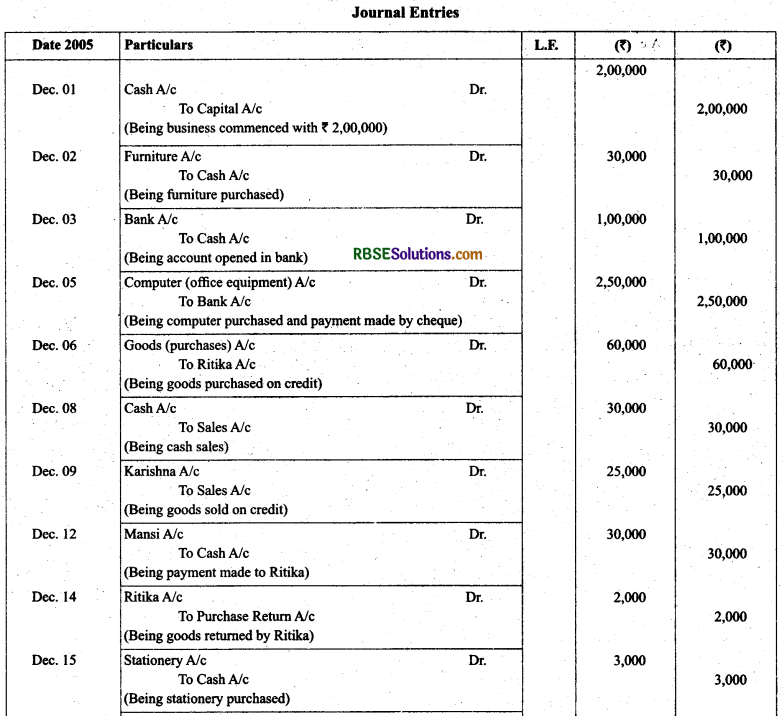

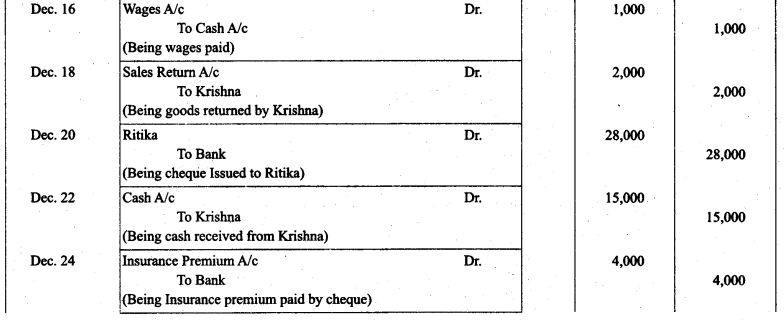

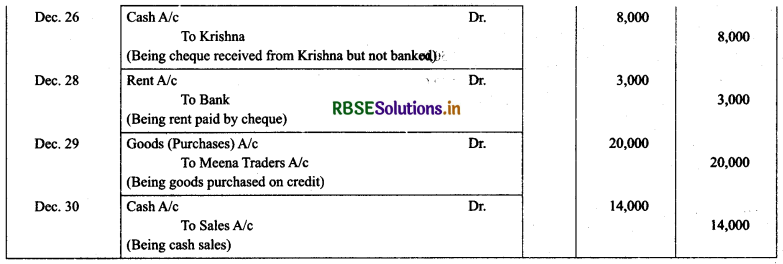

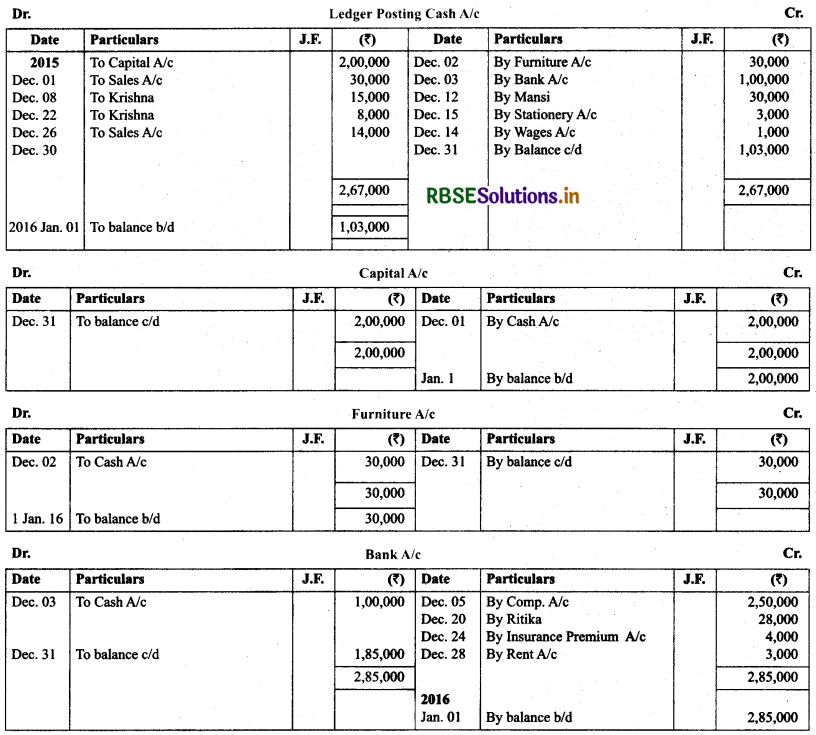

Journal Entries:

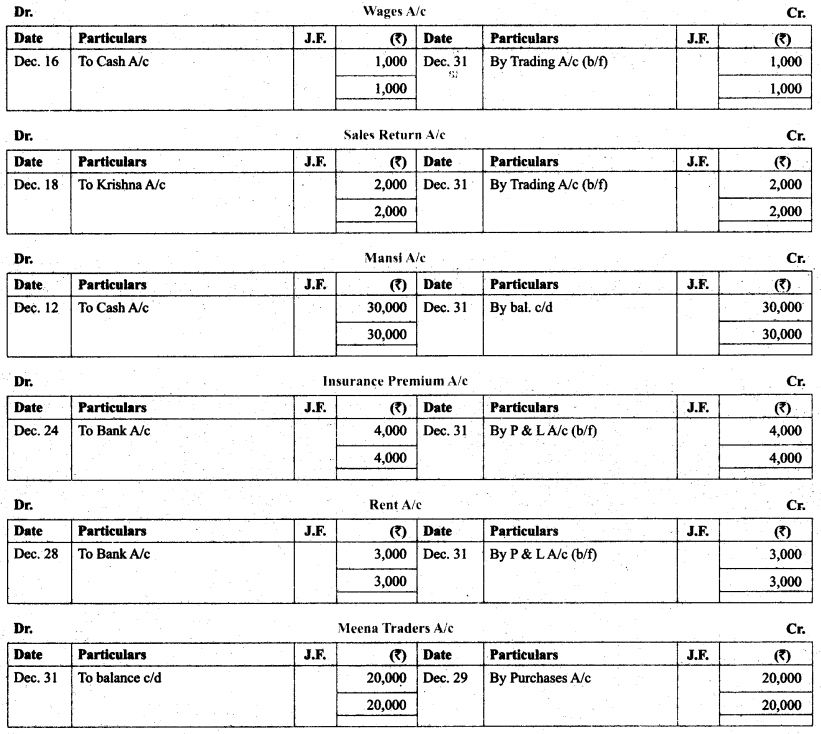

Question 21.

Journalise the following transactions in the books of Sanjana and post them into the ledger:

Solutions: