RBSE Class 11 Accountancy Important Questions Chapter 10 Financial Statements-II

Rajasthan Board RBSE Class 11 Accountancy Important Questions Chapter 10 Financial Statements-II Important Questions and Answers.

Rajasthan Board RBSE Solutions for Class 11 Accountancy in Hindi Medium & English Medium are part of RBSE Solutions for Class 11. Students can also read RBSE Class 11 Accountancy Important Questions for exam preparation. Students can also go through RBSE Class 11 Accountancy Notes to understand and remember the concepts easily.

RBSE Class 11 Accountancy Important Questions Chapter 10 Financial Statements-II

Very Short Answer Type Questions

Question 1.

How would you treat life insurance premium in the financial statements?

Answer:

It will be shown as drawings.

Question 2.

What is the basis of adjustment entries in the financial statements?

Answer:

Accrual basis.

Question 3.

Why is there need for the adjustment entries?

Answer:

Adjustment entries are required because some expenses and incomes are recorded on the basis of actual receipts and payments and such items are brought to their accrual value.

Question 4.

How is closing stock valued?

Answer:

Closing stock is valued as a least of cost price or market price.

Question 5.

Where will you show closing stock if it appears inside the trial balance?

Answer:

It will be directly taken on the assets side of the balance sheet.

Question 6.

How will you show closing stock if it appears outside the trial balance?

Answer:

It will be shown on the credit side of trading account or deducted from the purchases and on the assets side of the balance sheet.

Question 7.

Who outstanding expenses are shown in the financial statements through adjustment?

Answer:

Outstanding expenses are added in their respective expenses and on the liabilities side of the balance sheet.

Question 8.

State the entry for closing stock while valuing before the preparation of trial balance.

Answer:

Closing Stock A/c Dr To Purchases A/c

Question 9.

How prepaid expenses are adjusted while preparing financial statements?

Answer:

These are subtracted from their respective account and shown on the assets side of the balance sheet.

Question 10.

What is the treatment of incomes received in advance?

Answer:

Incomes received in advance are subtracted from their respective incomes and are shown on the liabilities side of the balance sheet.

Question 11.

If a firm maintains provision for depreciation, where it will be shown?

Answer:

It will be shown as a deduction from the respective asset on the assets side or on the liabilities side of the balance sheet.

Question 12.

Why provision for doubtful debts is maintained?

Answer:

Provision for doubtful debts is maintained keeping principle of prudence in mind which advocates to record all possible future losses but not the incomes.

Question 13.

State any two examples of revenue expenditures which in your opinion are wrongly taken as capital expenditures.

Answer:

(a) Amount paid on installation of machine wrongly debited to expense account.

(b) Wages paid on the construction of building wrongly debited to wages account.

Question 14.

State the entry for the goods given as free samples.

Answer:

Advertisement/Free Samples A/c Dr To Purchases A/c

Question 15.

Where the direct expenses are shown?

Answer:

Direct expenses are shown on the debit side of trading account.

Question 16.

Where the indirect expenses are shown?

Answer:

Indirect expenses are shown on the debit side of profit and loss account.

Question 17.

Where would you show trading expenses?

Answer:

Trading expenses are shown on the debit side of profit and loss account.

Short Answer Type Questions:

Question 1.

What is abnormal loss? State two examples.

Answer:

Abnormal loss is the loss which happens due to negligence.

Examples: Loss due to fire, loss of goods in transit.

Question 2.

Differentiate between direct costs and indirect costs.

Answer:

Direct costs are shown on the debit side of trading account whereas indirect costs are shown on the debit side of profit and loss account.

Direct cost involves cost of goods sold and direct expenses whereas indirect costs involves office & administration expenses and selling & distribution expenses.

Question 3.

How are goods costing ₹1,00,000 lost by fire adjusted in the final accounts if the insurance company admits 40% of the claim?

Answer:

Trading account will be credited with 60% of the cost of goods lost and with 40% with insurance claim. Further, loss by fire will be shown on the debit side of profit and loss account and insurance claim on the assets side of the balance sheet.

Long Answer Type Questions

Question 1.

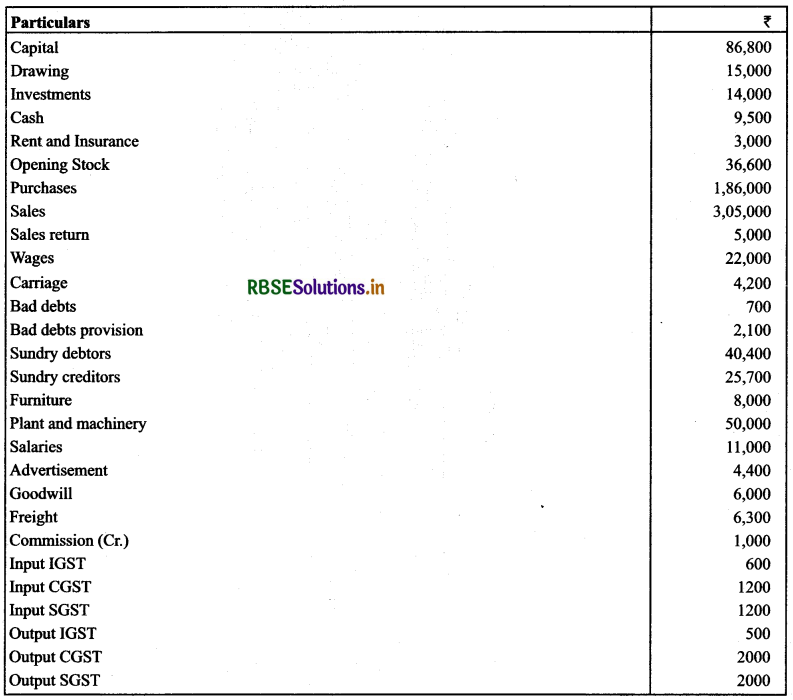

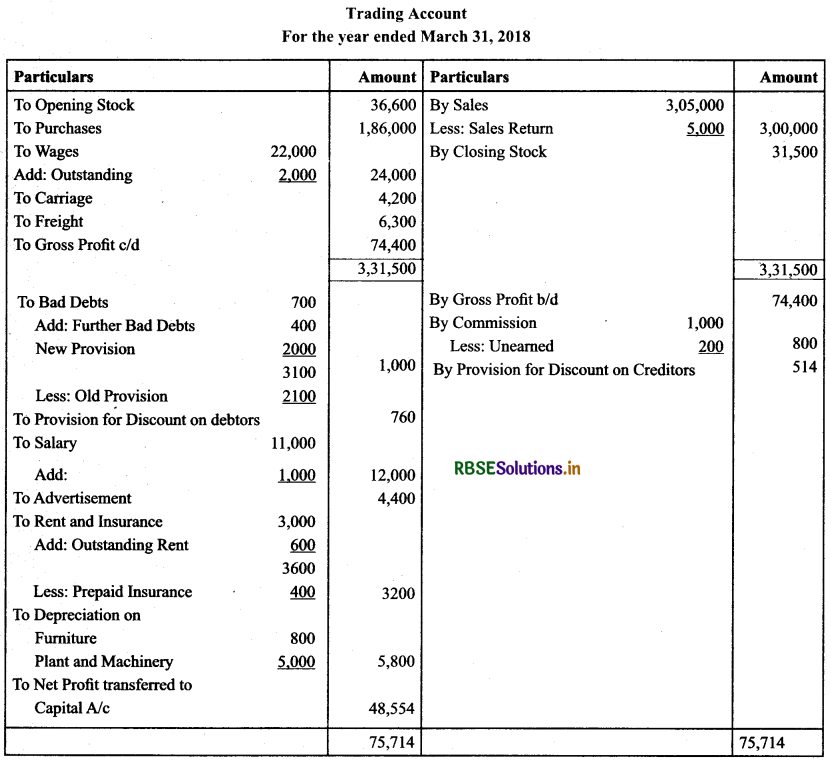

(Based on GST): From the following figures prepare Trading and Profit and Loss Account for the year ended 31st March, 2018 and a Balance Sheet as on that date:

Adjustments:

1. Stock on 31 st March 2010 was ₹ 31,500

2. Salary and wages for March 2010 were unpaid.

3. Rent outstanding amounted to ₹ 600 and insurance unexpired amounted to ₹ 400.

4. Commission amounting to ₹ 200 has been received in advance.

5. Write off ₹ 400 as bad debts, create provision for doubtful debts at 5% on sundry debtors and provide 2% provision for discount on debtors and creditors.

6. Depreciate furniture and plant and machinery by 10%.

Solution:

Question 2.

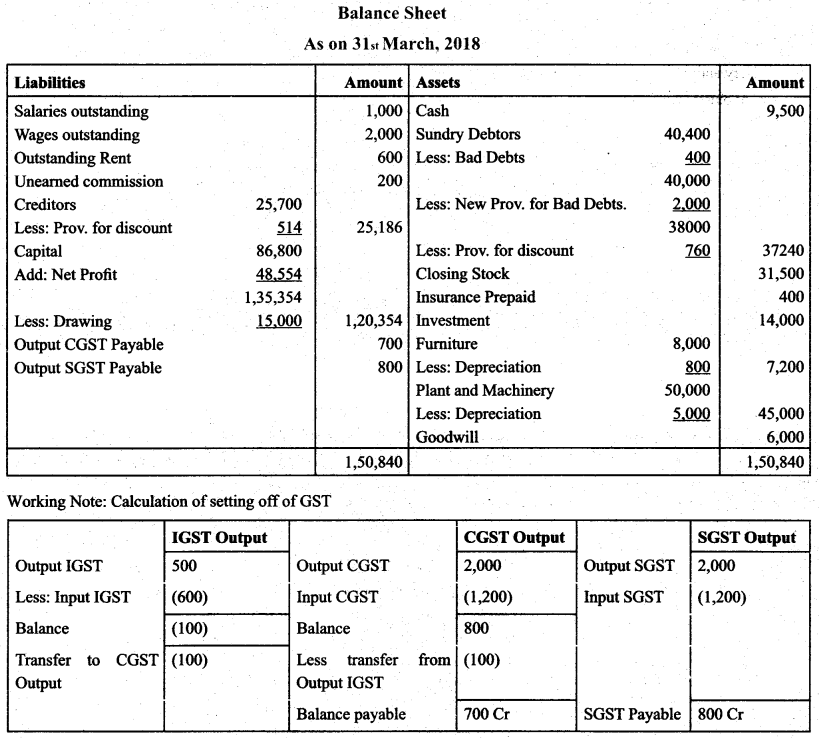

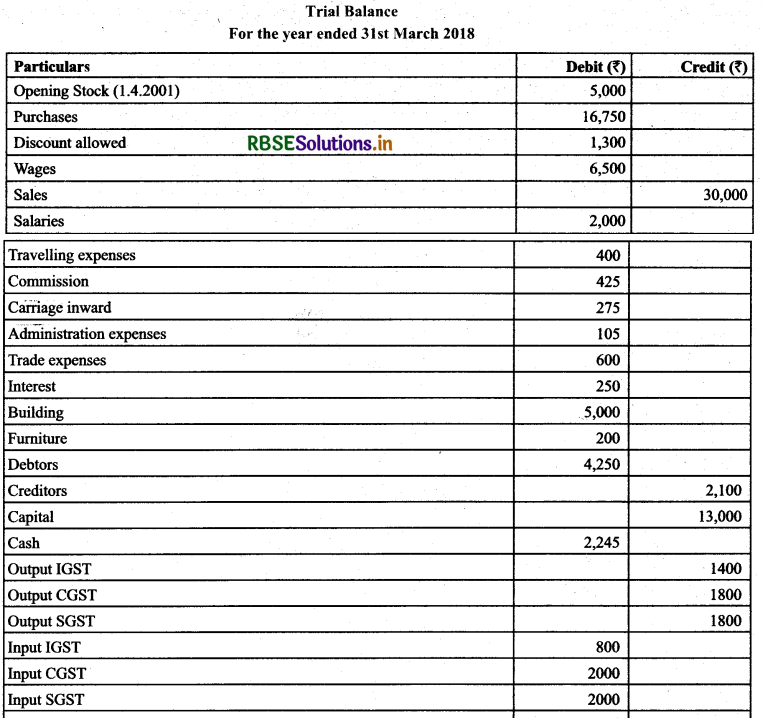

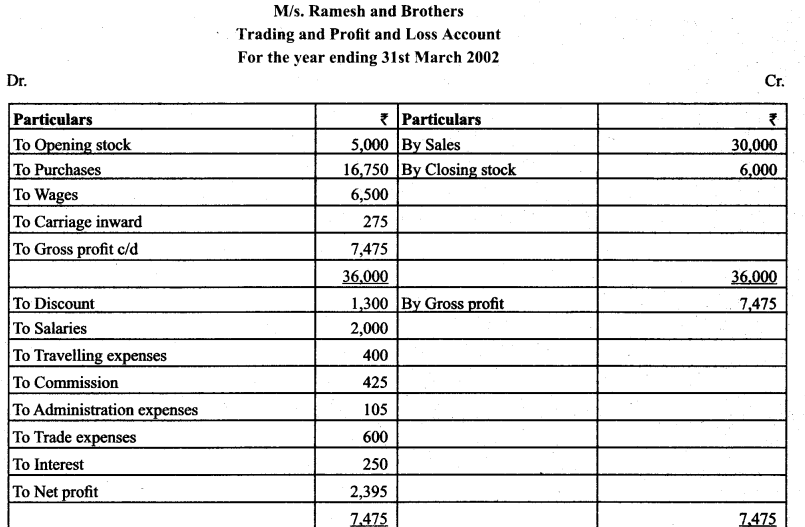

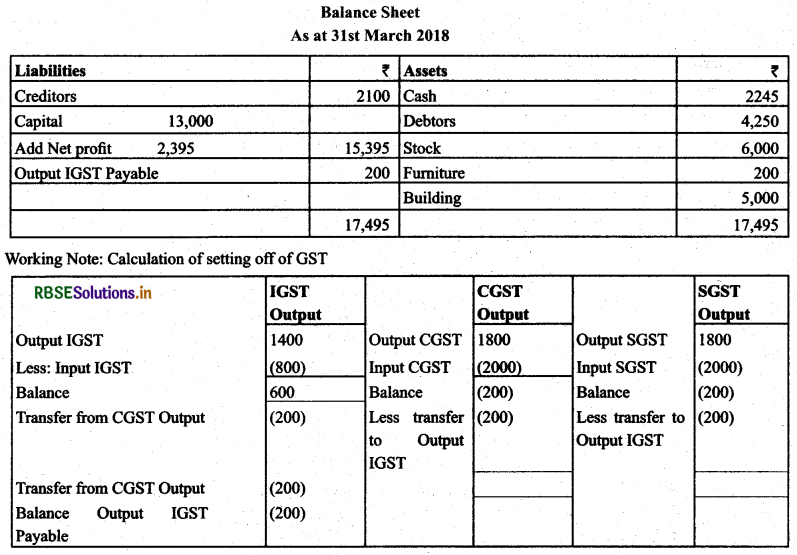

(Based on GST): From the following Trial Balance of M/s. Ramesh and Brothers, prepare trading and profit and loss account for the year ending on 31st March 2018 and the balance sheet as on the date:

Solution:

Higher Order Thinking Skills Questions

Question 1.

How would you treat closing stock appearing inside the trial balance?

Answer:

It will be shown on the assets side of the balance sheet.

Question 2.

What is the treatment of outstanding expenses appearing inside the trial balance?

Answer:

It will be shown on the liabilities side of the balance sheet only.

Question 3.

If prepaid expenses appear inside the mal balance, how would you treat while preparing financial statements

Answer:

We shall show on the assets side of the balance sheet

Question 4.

How would you treat if incomes received in advance appear inside trial balance?

Answer:

Such incomes shall be shown on the liabilities side of the balance sheet.

Question 5.

What is the difference between depreciation and provision for depreciation?

Answer:

The term depreciation refers to the depreciation charged on the respective asset and the provision for depreciation refers

to accumulation of depreciation on the respective asset.

Question 6.

According to which principle of accountancy, adjustments while preparing financial statements are recorded?

Answer:

Matching principle of accountancy.

Question 7.

How would you differentiate between bad debts and doubtful debts?

Answer:

Bad debts refers to actual loss already borne by a firm whereas doubtful debts refers to those debts which are likely to prove bad.

Question 8.

How capital expenditure is treated revenue expenditure?

Answer:

It is deducted from the expense in which such expenses has been added wrongly and is shown on the asset side or is added in the concerned asset.

Question 9.

What does sale of goods on approval basis mean?

Answer:

it means sale of goods will be considered as actual sales when such goods are approved by the buyer.

Question 10.

Which principle is the basis for the valuation of closing stock?

Answer:

Principle of conservatism.

Question 11.

Why is accrued income an asset?

Answer:

Accrued income refers to the income receivable and any amount receivable is an asset.

Question 12.

Why are the goods taken by the proprietor shown at the cost price?

Answer:

The goods taken by the proprietor for his personal use are recorded at cost price because these goods are not sold and there is no element of profit.

Question 13.

What is the difference between gross profit and net profit?

Answer:

Gross profit is the result of excess of revenue from operations (net sales) over cost of revenue from operations (cost of goods sold) whereas net profit is the result of excess of gross profit and other operating/non-operating incomes over other operating/non-operating expenses.

Question 14.

What is the difference between net profit and operating profit?

Answer:

Operating profit is the result of excess of gross profit and other operating incomes over the other operating expenses.

Question 15.

How would you treat‘Salaries and Wages Account’ from ‘Wages and Salaries Account’?

Answer:

Salaries and wages are shown on the debit side of profit and loss account whereas wages and salaries are shown on the debit side of profit and loss account.

Question 16.

How would you calculate adjusted purchases?

Answer:

Adjusted purchases is found out by deducting closing stock from the sum of opening stock and net purchases.

Question 17.

What is contingent liability?

Answer:

Contingent liability is a liability for which the happening is no certain. These are shown outside the balance sheet as a footnote.

Example: Bill receivable discounted but yet to mature.

Question 18.

How are goods lost by fire treated if not insured?

Answer:

Loss by fire will be credited once on the credit side of trading account and other on the debit side of profit and loss account.

Multiple Choice Questions

Question 1.

Outstanding wages is .................

(a) An expense

(b) An Asset

(c) A liability

(d) None of the above

Answer:

(c) A liability

Question 2.

Prepaid insurance will be ..................

(a) Shown as deduction from the insurance

(b) Shown on the assets side

(c) Shown as deduction from the insurance and shown on the assets side

(d) None of the above

Answer:

(c) Shown as deduction from the insurance and shown on the assets side

Question 3.

Closing stock is valued at .................

(a) Cost price

(b) Market price

(c) Revalued price

(d) Lower of cost price and market price

Answer:

(d) Lower of cost price and market price

Question 4.

A manager receives commission for ₹ 9,000 which he is entitled to receive @ 10% on the profit after charging such commission, the net profit before commission would be ..................

(a) 90,000

(b) 99,000

(c) 1,00,000

(d) None of the above

Answer:

(b) 99,000

Question 5.

Accrued income is .................

(a) A income related to next accounting year

(b) An income of current year but yet to be received

(c) An income related to previous year but received in current year

(d) None of the above

Answer:

(b) An income of current year but yet to be received

Question 6.

Type of accounts which are shown in the balance sheet are .................

(a) Nominal in nature

(b) Real in nature

(c) Personal in nature

(d) Personal and real in nature

Answer:

(d) Personal and real in nature

Question 7.

Under which according concept provision is made for doubtful debt?

(a) Conservation

(b) Materiality

(c) Going concern

(d) Prudence

Answer:

(d) Prudence

Question 8.

Life Insurance Premium is shown .................

(a) On the debit side of trading A/c

(b) On the debit side of Profit and Loss A/c

(c) As deduction from the capital in the balance sheet

(d) On the assets side of balance sheet

Answer:

(c) As deduction from the capital in the balance sheet

Question 9.

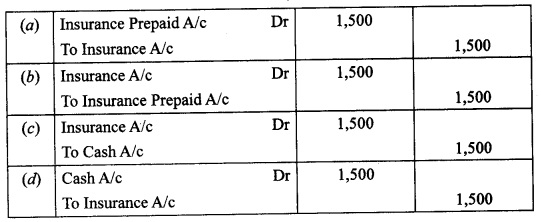

Insurance paid ₹ 8,000 (including premium of ₹ 6,000 per annum paid upto 30th June, 2020). What will be the adjusting

Answer:

(b)

Question 10.

Following information is given in Trial Balance

Bad Debt -- ₹ 6,000

Provision for Bad Debts -- ₹ 7,000

Debtors -- ₹ 80,000

Additional information:

It is desired to make a provision for doubtful debts @ of 10% on debtors. The amount debited to P&L A/c is ...............

(a) ₹ 16,000

(b) ₹ 10,000

(c) ₹ 13,000

(d) ₹ 7,000

Answers:

(d) ₹ 7,000

II. State whether the following statements are or false.

1. Closing stock always appears outside the trial balance.

2. If outstanding expenses appear inside the trial balance, it will not be shown in the income statement.

3. Deferred revenue expenditure and prepaid expenditure, both provide benefit in the future.

4. Income is debited and accrued income is credited to make adjustment for accrued income.

5. Provision for doubtful debts is calculated before the bad debts are deducted from the debtors.

6. Provision for discount on debtors is calculated after the provision for doubtful debts have been calculated.

7. Stock is always valued at cost price.

8. Insurance premium is always considered as drawings.

9. Liability side and assets side represent debit balances and credit balances respectively.

10. Provision for depreciation is deducted from the debtors and has credit balance.

Answers:

1. False

2. True

3. True

4. False

5. False

6. True

7. False

8. False

9. False

10. True

III. Fill in the blanks with correct answers.

1. Prepaid expense is an ........... for a business.

2. If accrued income appears inside the trial balance, it is shown in the ........... only.

3. An unearned income means incomes ........... in ...........

4. Personal insurance of employees will be debited to .......... account.

5. Personal insurance of owner will be debited to ........... account.

6. Visit charges paid to the technician to bring the machine into running condition will be debited to ........... account.

7. Profit and loss account represents ........... or ........... earned during the year.

8. Commission payable to works manager will be shown on the debit side of ........... account.

9. Operating profit is the different of incomes and ........... expenses,

10. Depreciation is a non-cash ............

Answers:

1. Asset

2. Balance sheet

3. Received/advance

4. Insurance

5. drawings

6. Machine

7. ProfIt/loss

8. Trading

9. Operating

10. Expense

- RBSE Solutions for Class 11 Accountancy Chapter 5 बैंक समाधान विवरण

- RBSE Solutions for Class 11 Accountancy Chapter 4 लेन-देनों का अभिलेखन-2

- RBSE Solutions for Class 11 Accountancy Chapter 6 तलपट एवं अशुद्धियों का शोधन

- RBSE Class 11 Accountancy Important Questions in Hindi & English Medium

- RBSE Solutions for Class 11 Economics Chapter 4 Presentation of Data

- RBSE Class 11 Accountancy Important Questions Chapter 12 Applications of Computers in Accounting

- RBSE Class 11 Accountancy Important Questions Chapter 11 Accounts from Incomplete Records

- RBSE Class 11 Accountancy Important Questions Chapter 9 Financial Statements-I

- RBSE Class 11 Accountancy Important Questions Chapter 7 Depreciation, Provisions and Reserves

- RBSE Class 11 Accountancy Important Questions Chapter 6 Trial Balance and Rectification of Errors

- RBSE Class 11 Accountancy Important Questions Chapter 5 Bank Reconciliation Statement