RBSE Solutions for Class 11 Accountancy Chapter 10 Financial Statements-II

Rajasthan Board RBSE Solutions for Class 11 Accountancy Chapter 10 Financial Statements-II Textbook Exercise Questions and Answers.

RBSE Class 11 Accountancy Solutions Chapter 10 Financial Statements-II

RBSE Class 11 Accountancy Financial Statements-II Textbook Questions and Answers

Test Your Understanding I

Choose the correct answer.

Question 1.

Rahul’s trial balance provide you the following information:

Debtors ₹ 80,000

Bad debts ₹ 2,000

Provision for doubtful debts ₹ 4,000

It is desired to maintain a provision for bad debts of ₹ 1,000

State the amount to be debited/credited in profit and loss account:

(a) ₹ 5,000 (Debit)

(b) ₹ 3,000 (Debit)

(c) ₹ 1,000 (Credit)

(d) none of these.

Answer:

(c) ₹ 1,000 (Credit)

Question 2.

If the rent of one month is still to be paid the adjustment entry will be:

(a) Debit outstanding rent account and Credit rent account

(b) Debit profit and loss account and Credit rent account

(c) Debit rent account and Credit profit and loss account

(d) Debit rent account and Credit outstanding rent account.

Answer:

(d) Debit rent account and Credit outstanding rent account.

Question 3.

If the rent received in advance ₹ 2,000. The adjustment entry will be:

(a) Debit profit and loss account and Credit rent account

(b) Debit rent account Credit rent received in advance account

(c) Debit rent received in advance account and Credit rent account

(d) None of these.

Answer:

(b) Debit rent account Credit rent received in advance account

Question 4.

If the opening capital is ₹ 50,000 as on April 01,2016 and additional capital introduced ₹ 10,000 on January 01,2017. Interest charge on capital 10% p.a. The amount of interest on capital shown in profit and loss account as on March 31,2017 will be:

(a) ₹ 5,250

(b) ₹ 6,000

(c) ₹ 4,000

(d) ₹ 3,000.

Answer:

(a) ₹ 5,250

Question 5.

If the insurance premium paid ₹ 1,000 and pre-paid insurance ₹ 300. The amount of insurance premium shown in profit and loss account will be:

(a) ₹ 1,300

(b) ₹ 1,000

(c) ₹ 300

(d) ₹ 700.

Answer:

(d) ₹ 700.

Short Answer Type Question

Question 1.

Why is it necessary to record the adjusting entries in the preparation of final accounts?

Solution:

Adjustment entries are passed to bring the value of expenses and incomes relating to the financial statements for which the accounts are prepared due to the application of accrual concept. This is also done to find out the accurate value of assets and liabilities.

Question 2.

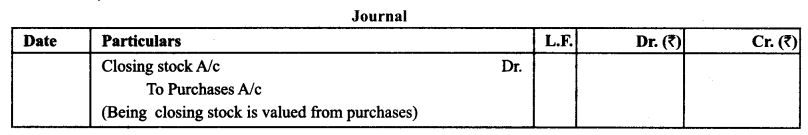

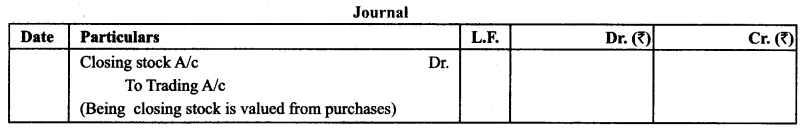

What is meant by closing stock? Show its treatment in final accounts?

Solution:

Closing Stock’ denotes the unsold or unused stock of goods at the end of the accounting period.

Treatment of closing stock in final accounts:

(a) Valuation before the Preparation of Trial Balance

Treatment: It appears inside the trial balance and it is shown directly on the assets side

(b) Valuation after the Preparation of Thai Balance

Treatment: It is shown on the credit side of trading account and on the assets side.

Question 3.

State the meaning of:

(a) Outstanding expenses

(b) Prepaid expenses

(c) Income received in advance

(d) Accrued income

Solution:

(a) Outstanding expenses: It is the part of expense relating to one financial year which is yet to be paid.

Treatment: It is shown on the liabilities side and add in the respective expense either on the debit side of trading account or profit & loss account.

(b) Prepaid Expenses: It is the amount which has been paid in the accounting period for which the final accounts are being prepared but the actual expenditure relates to the next accounting period.

Treatment: Deduct from the concerned expense and show on the assets side.

(c) Income Received in Advance: The portion of income which belongs to next accounting year is known as income received in advance. Treatment: Add in the concerned income and show on the assets side.

(d) Accrued Income: It is the income earned for the current financial year but not received.

Treatment: It is added in the concerned income and shown on the assets side.

Question 4.

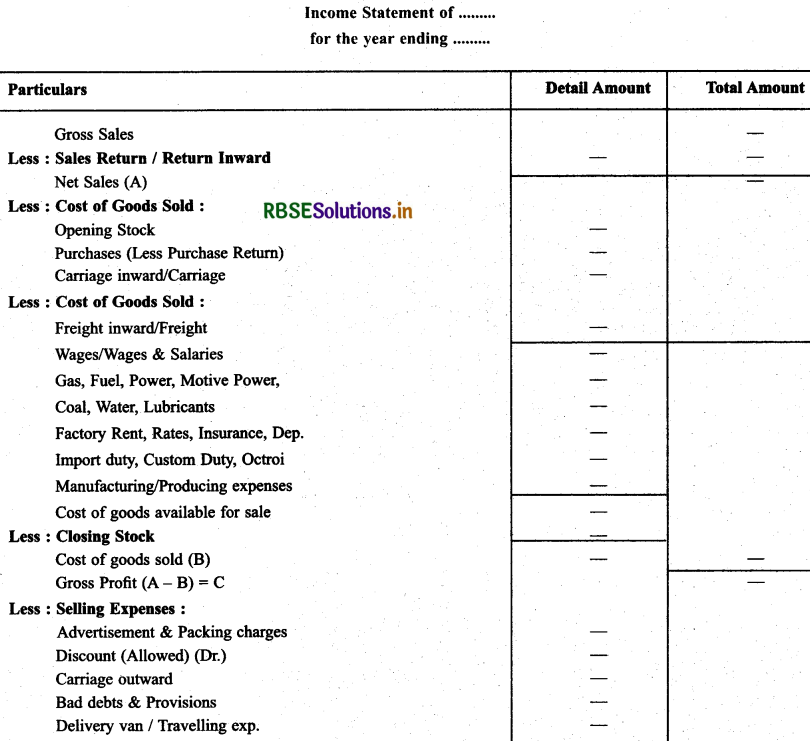

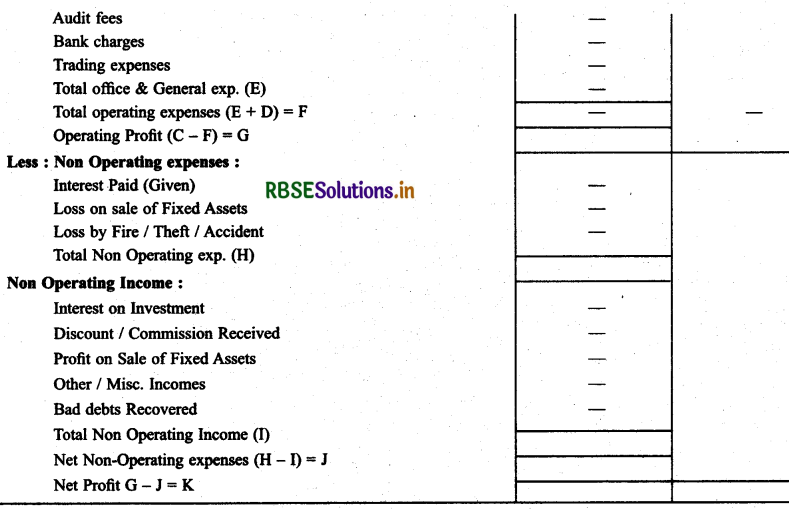

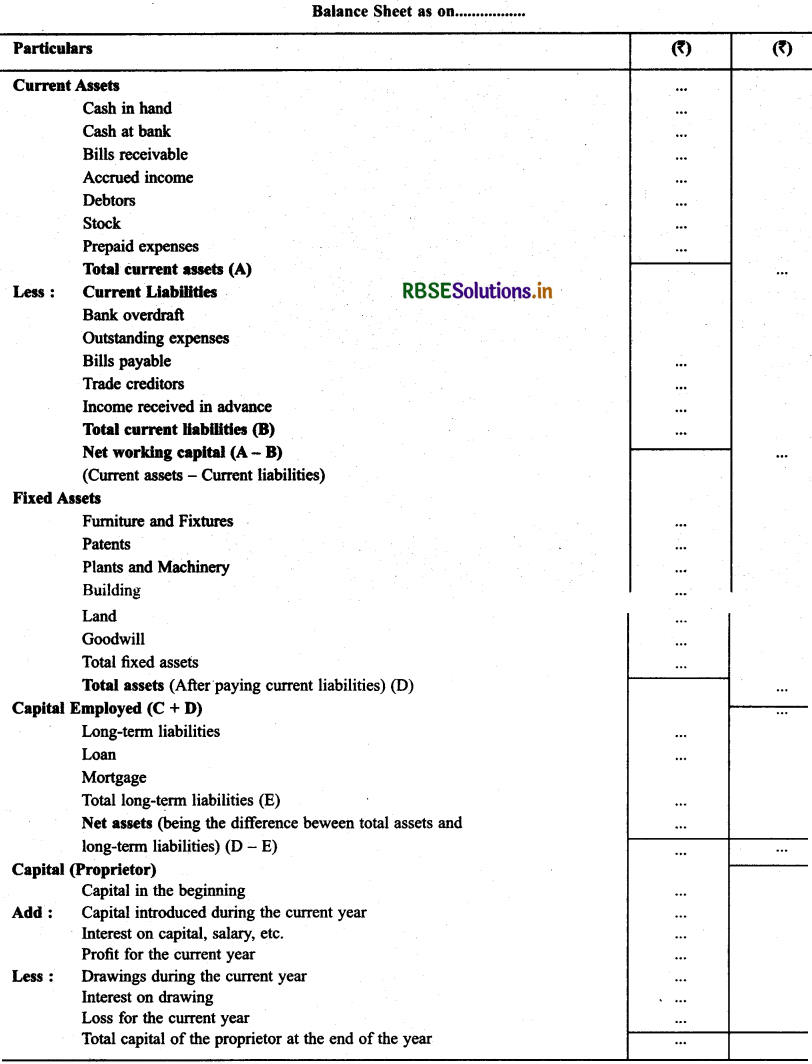

Give the Performa of income statement and balance in vertical form.

Solution:

Question 5.

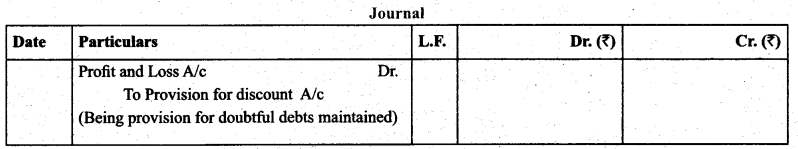

Why is it necessary to create a provision for doubtful debts at the time of preparation of final accounts?

Solution:

It is a normal feature of business operations that some debts prove irrecoverable which means that the amount to the realised from them becomes bad. In order to arrive at the expected amount to be realised from the debtors, a part of profit is set aside to write off probable bad debts. Profit set aside is known as provision for doubtful debts. Treatment: It is shown on the debit side of profit and loss account and as deduction from the debtors in the balance sheet.

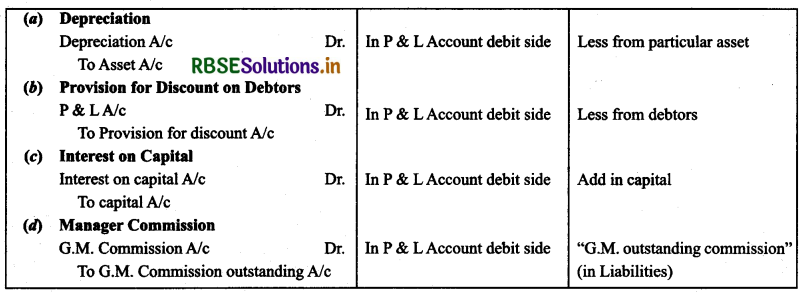

Question 6.

What adjusting entries would you record for the following?

(a) Depreciation

(b) Discount on debtors

(c) Interest on capital

(d) Manager’s commission

Solution:

Question 7.

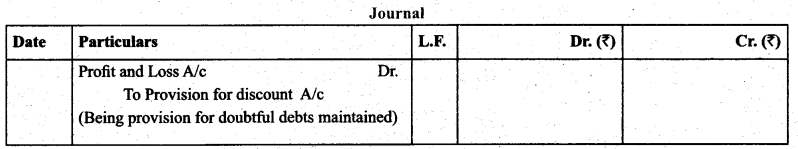

What is meant by provision for discount on debtors?

Solution:

Customers who make prompt payments are allowed some discount by the business. It is obvious that the real worth of debtors is the gross figure of debts minus the estimated cash discount that they might take in subsequent year.

The amount set aside for such estimated amount of discounted to be allowed is known as provision for discount on debtors.

Treatment: It is shown on the debit side of profit and loss account and as deduction from the debtors on the assets "

Question 8.

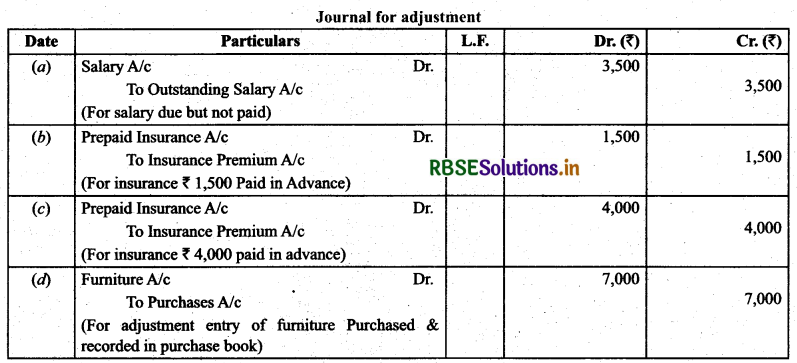

Give the journal entries for the following adjustments:

(a) Outstanding salary ₹ 3,500.

(b) Rent unpaid for one month at ₹ 6,000 per annum.

(c) Insurance prepaid for a quarter at ₹ 16,000 per annum.

(d) Purchase of furniture costing ₹ 7,000 entered in the purchases book.

Solution:

Long Answer Type Questions

Question 1.

What are adjusting entries? Why are they necessary for preparing final accounts?

Solution:

Meaning of Adjusting Entries: Financial statements are prepared on the basis of accrual concept of accounting. While preparing financial statements, adjustments means to adjust the expenses and incomes such that they may belong to financial year for which the accounts are to be prepared.

Necessity of Adjusting Entries for Preparing Final Accounts: Certain expenditures may not have been paid for the entire financial year and similarly incomes may not have been received for the entire financial year. So, we need to add outstanding expenses in the expense paid and add and accrued incomes in the incomes received. Similarly, some expenditures may have been paid in advance and some incomes may have been received in advance. So, we need to deduct advance expense paid from the expense or deduct advance income received from the income concerned.

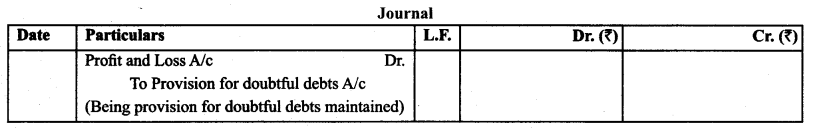

Question 2.

What is meant by provision for doubtful debts? How are the relevant accounts prepared and what journal entries are recorded in final accounts? How is the amount for provision for doubtful debts calculated?

Solution:

Customers who make prompt payments are allowed some discount by the business. It is obvious that the real worth of debtors is the gross figure of debts minus the estimated cash discount that they might take in subsequent year.

The amount set aside for such estimated amount of discounted to be allowed is known as provision for discount on debtors.

Treatment: It is shown on the debit side of profit and loss account and as deduction from the debtors on the assets

Question 3.

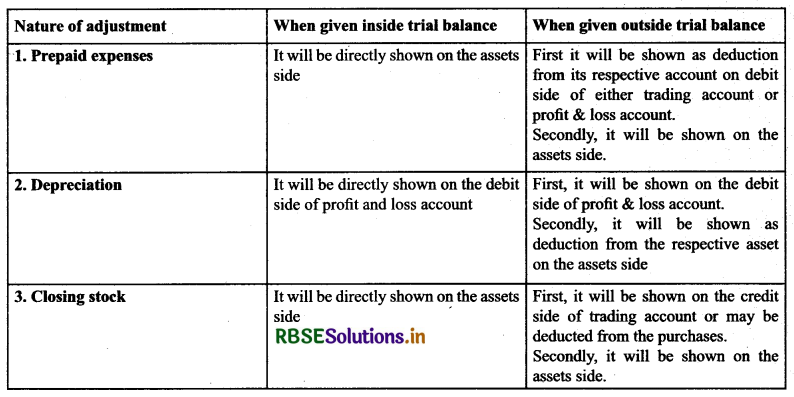

Show the treatment of prepaid expenses depreciation, closing stock at the time of preparation of final accounts when:

(a) When given inside the trial balance?

(b) When given outside the trial balance?

Solution: