RBSE Class 11 Accountancy Notes Chapter 8 Bill of Exchange

These comprehensive RBSE Class 11 Accountancy Notes Chapter 8 Bill of Exchange will give a brief overview of all the concepts.

Rajasthan Board RBSE Solutions for Class 11 Accountancy in Hindi Medium & English Medium are part of RBSE Solutions for Class 11. Students can also read RBSE Class 11 Accountancy Important Questions for exam preparation. Students can also go through RBSE Class 11 Accountancy Notes to understand and remember the concepts easily.

RBSE Class 11 Accountancy Chapter 8 Notes Bill of Exchange

Bill of Exchange:

Meaning : Bill of exchange is a written instrument directing a person to pay the amount specified in the bill to or to the order of specified person or to bearer of instrument.

Features:

- It is an unconditional order to pay

- It must be signed by the drawer or maker

- It must contain an order directing specific person to pay the money

- It must contain the acceptance of the debtor

Advantages:

- Sale and purchase of goods on credit

- Easy to recover the amount

- Availability of discounting facility

- Valid evidence of debt

- Endorsement

Kinds of bills

(a) Trade bills: Theses are prepared due to business transactions

(b) Accommodation bills: These are prepared by one businessman on another to help each other financially.

Parties involved:

There are three parties involved, viz; Drawer, Drawee and Payee

Promissory Note:

Meaning: It is an unconditional undertaking signed by the maker, to pay a certain sum of money only to or to the order of a certain person, or to the bearer of the instrument.

Features:

- It must be in writing

- It must contain an unconditional promise to pay

- It must be signed by the maker

- It must contain an order to pay a fixed amount

Parties involved: There are two parties involved. Drawer (maker) and drawee (payee).

Important Terms

- Days of grace: Three days of added to the period of the bill.

- Date of maturity: It is arrived at by adding three days of grace to the period of the bill. If the due date falls on public holiday, the bill of exchange will become due on the preceding business day.

- Discounting of the bill: When the holder of the bill receivable encashes it through bank, the bank charges certain amount on the face value of the bills of exchange, it is known as discounting of the bill.

- Endorsement of bill: When the bill is transferred by the holder to his creditor for the satisfaction of payment, it is known as endorsement of bill.

- Dishonour of bill: When the drawee of the bills receivable fails to make payment of the bill, it is known as dishonour of bill.

- Noting charges: When the bill receivables proves dishonoured on its presentation, the holder of the bill has to get it noted through Notary Public. The fee charged for this service is known as noting charges.

- Retiring the bill at rebate: When the bill receivable is honoured by the acceptor before the date of maturity, it is known as retirement of bill at rebate.

- Renewal of bill: When the bill is dishonoured, the drawer of the bill requests the drawee to drawer another bill. The amount of the bill is increased with the interest for the extended period.

Accounting Treatment:

1. When the drawer retains the bill with him till the date of its maturity and gets the same collected directly

|

Transaction |

Books of Creditor/Drawer |

Books of Debtor/Acceptor |

|

Sale/Purchase of goods |

Debtor’s A/c Dr. |

Purchases A/c Dr. |

|

Receiving/Accepting the bill |

Bills Receivable A/c Dr. |

Creditor’s A/c Dr. |

|

Collection of the bill |

Cash/Bank A/c Dr. |

Bills Payable A/c Dr. |

2. When the bill is retained by the drawer with him and sent to bank for collection a few days before maturity

|

Transaction |

Books of Creditor/Drawer |

Books of Debtor/Acceptor |

|

Sale/Purchase of goods |

Debtor’s A/c Dr. |

Purchases A/c Dr. |

|

Receiving/Accepting the bill |

Bills Receivable A/c Dr. |

Creditor’s A/c Dr. |

|

Sending the bill for collection |

Bills sent for collection A/c Dr. |

No entry |

|

On Receiving from the bank advice that the bill has been collected |

Bank A/c Dr. |

Bills Payable A/c Dr. |

3. When the drawer gets the bills discounted from the bank.

|

Transaction |

Books of Creditor/Drawer |

Books of Debtor/Acceptor |

|

Sale/Purchase of goods |

Debtor’s A/c Dr. |

Purchases A/c Dr. |

|

Receiving/Accepting the bill |

Bills Receivable A/c Dr. |

Creditor’s A/c Dr. |

|

Discounting the bill |

Bank A/c Dr. |

No entry |

|

On maturity of the bill |

No entry |

Bills payable A/c Dr. |

4. When the bill is endorsed by the drawer in favour of his creditor

|

Transaction |

Books of Creditor/Drawer |

Books of Debtor/Acceptor |

|

Sale/Purchase of goods |

Debtor’s A/c Dr. To Sales A/c |

Purchase A/c Dr. To Creditor’s A/c |

|

Receiving/Accepting the bill |

Bills Receivable A/c Dr. To Debtor’s A/c |

Creditor’s A/c Dr. To Bills payable A/c |

|

Endorsing the bill |

Creditor’s A/c Dr. To Bills Receivable A/c |

No entry |

|

On maturity of the bill |

No entry |

Bills payable A/c Dr. To Bank A/c |

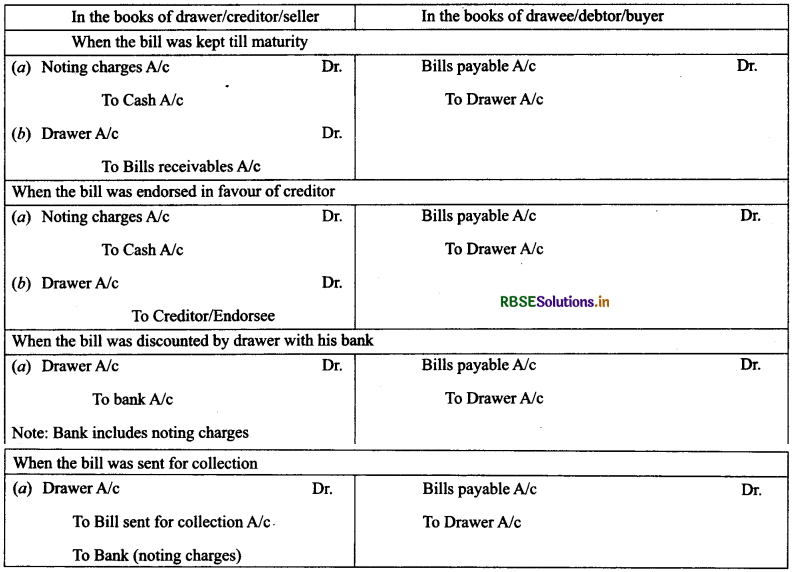

Dishonour of Bill (AccountingTreatment):

- RBSE Solutions for Class 11 Accountancy Chapter 5 बैंक समाधान विवरण

- RBSE Solutions for Class 11 Accountancy Chapter 4 लेन-देनों का अभिलेखन-2

- RBSE Solutions for Class 11 Accountancy Chapter 6 तलपट एवं अशुद्धियों का शोधन

- RBSE Class 11 Accountancy Important Questions in Hindi & English Medium

- RBSE Solutions for Class 11 Economics Chapter 4 Presentation of Data

- RBSE Class 11 Accountancy Important Questions Chapter 12 Applications of Computers in Accounting

- RBSE Class 11 Accountancy Important Questions Chapter 11 Accounts from Incomplete Records

- RBSE Class 11 Accountancy Important Questions Chapter 10 Financial Statements-II

- RBSE Class 11 Accountancy Important Questions Chapter 9 Financial Statements-I

- RBSE Class 11 Accountancy Important Questions Chapter 7 Depreciation, Provisions and Reserves

- RBSE Class 11 Accountancy Important Questions Chapter 6 Trial Balance and Rectification of Errors