RBSE Class 11 Accountancy Notes Chapter 7 Depreciation, Provisions and Reserves

These comprehensive RBSE Class 11 Accountancy Notes Chapter 7 Depreciation, Provisions and Reserves will give a brief overview of all the concepts.

RBSE Class 11 Accountancy Chapter 7 Notes Depreciation, Provisions and Reserves

Meaning:

Depreciation described as a permanent, continuing and gradual shrinkage in the book value of fixed assets due to the use, passage of time and obsolescence through technology or market change. It is the expired cost of fixed asset which is charged against the revenue of a given period.

Features of Depreciation

(a) Depreciation is the fall in the value of fixed assets. These assets include machines, plants, furniture, buildings, computers, trucks, vans, equipments, etc.

(b) It is an expired cost of the fixed asset.

(c) It is a non-cash expense.

(d) Deprecation is a continuous, regular, gradual and permanent decline in the book value of an asset.

(e) Depreciation is not always physical deterioration but loss of usefulness from business point of view.

(f) Depreciation charged on tangible fixed assets (also known as depreciable asset). The term is not used for fictitious assets such as goodwill, patent right, etc. and wasting assets such as mines.

Need of Charging Depreciation:

(a) To Ascertain the True Result of the Business: To arrive at the true profits, depreciation must be provided for and recorded as a loss of the business.

(b) To Replace an Asset: To replace certain assets which become useless after sometime by the new ones, a provision of depreciation should be made by setting aside every year an amount equal to the depreciation of an assets.

(c) To Exhibit True Value of Balance Sheet: It is not possible to show assets at their true values in a Balance Sheet unless depreciation is deducted from their values.

(d) To Spread the l oss Caused by Depreciation of Assets Over a Number of Y ears: The loss in the value of assets is undoubtedly a loss of the business and it is spread over a number of years by making a provision for depreciation.

(e) To Make Correct Payment of Income Tax: If no provision for depreciation is made the profit of the year will enhance and due profit more income tax will have to be paid.

Causes for Charging Depreciation

(a) Wear and Tear: Most common cause of depreciation is the wear and tear of an asset during the course of its use. The more an asset is used, the more is the wear and tear and decrease in its value.

(b) Efflux of Time: With the expiry of time, the value of an asset may decrease even if it is not used in the business operations.

(c) Obsolescence: On account of some new inventions, value of an existing asset may decrease. Obsolescence arises when an asset becomes obsolete or outdated because of the availability of a new improved type which is able to perform the same job more efficiently or economically.

(d) Accidents: An asset may lose some of its value due to an accident, such as storm, fire, rain, etc. or because of human error.

(e) Exhaustion: Wasting assets like mines, oil wells, etc. get exhausted due to continuous extraction of minerals, oils, etc.

(f) Fall in Price: Though fluctuation in the market price of an asset is not recorded in the books but if the fall in the price is permanent we have to account for the loss.

Factors Affecting the Amount of Depreciation

Amount of charging depreciation depends upon three factors:

(a) Cost of Asset: It is also known as historical cost or original cost. It includes cost price and other costs which are incurred to put the asset into working condition. All such costs are capital in nature and once the asset comes into working capital, the expenses which are incurred to keep the asset into running condition, are considered as revenue expenditure. All revenue expenditures are shown in the profit and loss account.

Cost of asset = Cost price + all cost incurred from the date of purchase till asset is put to use.

Costs other than cost price = Freight, transportation, transit insurance, installation cost, registration cost, commission on purchase, initial repairs, softwares for asset bought.

(b) Estimated Net Residual Value: It is also known as the salvage value or scrap value which is estimated to be realised after the end of its useful life. Such value is reduced by the associated cost necessary to incur.

Depreciable Cost: It is the cost which is the base to find out the amount of depreciation. It is calculated by deducing residual value of asset from the cost of the asset.

Depreciation cost = Cos of the Asset - Net Realisable value.

(c) Estimated Useful Life: Useful life of an asset is economic or commercial life of the asset. Physically life is not important as asset may exist but it may not be commercially viable due to outdated technology or its effectiveness to produce as desired.

Depreciation and Similar Terms:

(a) Depletion: The term is used in connection with the extraction of natural resources from the earth like mines, wells, queries etc. The decrease in the availability of natural resources is known as depletion. Accounting treatment for depreciation and depletion is same.

(b) Amortisation: It refers to the writing off the cost of intangible assets acquired like patents, copyrights, trademarks, franchise, goodwill etc. these intangible assets too have limited life. Accounting treatment is same as for tangible fixed assets.

Methods of Calculating Depreciation

There are two methods mandated by law and enforced by professional accounting practice. These are:

(a) Straight Line Method: This method is also known as fixed instalment method or original cost method. Fixed amount of depreciation is charged on the basis of usage in an accounting year and the cost is reduced to its salvage value.

Depreciation = \(\frac{\text { Cost of the asset }-\text { Estimated net realisable value }}{\text { Estimated useful life of the asset }} \)

Rate of Depreciation = \(\frac{\text { Annual depreciation }}{\text { Cost of asset }}\) × 100

Advantages of Straight Line Method

(a) Simple to use and popular

(b) Possible to distribute full depreciable cost over useful life to scrap value or nil.

(c) Makes comparison of profits easy as same amount of depreciation is used every year.

Limitations of Straight Line Method

(a) Faulty assumption of same amount of the utility of an asset in different accounting years.

(b) Total amount charged on accoimt of depreciation and repairs taken together do not remain uniform throughout the life of the asset.

(c) It does not take effective use of asset.

Suitability: it is suitable where the useful life of the asset can be estimated accurately such as leasehold building, patents etc., where the repair charges are low and possibility of obsolescence is low.

(b) Written down value method: It is also known as diminishing balance method and reducing balance method. At the every year, depreciation is charged on the book value of the asset. This method is based on the assumption that benefit from the asset goes on decreasing with the passage of time and hence amount of depreciation goes on decreasing each year.

Calculation of Depreciation: Depreciation is calculated at a fixed percentage on the original cost in the first year but in subsequent years it is calculated at the same percentage on the written down value gradually reducing during the expected working life of the asset.

Rate of depreciation

R = [1 - n\(\sqrt{\frac{s}{c}}\)] × 100

Where, r = Rate of depreciation

n = Expected useful life

s = Scrap value

c = Cost of an asset

Advantages of Written Down Value Method

(a) It is easy and simple method

(b) There is equal burden of depreciation as per the usage of asset

(c) It is recognised by the income tax law.

Limitations of Written Down Value Method

(a) It is difficult to determine appropriate rate of depreciation

(b) Value of asset cannot be brought down to zero.

Suitability: it is suitable for those assets where technological changes are high, like incase of plants, machinery etc. and where repair expenses are quite high.

Difference between straight line method and written down value method

|

Basis |

Straight line method |

Written down value method |

|

1. Basis |

It is calculated on the original cost of asset every year |

It is calculated on the original cost in the first year and on the book value thereafter. |

|

2. Amount of depreciation |

The yearly amount of depreciation remains same every year |

The amount of depreciation goes on decreasing every year. |

|

3. Burden of depreciation |

It creates more burden on the profits in later years. |

As the book value of asset decreases, the amount of depreciation decreases and balanced burden on profits every year. |

|

4. Book value on the expiry of life |

Book value becomes zero at the end of estimated life of asset |

The book value never becomes zero. |

|

5. Recognition as per law |

It is not recognized under Income Tax Law |

It is recognized under income tax law. |

Methods of Recording Depreciation

There are two methods of recording depreciation:

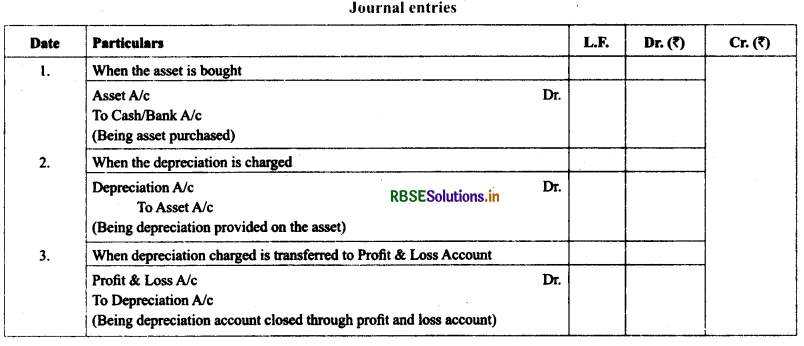

(a) When the Depreciation is Charged to the Asset Concerned

Under this method, depreciation is charged on the cost of the asset at the end of each year and the same is subtracted from its value on the asset side of the balance sheet.

(b) When the Depreciation Fund is Maintained for the Asset Concerned

(b) When the Depreciation Fund is Maintained for the Asset Concerned

Under this method, asset account is maintained at its original cost and depreciation required on such assets is recorded in a separate account meant for this purpose, it is known as ‘Provision for depreciation’ or Accumulated depreciation A/c’ or Accumulated depreciation A/c’.

Provision for depreciation continue to increase every year and it is transferred to the asset account when the asset is discarded or sold. It is transferred to asset account wholly if the whole asset is sold/discarded or proportionately if a part of the asset is sold/discarded.

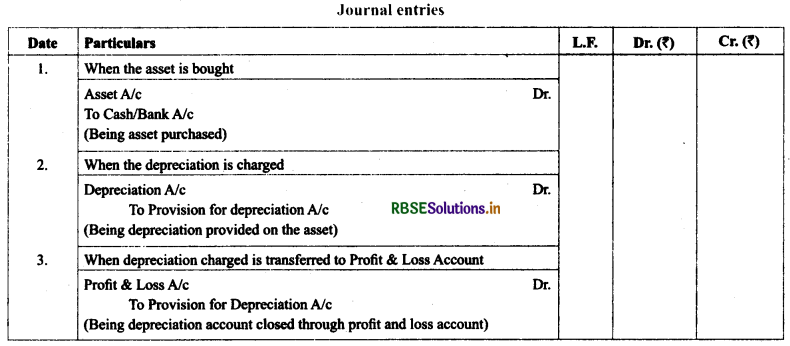

Asset Disposal Account

Asset disposal account may be required to prepare when an asset or part of asset is sold. Book value of asset sold (if depreciation is directly charged on the asset) or the original cost of the asset sold (if depreciation account is separately prepared) is transferred on the debit side of asset disposal account. All entries on the sale are entered in the asset disposal account in such a case.

Provision - Meaning, Accounting Treatment

Provision - Meaning, Accounting Treatment

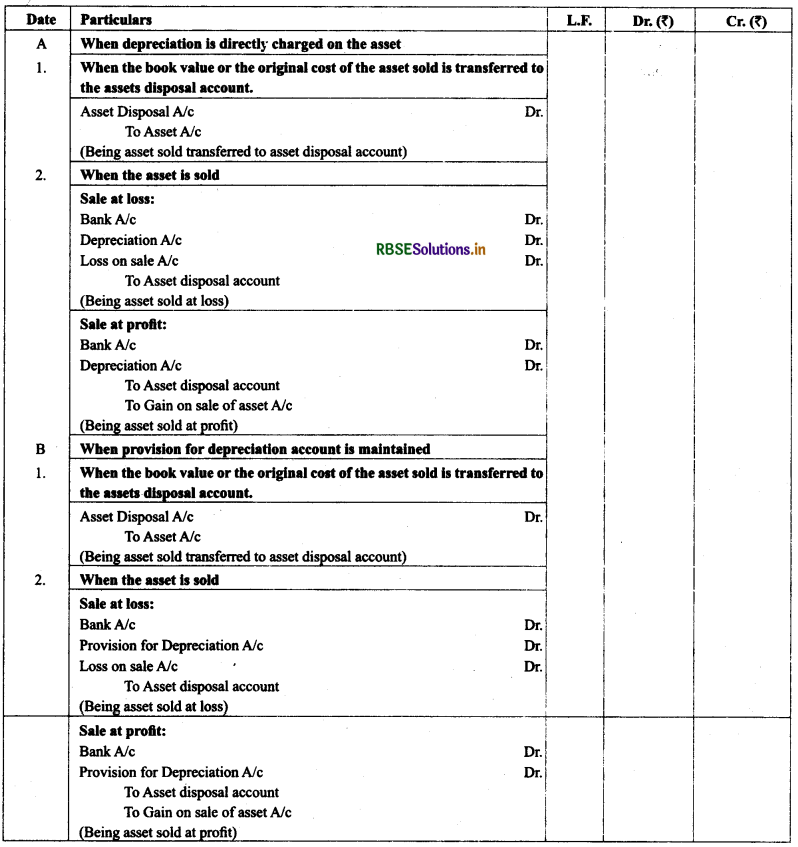

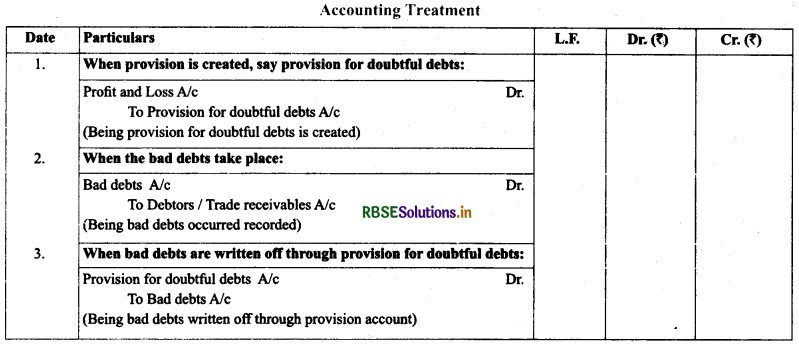

Meaning: Retaining a part of profit for an expense or loss for which amount is not certain is called provision. It is charged against the profit, means it is created even a firm involves loss and is shown on the debt side of profit and loss account while creating.

Examples: Provision for depreciation, Provision for bad and doubtful debts, Provision for taxation, Provision for discount on debtors, and Provision for repairs and renewals.

Disclosure: The provisions which have been against the use of any asset, are shown as deduction form their respective assets on the assets side and others are shown on the liabilities side.

Reserves - Meaning,Types & Accounting Treatment

Reserves - Meaning,Types & Accounting Treatment

Meaning:

- Retaining a part of profit not for any particular expense, loss and liability but to strengthen the financial position or to meet financial needs of future, is called reserve.

- It is an appropriation of profit, means it is created if the profits are available.

- When a reserves is created, it reduces the availability of profits to the owners and in case of companies, shareholders receive lower amount of dividend.

Examples: General reserve, Workmen compensation reserve, Investment fluctuation fund, Capital reserve, Dividend equalisation reserve, Reserve for redemption of debenture etc.

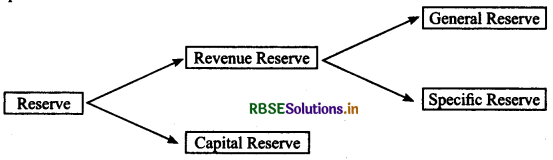

Types of Reserves

Reserve can be broadly classified as Revenue Reserve and Capital Reserve General Reserve and Specific Reserve

(A) Revenue Reserve: These are the reserve which are created out of divisible profits which would have been distributed as profit among owner(s) or shareholders. Revenue reserve may be classified into two categories:

(a) General Reserve: When a reserve is created without any purpose, it is called as general reserve. It is meant for future emergencies or expansion of the business. It is a free reserve and management can utilise for any purpose.

(b) Specific Reserve;It is a reserve which is created for some specific purpose and it can be used only for such purpose for which it is created.

Some of the specific reserves are:

- Dividend Equilisation Reserve: It is maintained to stabalise the dividend rate. It is used to declare dividend in the year of low profits or no profits.

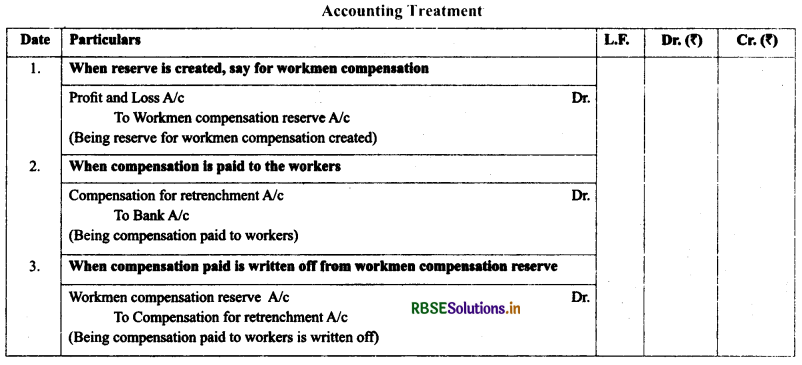

- Workmen Compensation Reserve: It is created to write off the various claims settled between management and employees.

- Investment Fluctuation Fund: It is created to set off the decline in the value of investments.

- Debenture Redemption Reserved is created under legal norms to repay the amount of debentures'outstanding in time.

- Capital Reserve: These reserve are created due to occurring of capital profits. These do not arise from the normal operating activities.

These reserves are not available for the distribution as dividend but are used to write off capital expenditures and losses etc. example of such reserves are:

- Premium on issue of shares or debenture.

- Profit on sale of fixed assets.

- Profit on redemption of debentures.

- Profit on revaluation of fixed asset & liabilities.

- Profits prior to incorporation.

- Profit on reissue of forfeited shares

Secret Reserves: These reserves do not have any account and do not appear in the balance sheet. It is kept hidden by manipulating the values of accounts. The purpose of creating secret reserve is to show reduced income and to pay low dividends. Such reserves can be used to normalise the incomes in the years of recession. Secret reserve can be created in the following ways:

- Overcharging of depreciation than required.

- Undervaluation of inventories.

- Charging capital expenditures to profit and loss account.

- Making excessive provision for doubtful debts.

- Showing contingent liabilities as actual liabilities.

Note: Creation of secret reserve is acceptable justifiable on the grounds of expediency, prudence and to prevent competition.

Difference between Provision and Reserve

|

Basis |

Provision |

Reserve |

|

1. Nature |

It is charge against the profit |

It is an appropriation in nature |

|

2. Purpose |

It is created for a known liability |

It is created to strengthen the financial position |

|

3. Effect on taxable income |

It reduces taxable income |

It does not affect taxable income as it is created out of taxed income |

|

4. Presentation |

It is shown as deduction from the asset concerned or on the liabilities side |

It is always shown on the liabilities side under reserves and surplus |