RBSE Class 11 Accountancy Notes Chapter 4 Recording of Transactions-II

These comprehensive RBSE Class 11 Accountancy Notes Chapter 4 Recording of Transactions-II will give a brief overview of all the concepts.

RBSE Class 11 Accountancy Chapter 4 Notes Recording of Transactions-II

Special Journals:

Concept: In small organisations, all business transactions can be recorded in journal book and are transferred there from to the ledger which consists of various accounts but as the size of the organistion grows, it becomes difficult to record each transaction in the journal book especially when the transactions are of repetitive nature. For this purpose, special journals or day books are prepared. These special journals are called subsidiary books. The transactions which cannot be recorded in any of the subsidiary book, are recorded in the journal proper.

Meaning of Subsidiary Books: The journals which are prepared to record the transactions of repetitive nature are called special journals or subsidiary books or books of original entry.

Classification of Subsidiary Books: The subsidiary books can be classified into two broad categories;

(a) Cash book

(b) Other subsidiary books

Cash Book:

Meaning of Cash Book: It is day book which is prepared to record cash receipts and cash payments. It starts with balance Of cash or bank or both.

It serves the purpose of journal as well as ledger means no entry of cash and bank is recorded in the journal book and no separate account is maintained for cash and bank in the ledger.

Features of Cash Book

- All cash and bank transactions are recorded in cash book.

- Receipts are recorded on debit side and payment are recorded on credit side.

- It is based on rules of double entry system.

- Transactions are recorded in chronological order.

- It perform the role of both ledger and journal.

- Format of cash book is just like ledger; cash book is balanced daily.

- In cash book cash column must have debit balance always. It can’t have credit balance because no one can pay more than what one possesses.

Types of Cash Book

Cash book is divided into two broad categories

(a) Main cash book

- Single column cash book: It can be prepared either for cash or bank account.

- Double column cash book: It can be prepared

- for cash and discount accounts,

- bank and discount accounts and

- cash and bank accounts.

- Three column cash book: it is prepared for cash, bank and discount account.

(b) Petty cash book

- Simple petty cash book

- Analytical petty cash book

Note: As per syllabus, single column cash book with cash column, double column cash book with cash and bank column are being discussed.

Single Column Cash Book:

This book is prepared to record cash receipts and cash payments. On the debit side, all cash receipts are recorded and on the credit side, all cash payments are recorded. No, cash account is prepared in the ledger.

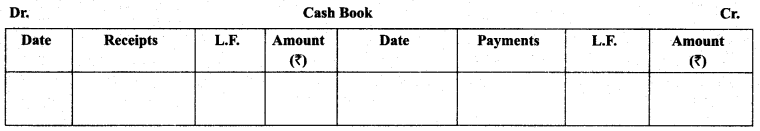

Format of single column cash book

Posting in Ledger:

From the debit side and credit side of it, all accounts are opened in the ledger with their respective names. When any account is opend from the debit side of it, we write ‘By Cash A/c’ on the credit side of such account and when any account is opened from the credit side of it, we write ‘To Cash A/c’ on the debit side of such account in the ledger.

Double Column Cash Book:

In double scolumn cash book, two columns are drawn on each side of cash book, one for cash transactions and other for cheque transactions. On the debit side, cash reciepts and receipts in cheques are recorded and on the credit side cash payments and payments in cheque are recorded. This book serves the purpose of cash account as well as bank account and no account for cash and bank is prepared in the ledger book.

Posting in Ledger:

Posting is done in the same way as is done in single column cash book. From the debit side, all accounts credited are opened in the ledger. On the credit side of such accounts, we write ‘By Cash A/c’ or ‘By Bank A/c’ as the cash may be. Similarly, from the credit side, all accounts debited in cash book are opened in the ledgeer. On the debit side of such accounts, we weite ‘To Cash A/c’ or ‘To Bank A/c’ as the case may be.

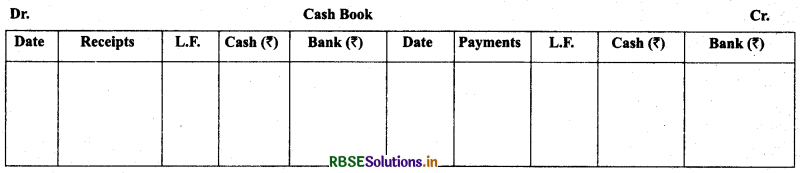

Format of Double Column Cash Book

Important Entries Relating to Bank:

Important Entries Relating to Bank:

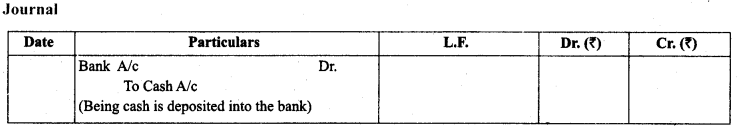

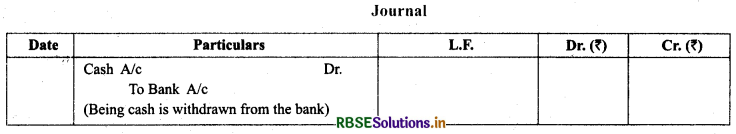

(a) Contra Entries: Any transaction which involves cash account and bank account in which if cash account is debited then bank account is credited and vice-versa, such tranactions are called contra entries. Against such entries, the word ‘Contra’ is written in the L.F. column which indicates that these entries are recorded on the both sides of cash book and not to be recorded in the ledger.

These entries are:

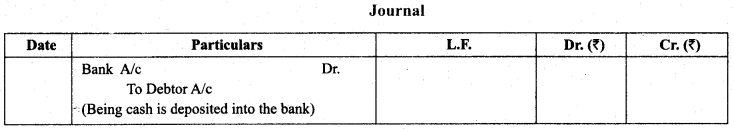

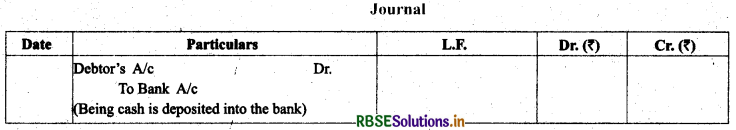

(1) When cash is depostied into bank Journal

(2) When cash is withdrawn from bank

(b) Receipt of Cheque and deposit on the same day

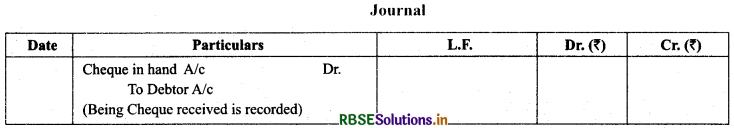

(c) Receipt of Cheque and deposit on another day On the day of receipt

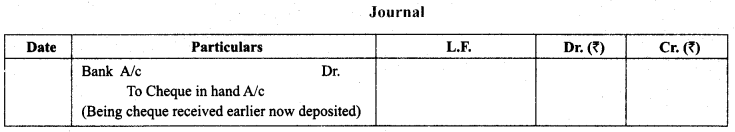

On the day of deposit

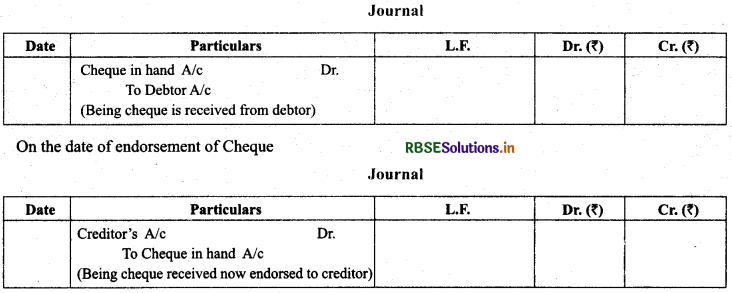

(d) Receipt of Cheque and endorsement to any creditor On the date of receipt of cheque

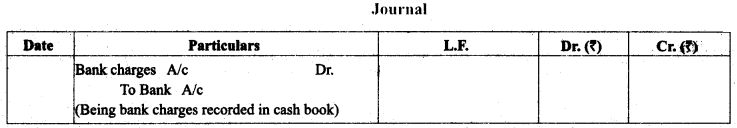

(e) Bank charges/interest charges made by bank

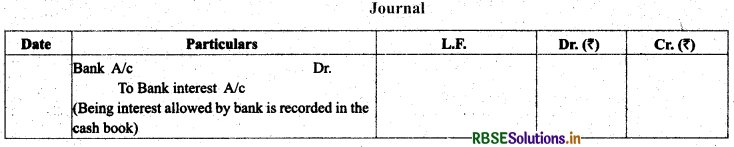

(f) Interest allowed by bank

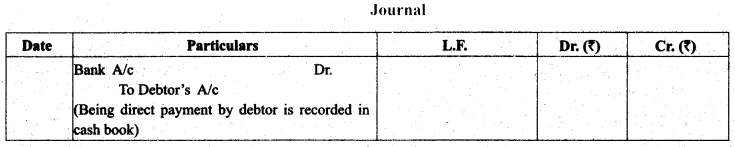

(g) Cheques directly deposited by customers into our bank

(h) Cheque deposited earlier, returns dishonoured

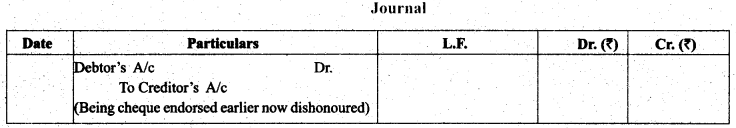

(i) Cheque endorsed earlier, returns dishonoured

Petty Cash Book:

The transactions involving large amounts are recorded in cash book but for the small of transactions, another book is prepared which is known as petty cash book. This book contains the transactions of repetitive nature with small amounts like postage, fare, conveyance, postage, stationery etc.

Imprest System of Petty Cash Book:

In the beginning of certain period, the petty cashier is given a fixed amount and out of which he is supposed to incur certain expenditures. In the beginning of next period, the expenses incurred are reimbursed by the head cashier. Thus, the petty cashier has the same balance in the beginning of the next period. This system of maintaining of receipts and making payment is called imprest system.

Advantages of Petty Cash Book

- lime Saving and Cost Effective: As petty cashier handles the work of making all petty expense, the main cashier has to record only the total of such expenses at the end of each month.

- Convenience in Preparing the Cash Book: As the number of small payments in every business is quite large and as these are recorded in the petty cash book itself, the main cashier is not overburdened.

- Control on petty expenses. The main cashier keeps checking the petty cash book from time to time and unnecessary expenditures are controlled.

- Simple Method. The maintenance of petty cash book does not require any specialised knowledge of accounting.

Types of Petty Cash Book:

There are two ways to prepare petty cash books.

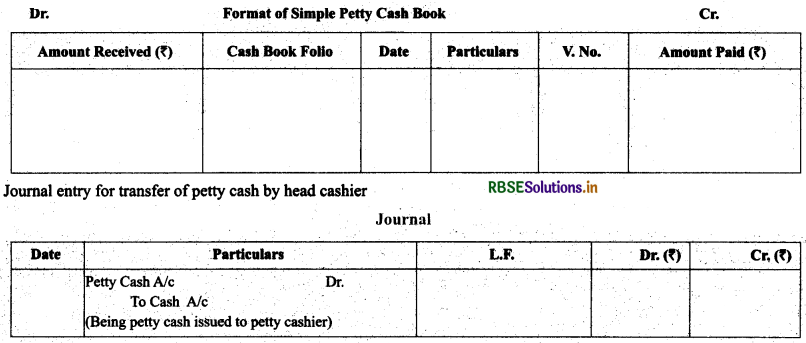

(a) Simple petty cash book: It is prepared like a simple cash book having debit and credit side. All incoming cash is shown on debit side and all outgoing cash is shown on credit side.

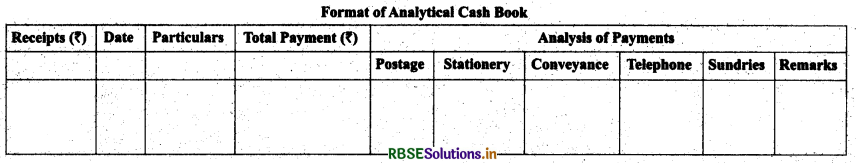

(b) Analytical or Columnar Petty Cash Book: In this type of petty cash book, on the payment (Credit) side, a separate column is provided for each class of most common expenses. Number of columns depends upon the nature and need of the particular business. Those expenses that are not entered in any separate column are entered in a column designated as ‘Sundry Expenses’.

Special Purpose Subsidiary Books

Special Purpose Subsidiary Books

Concept: There are two types of transactions. Cash transactions and non-cash transactions. Cash transactions are recorded in cash book. Non-cash transactions are further classified into two categories, transactions relating to revenue generations and others. Non cash transactions relating to revenue generations are recorded in the special purpose books whereas other nOn-cash transactions are recorded in journal proper.

Meaning of special purpose subsidiary books: These books are prepared to record the special transactions of repetitive nature. Such special transactions include credit purchase/sale, returns, receivables and payables.

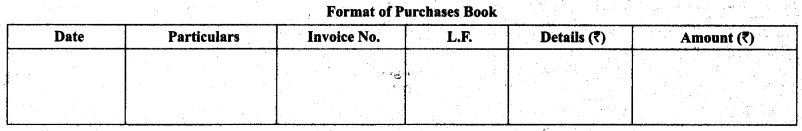

(a) Purchase Book: It is prepared to record credit purchases of goods. It is preapared on the basisof source documents such as invoices and bills. The net amount of goods bought alongwith the trade discount and taxes are recorded alongwith the name of the creditors. The entries recorded are directly transferred to the ‘Credit side’ of creditors’ accounts in the ledger but the balance of purchase book is transferred to the ‘Debit Side’ of purchase account on daily, weekly, fortnighly, monthly basis depending upon the quantum of purchases.

Format of Purchase Book

Details of Purchase Book

Details of Purchase Book

- Date: It shows the date of a transaction.

- Particulars: It shows name of the supplier of goods along with the quantity .

- Invoice No: It contains invoice number of the goods supplied by the supplier.

- L.F. In this column, we write the page number of the account of supplier in the ledger.

- Details: In this column, details of amount like rate per article, gross price, trade discount, Input CGST, Input SGST, Input IGST and expenses involved (freight charges, etc.) are mentioned.

- Amount: Net amount of the transaction is shown in this column.

Some other Important items Related to Purchases

1. Input CGST: It is paid on the intra-state purchase of goods and services. It is paid as half of the tax rate and is the income of the central government. It is subject to adjust against Output CGST or IGST.

2. Input SGST: It is also paid on the intra-state purchase of goods and services. It is also paid as half of the tax rate and is the income of the state government concerned in which goods have been sold. It is subject to adjust against Output SGST.

3. Input IGST: It is paid on the inter-state purchase of goods and services. It is subject to adjust against Output IGST or CGST.

4. Freight: At the time of sending goods, the seller spends money on freight (also known as cartage). Generally, the sellers charge freight from the buyers. If the seller has charged freight, its amount is added in the invoice.

5. Packing and Forwarding Charges: Like freight, the Seller may charge packing and forwarding charges in the invoice* Packing charges are those expenses which are involved in packing of goods. Forwarding charges are those expenses which are incurred in transporting goods from the seller’s godown to the place of transporting agency.

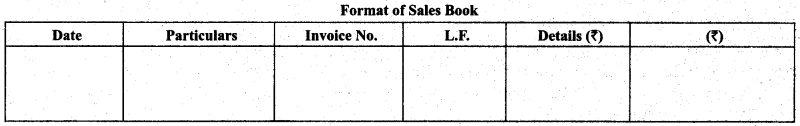

(b) Sales Book: It is prepared to record credit sales of goods. It is preapared on the basis of source documents such as sales invoice and bill. The net amount of goods sold alongwith the trade discount and taxes are recorded alongwith the name of the debtors. The entries recorded are directly transferred to the ‘Debit side’ of Debtors’ accounts in the ledger but the balance of sales book is transferred to the ‘Credit side’ of sales account on daily, weekly, fortnighly, monthly basis depending upon the quantum of sales.

Format of Sales Book

Details of Sales Book

Details of Sales Book

- Date: It shows the date of a transaction.

- Particulars: It shows name of the customer of goods along with the quantity.

- Invoice No: It contains invoice number of the goods supplied to the customer.

- L.F. In this column, we write the page number of the account of customer in the ledger.

- Details: In this column, details of amount like rate per article, gross price, trade discount, GST and expenses involved (freight charges, etc.) are mentioned.

- Amount: Net amount of the transaction is shown in this column

Some other Important items Related to Purchases

1. Output CGST: It is charged on the intra-state sale of goods and services. It is charged as half the tax rate and is the income for the central government. It is used to set off Input GGST and the balance is paid to the government.

2. Output SGST: It is also charged on the intra-state sale of goods and services. It is charged as half of the tax rate and is the income for the state government in which sales takes place. It is used to set off Input SGST.

3. Output IGST: It is charged on the inter-state sale of goods and services. It is used to set off Input IGST, CGST and SGST.

4. Freight: If the seller has paid freight for sending goods sold to the buyer, he charges this amount from the buyer by adding it in the invoice. For this purpose, a separate column is provided in Sales Book.

5. Packing and Forwarding Charges: The seller charges packing and forwarding expenses from the buyer by adding these in the invoice. For this purpose, a separate column is provided in Sales Book.

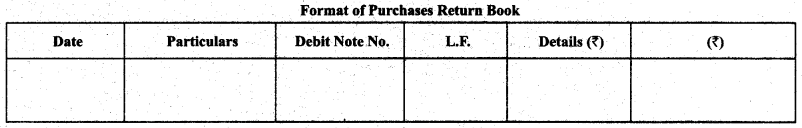

(c) Purchase return/returns outward Book: It is prepared to record the return of goods to the supplier, from whom the goods were bought on credit basis, due to defect in goods, poor quality or any other valid reason. For every return, debit note (in duplicate) is prepared and original one is sent to die supplier to enable him to record the entry in his book and debit note becomes the basis to record purchase returns. The supplier may also prepare a note which is called credit note.

From this journal, the supplier account is debited in the ledger for every return and total of this book is transferred on the credit side of purchase return account periodically.

Format of Purchase Return Book

Details of Purchase Return Book

Details of Purchase Return Book

- Date: It shows the date of a transaction.

- Particulars: It shows name of the supplier of goods to whom the goods are returned.

- Debit Note No: It contains debit note number.

- L.F. In this column, we write the page number of the account of supplier which such returns are recorded.

- Details: In this column, details of amount like rate per article, gross price, trade discount etc. are mentioned.

- Amount: Net amount of the transaction is shown in this column.

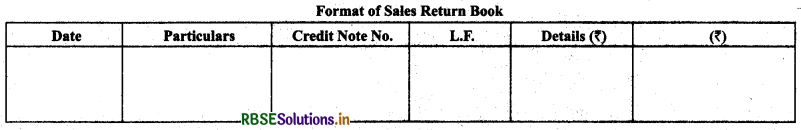

(d) Sales Return/Returns Inward Book:

This journal is prepared to record the goods return by the customers to whom the goods were sold on the credit basis. For this pupose, credit note is preapred. This source document becomes the basis to record the transactions relating to sales returns.

From this journal, the customer’s account is creditred in the ledger for every return mid total of this book is transferred on the debit side of sales return account periodically.

Format of Sales Return Book

Details of Sales Return Book

Details of Sales Return Book

- Date: It shows the date of a transaction.

- Particulars: It shows name of the supplier of goods to whom the goods are returned.

- Credit Note No: It contains credit note number.

- L.F. In this column, we write the page number ofthe account of supplier which such returns are recorded.

- Details: In this column, details of amount like rate per article, gross price, trade discount etc. are mentioned.

- Amount: Net amount ofthe transaction is shown in this column.

Journal Proper

Meaning: It is prepared to record all those transactions which cannot be recorded in any of the special journals or subsidiary books.

Transactions to be included in journal proper

(a) Opening Entry: To open the various accounts of assets, liabilities and Capital, opening balances are written with the help of opening entry.

(b) Adjustment Entries: To update the accounts on the accrual basis, certain entries are made at the end of the year. These entries include, outstanding expenses, accrued incomes, advance incomes, prepaid expenses, depreciation, provisions, reserves etc.

(c) Rectification Entries: Journal proper is also used to rectify the errors in recording the transactions in journal and posting therefrom to ledgers.

(d) Transfer Entries: Journal proper is used to close all nominal accounts from the trial balance while transferring their balances in the income statement Such entries are also called transfer entries.

(e) Other Entries: The entries which do not find place in any of the subsidiary books, are recorded in the journal book. Example, purchase/sale of any asset on credit, bad debts, depreciation, goods distributed as free Sample, loss of goods by fire etc.