RBSE Class 11 Accountancy Notes Chapter 12 Applications of Computers in Accounting

These comprehensive RBSE Class 11 Accountancy Notes Chapter 12 Applications of Computers in Accounting will give a brief overview of all the concepts.

RBSE Class 11 Accountancy Chapter 12 Notes Applications of Computers in Accounting

Meaning of Computer and Elements

Meaning of computer: A computer is a device capable of performing variety of operations, calculations and operations based on instructions provided by a software or hardware program.

Elements of Computer System

(a) Hardware: Hardware of computers include monitor, printer, key board, processor, mouse, processor etc.

(b) Software: In order to solve a particular problem, a computer needs to be given specific instructions written in a particular language. Set of instructions is known as program and set of different programs is known as ‘software’.

Example: By installing ‘Accounting software’, accounts can be prepared, through ‘Pay roll software’, the attendance of employees can be monitored, through ‘GST software’, Input GST and Output GST can be maintained.

(c) People: The individuals working on the computer systems by using hardware and software are also called live-ware of the computer. They are three types, systems analysts, programmers and operators.

(d) Procedure: Series of operations exercised by the people to achieve desired results. They are three types: software oriented, hardware oriented and internal procedure. These procedures are of three types: hardware oriented, software oriented and internal procedure.

(e) Data: These are the facts in terms of number or text, gathered and entered into a computer system. Examples, data of attendance of students, data on the pay to employees etc.

Connectivity: The way the computers are connected through internet, satellite links, microwave transmission etc.

Capabilities of Computer System

Characteristics of a computer system in computer to human beings are turn out to be its capabilities. These are:

(a) Speed: It refers to the amount of time computers take to complete a task.

(b) Accuracy: It refers to the degree of exactness the computers can perform.

(c) Reliability: It refers to the ability of the computer system to serve the users.

(d) Versatility: It refers to the multiple jobs the computers can perform, simple as well as complex.

(e) Storage: It refers to the amount of data a computer can store and access.

Limitations of Computer System

(a) Lack of commonsense: Since computers work as per the programs installed, we cannot expect computers to apply commonsense.

(b) Zero IQ: Computers cannot visualise what to do under a particular situation as they are programmed what they need to do.

(c) Lack of decision making: Computers do not possess all the elements like knowledge, intelligence, wisdom, ability etc. are required to take decisions.

Components of Computer System

(a) Input Unit: It controls various devices while help store the data. These devices include keyboard, mouse, optical scanner, MICR (Magnetic Ink Character Recognition), OCR (Optical Characteristic Recognition), Bar Code Reader, Smart Card Reader etc.

(b) Central Processing Unit: It is the main part of computer system which processes data. This part includes

- Arithmetic and Logic Unit: It is responsible for all arithmetical computations.

- Memory Unit: This is used to store the data is stored before being actually processed.

- Control Unit: It control and coordinates all the activities of all other units.

(c) Output Unit: This unit translates the processed date from machine codded form to a human readable form.

Computerised Accounting: Evolution and Features

Evolution: Technically, computers have been in use since 5,000 years ago in the form of Abacus. Conventionally, bookkeeper used to maintain cash book and other subsidiary books to record the transactions of the business to prepare summary of final accounts. Gradually, the machines were used to reduce the repetition and workload and later first full sized digital computer in history was developed in 1944 called ‘The Mark I’.

Features of Computerised Accounting

(a) Accounting software is used to implement computerised accounting system.

(b) It is based on the concept of databases.

(c) Online input and storage of accounting data.

(d) Every transaction and account is assigned unique code.

(e) Generation of instant reports like Stock Statement, Trial Balance, GST Returns etc.

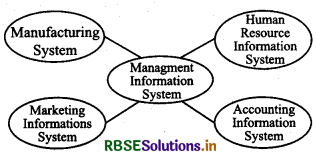

Information System - MIS and AIS

(a) Management Information System: It is a system which helps the management take decisions and manage and organisation effectively. It is viewed as Operational, Tactical and Strategic.

(b) Accounting Information System: It is a sub-system of Management Information System. It collects, processes, summarises, and reports about a business organisation in monetary terms.

Computerised Accounting vs. Manual Accounting

Computerised Accounting System is a system, which processes financial transactions and events as per General Accepted Accounting Principles.

Computerised Accounting System has two basic requirements:

- Accounting framework: It consists of set of principles, coding and grouping structure of accounting.

- Operating procedure: It is a well-defined operating procedure blended suitably with the operating environment of the organisation.

Advantages of computerised accounting system

(a) Speed: It is always faster than in manual accounting.

(b) Accuracy: Possibility of errors is eliminated

(c) Reliability: They are immune to tiredness, boredom ahd fatigue, the informations are always reliable.

(d) Upto date information: The accounting records are always updated when the data is entered and stored.

{e) Real time user interface: Most of the compuer systems'are interlinked, they provide real time information to the users.

Limitations of computerised system

(a) Cost of training: Huge cost is involved to train the employees on hardwares and softwares

(b) Staff opposition: Staff may resent as they feel they will become less important or may lose their jobs.

(c) Disruption: It happens when the organisation switches to computerised system from manual accounting.

(d) System failure: Hardware failure and subsequent loss of work is a common problem.

(e) Ill effects on health: Excessive use of computers impacts on health like back pain, eyes strain, muscular pains.

Difference between computerized accounting and manual accounting

|

Basis |

Computerized Accounting |

Manual Accounting |

|

Identification of transactions |

Financial transactions |

Financial transactions |

|

Recording |

On the basis of database |

Books of original entries |

|

Classification |

No duplication of transactions |

Duplication of transaction as transactions are first recorded in journal and then to ledger accounts. |

|

Generation of Accounts |

Not necessary |

Necessary |

|

Summarising |

Processing of transactions produces final balances |

Summarisation through trial balance |

|

Adjusting entries |

No such entries |

Necessary to adhere to cost matching revenue |

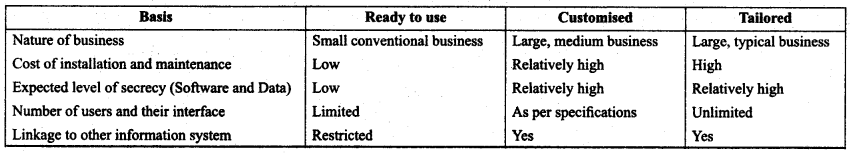

Sourcing of Accounting Softwares:

Accounting softwares are classified into the following categories:

(а) Ready to use softwares: These are general softwares where adaptability is very high like Tally, Ex, Busy etc.

(b) Customised softwares: Ready to use softwares are modified to suit the specific requirements of the users.

(c) Tailor made softwares: These are softwares, which are developed to meet the requirements of the user based on discussion between the user and developers.

Difference between different accounting softwares

Generic considerations before sourcing accounting softwares

Generic considerations before sourcing accounting softwares

(a) Flexibility: A computer system must be flexible in respect of data handling and report preparations.

(b) Maintenance cost: Softwares must be bought after thorough analysis as cheap softwares sometimes prove to be costly due to high alterations, modifications, improvements etc.

(c) Size of the organisation: Small organisations prefer simple softwares whereas big organisations prefer sophisticated softwares.

(d) Easy in adaptation: Softwares must be simple and easy to use, otherwise complex softwares require rigorous training cost.

(e) Secrecy of data; Softwares must have protection layers to protect the data from theft, hacking etc.

Accounting Reports

Meaning: When the data is processed, it becomes information and when the information is summarised to meet a particular need, it becomes report. Such reports may be routine reports or specific reports. (lu

Essentials (criterions) of an accounting report

(a) Relevance

(b) Timeliness

(c) Accuracy

(d) Completeness

(e) Summarisation

Steps involved in designing accounting reports

- Definition of objectives: The objectives of the report must be clearly defined,

- Structure of the report: The structure should include information and the style of presentation.

- Querying with the database: The accounting information queries must be clearly defined.

- Finalisation of the report.