RBSE Class 11 Accountancy Important Questions Chapter 7 Depreciation, Provisions and Reserves

Rajasthan Board RBSE Class 11 Accountancy Important Questions Chapter 7 Depreciation, Provisions and Reserves Important Questions and Answers.

RBSE Class 11 Accountancy Important Questions Chapter 7 Depreciation, Provisions and Reserves

Very Short Answer Type Questions

Question 1.

What is depreciation?

Answer:

Depreciation is permanent and continuing diminution in the quality, quantity or the value of an asset.

Question 2.

Name two characteristics of depreciation.

Answer:

(1) It is decline in the value of tangible fixed assets.

(2) It is a gradual and continuous process.

Question 3.

State two causes of depreciation.

Answer:

(1) Normal wear and tear

(2) Efflux of time

Question 4.

Explain the term Obsolescence.

Answer:

It is a loss arising from out dating and replacing the existing asset with the new and improved model of that asset.

Question 5.

How is the term depreciation different from the term amortization?

Answer:

Depreciation refers to the fall in the value of tangible asset whereas the term amortization refers to written off part of

intangible assets.

Question 6.

Differentiate between state line method of charging depreciation from written down value method.

Answer:

Straight line method suggest to charge depreciation on the original value of the asset whereas the written down value method suggest to charge depreciation on the reduced value of asset after charging previous year(s) depreciation.

Question 7.

What is provision?

Answer:

It is an estimated amount set aside to meet uncertain loss or expense in future.

Question 8.

Give two examples of provision.

Answer:

Provision for doubtful debts and provision for income tax.

Question 9.

What is reserve?

Answer:

It is the part of profit set aside to strengthen the financial position of the business and to meet unforeseen losses or

liability.

Question 10.

How would be classify the reserves?

Answer:

Reserves can be classified into two categories, viz. Revenue Reserve and Capital Reserve.

Question 11.

Classify the revenue reserves.

Answer:

General reserve and specific reserve.

Question 12.

State capital reserve.

Answer:

The profit arisen out of any activity other than normal trading activities is known as capital reserve.

Question 13.

Differentiate between provision and reserve.

Answer:

Provision is created to meet future contingency which are known but amount of there is unknown whereas Reserve is created to strengthen the financial position of the business and to meet out unforeseen losses or liability.

Question 14.

Give two examples of capital reserve.

Answer:

Profit and on sale of fixed assets and profit earned prior to incorporation of a company.

Question 15.

What is secret reserve?

Answer:

Secret reserve refers to retention of surplus profit which are not disclosed in the balance sheet.

Short Answer Type Questions:

Question 1.

State three points of importance of charging depreciation.

Answer:

(a) To ascertain true result of the business: To arrive at the true profits, depreciation must be provided for and recorded as a loss of the business.

(b) To replace the existing assets: To replace certain assets which become useless after sometime by the new ones, a provision of depreciation should be made by setting aside every year an amount equal to the depreciation of an assets.

(c) To make correct calculation of tax: Depreciation is charged on the profit and thus reduces taxable profits. If not charged, it will increase tax liability.

Question 2.

What are the factors affecting the amount of depreciation.

Answer:

The following factors are considered while calculating the value of depreciation:

(i) Cost of asset. Cost of an asset includes purchase price, freight, installation charges and cost of subsequently improvements.

(ii) Working life of the asset. The estimated working life of the asset must also be ascertained. It can be calculated in terms of time (months or years or hours) or output (units or other operating measures, such as mileage etc)

(iii) Scrap or residual value of asset. Residual value (scrap or salvage value) is an estimated sale value of the asset at the end of its economic life of the firm. The estimated scarp value should be determined after deducting the disposal and removal costs (if any).

Question 3.

Discuss the factors which determine the estimated economic life of an asset.

Answer:

Useful life of a depreciable asset depends upon the following factors:

(a) Legal or contractual limits like in case of leasehold assets.

(b) The number of shifts for which the asset may be used.

(e) Repair and maintenance policy of the company.

(d) Technological upgradation Innovations and improvements in production methods.

Long Answer Type Questions:

Question 1.

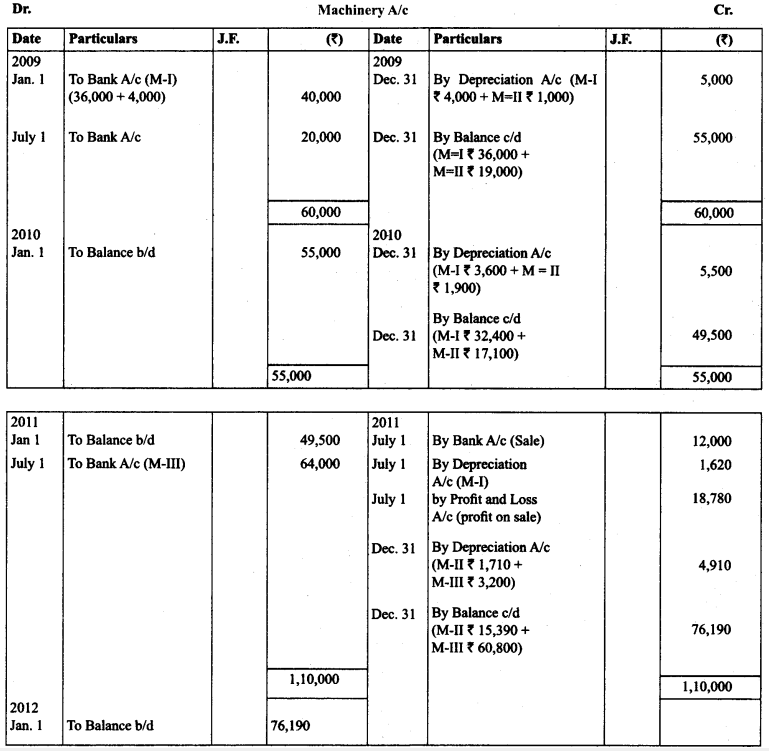

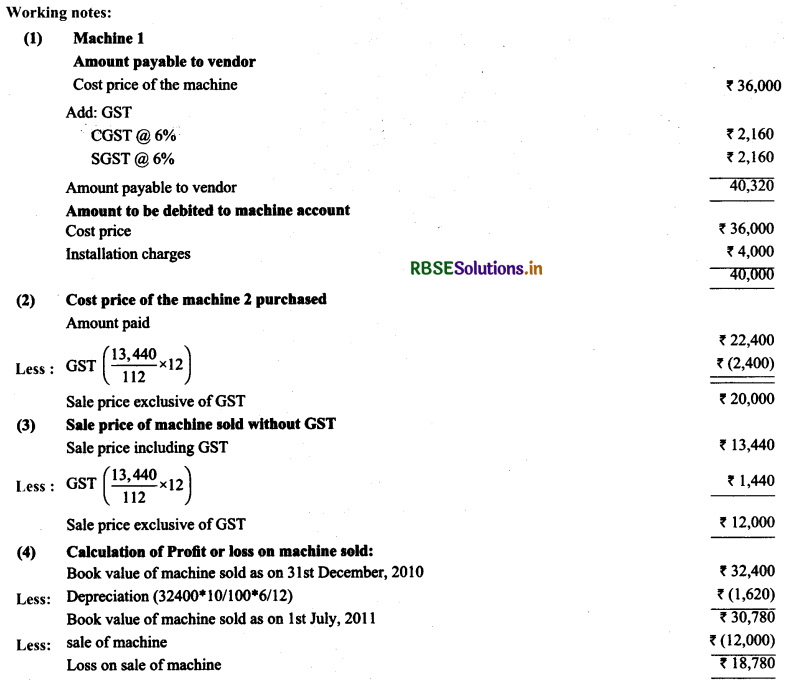

(Based on GST): Swadeshi Automobiles Limited purchased on 1st January, 2009 a machinery for 36,000 phis Input COST and Input SGST @ 12% and spent 4,000 on its installation. On 1st July, 2009 another machine purchased for 22,400 including Input COST and Input SOST @ 12%. On 1st July, 2011, machine bought on 1st January, 2009 was sold for 13,440 including Output CGST and Output SOST @ 12% and a new machine purchased for 64,000 pIus Input COST and Input SOST @ 12% on the same date. Depreciation is provided on 31st December @ 10%p.a. on the written down value method. Prepare machinery A/c from 2009 to 2011.

Answer:

Higher Order Thinking Skills Questions

Question 1.

Why does sales account always have credit balance?

Answer:

Sales is an income for the business and incomes have credit balance.

Question 2.

Trial balance has two sides, debit side and credit side. Is it an account? Explain with reason.

Answer:

Though trial balance has two sides but it cannot be an account because every account increases from one side and decreases from other side. It is a statement to record the closing balances of all accounts at the end of an accounting year.

Question 3.

“Trial Balance is a prima facie evidence of the arithmetical accuracy of books of accounts.” Do you agree with this statement? Give reason.

Answer:

Yes. When the totals of all debits and all credits are equal, it is said that the posting and balancing of accounts is arithmetically correct. But there can be errors which are not reflected in the agreement of trial balance and agreement cf trial balance is not the conclusive proof arithmetical accuracy.

Question 4.

When is the closing stock shown outside the trial balance?

Answer:

Closing stock is shown outside the trial balance when the closing stock is not valued before the preparation of trial balance.

Question 5.

When is the closing stock shown inside the trial balance?

Answer:

Closing stock is shown inside the trial balance when it is valued before the preparation of trial balance.

Question 6.

It is essential to show all accounts in the trial balance, still there are certain accounts which are not posted in the trial balance. Identity.

Answer:

The accounts which don’t have any balance or the accounts which have nil balance.

Question 7.

If you are preparing Ledger from Cash Book, which accounts will you not open in Ledger?

Answer:

Cash and bank account.

Question 8.

If a firm has allowed discount, on which side of discount account, such loss will be shown?

Answer:

Debit side.

Question 9.

Can we prepare financial statements without preparing trial balance? If it is not prepared, what will be the consequences?

Answer:

Yes, the financial statements can be prepared without preparing trial balance but there are likely chances that balance sheet may not match.

Question 10.

Name the error which is committed by violating the principles of accounting.

Answer:

Error of principle.

Question 11.

Name the errors which are not rectified through suspense account.

Answer:

Error of principle, compensating errors and errors of full omission.

Question 12.

How does suspense account take place and gets closed?

Answer:

When the trial balance does not agree, the balance on the either side of the trial balance is transferred to a newly opened account, known as ‘suspense account’. When all one sided errors are rectified, it gets automatically closed.

Question 13.

Explain with reason how the following transactions will affect the trial balance?

(a) Purchase of goods for ₹ 10,000 were recorded as ₹ 1,000.

(b) Sales of machinery for ₹ 20,000 was omitted to be recorded in the debtors account.

Answer:

(a) Trial balance will agree as in both purchase book and creditor’s account, same amount has been recorded.

(b) Trial balance will not agree as the transactions was recorded in the sales book but not in the customer’s account.

Question 14.

Identify the errors which will be disclosed by the trial balance.

(a) Purchase of furniture for ₹ 10,000 from Saurabh was recorded in Sarabh’s Account.

(b) ₹ 5,000 received from Santosh whose account was written off as bad in the previous year, now debited to her account.

Answer:

(a) It will not affect the trial balance as both sides of accounts recorded same amount.

(b) It will not tally as debit side exceeded by ₹ 5,000.

Question 15.

Identify the nature of errors in the following cases:

(a) Wages paid on the erection of machinery was debited to wages account.

(b) Credit purchase of furniture was recorded in the purchase book.

(c) Goods purchased for ₹ 10,000 were recorded as ₹ 1,000.

(d) Goods worth ₹ 1,000 returned by the customer were not recorded.

Answer:

(a) Error of principle.

(b) Error of principle.

(c) Error of commission.

(d) Error of omission.

I. Multiple Choice Questions

Question 1.

Cost price of an asset is ₹ 2,52,000; scrap value is ₹ 12,000; Useful Life is 6 Years. The rate of depreciation under Straight Line Method will be

(a) 15.87%

(b) 16.67%

(c) 15.80%

(d) 16.56%

Answers:

(a) 15.87%

Question 2.

What will be the percentage of depreciation under SLM in the following case:

Original Cost of Machine ₹ 3,50,000

Salvage value after 9 years ₹ 30,000

Repair charges in 2nd year ₹ 20,000

(a) 11.11%

(b) 10.15%

(c) 10.34%

(d) 9.37%

Answers:

(b) 10.15%

Question 3.

Which one of the following is not a feature of written down value method of depreciation?

(a) Book value of the asset may become zero in any year

(b) Depreciation is calculated on the book value

(c) Amount of depreciation go on reducing every year

(d) Scrap value is not determined

Answers:

(a) Book value of the asset may become zero in any year

Question 4.

Which of the following best describes the term depreciation?

(a) Estimating the value of fixed asset at the end of each year

(b) It helps reduce the income tax

(c) It helps allocating the cost of fixed asset over its useful life

(d) It brings the value of fixed asset near to the market value

Answers:

(c) It helps allocating the cost of fixed asset over its useful life

Question 5.

When a known liability cannot be determined with substantial accuracy, then

(a) Reserve should be created

(b) Provision should be created

(c) A definite liability should be created

(d) A contingent liability should be created

Answers:

(b) Provision should be created

Question 6.

Depreciation is not charged due to

(a) Wear and tear

(b) Efflux of time

(c) Fall in the market value of fixed assets

(d) obsolescence

Answers:

(c) Fall in the market value of fixed assets

Question 7.

Which of the following is charge against the profits

(a) creation of reserve

(b) creation of provision

(c) creation of both reserve and provision

(d) none of the above

Answers:

(b) creation of provision

Question 8.

Which of the following is the correct difference between reserve and provision?

(a) Provision is created for known liability whereas reserve is created for unknown liability

(b) Provision is an appropriation of profit whereas reserve is a charge against the profits

(c) Provision is charge against the profits whereas reserve is an appropriation of profits

(d) Reserve is created before the tax liability whereas provision is created after the tax liability

Answers:

(b) Provision is an appropriation of profit whereas reserve is a charge against the profits

Question 9.

Capital reserve is created due to ....................

(a) Revenue receipt

(b) Capital receipt

(c) Any of the receipts

(d) None of the above

Answers:

(b) Capital receipt

Question 10.

The amount of depreciation becomes negligible but not zero under

(a) Straight line method

(b) Written down value method

(c) Original cost method

(d) Fixed installment method of depreciation

Answers:

(b) Written down value method

II. State whether the following statements are true or false.

1. Depreciation is charged on all assets.

2. Depreciation is not charged on any assets whose life cannot be determined.

3. The purpose of preparing provision for depreciation is to show the asset at its original cost.

4. Depreciation is charged due to changes in the market value of assets.

5. Depreciation reduces the taxable income.

6. Charging of depreciation is compulsory as per law.

7. Scrap value is not considered while calculating depreciation under diminishing balance method.

8. Depreciation due to obsolescence refers to change of technology.

9. Depreciation is also charged to find true and fair profit or loss.

10. There are more than two methods of providing depreciation.

Answers:

1. False

2. True

3. True

4. False

5. True

6. True

7. True

8. True

9. False

10. True

Ill. Fill in the blanks with correct answer.

1. If the credit side of the trial balance is greater than the debit balance, the susupense account will have ______ balance.

2. Depreciation provides funds for ____

3. Scrape value of asset refers to the ____ of the asset that is expected to be realized on the expiry of its useful.

4. Temporary rise or decline in the market value of assets is called _____

5. Depreciation is not charged on _____ and _____ assets.

6. Reduction in the value of intangible assets is known as _____

Answers:

1. Debit

2. Replacement

3. Amount life

4. Fluctuation

5. Land/ current

6. Amortization