RBSE Solutions for Class 11 Economics Chapter 8 Index Numbers

Rajasthan Board RBSE Solutions for Class 11 Economics Chapter 8 Index Numbers Textbook Exercise Questions and Answers.

Rajasthan Board RBSE Solutions for Class 11 Economics in Hindi Medium & English Medium are part of RBSE Solutions for Class 11. Students can also read RBSE Class 11 Economics Important Questions for exam preparation. Students can also go through RBSE Class 11 Economics Notes to understand and remember the concepts easily.

RBSE Class 11 Economics Solutions Chapter 8 Index Numbers

RBSE Class 11 Economics Index Numbers Textbook Questions and Answers

Question 1.

An index number which accounts for the relative importance of the items is known as:

(i) weighted index

(ii) simple aggregative index

(iii) simple average of relatives

Answer:

(i) An index number which accounts for the relative importance of the items is known as weighted index.

Question 2.

In most of the weighted index numbers the weight pertains to:

(i) base year

(ii) current year

(iii) both base and current year

Answer:

(i) In most of the weighted index numbers the weight pertains to base year.

Question 3.

The impact of change in the price of a commodity with little weight in the index will be:

(i) small

(ii) large

(iii) uncertain

Answer:

(i) The impact of change in the price of a commodity with little weight in the index will be small.

Question 4.

A consumer price index measures changes in:

(i) retail prices

(ii) wholesale prices

(iii) producers prices

Answer:

(i) A consumer price index measures changes in retail prices.

Question 5.

The item having the highest weight in consumer price index for industrial workers is:

(i) Food

(ii) Housing

(iii) Clothing

Answer:

(i) The item having the highest weight in consumer price index for industrial workers is food.

Question 6.

In general, inflation is calculated by using:

(i) wholesale price index

(ii) consumer price index

(iii) producers price index

Answer:

(i) In general, inflation is calculated by using wholesale price index.

Question 7.

Why do we need an index number?

Answer:

Index number is needed due to the following reasons:

(i) An index number is helpful in negotiation of wage, formulation of policies related to income, price, rent control, taxation and other general economic issues.

(ii) It is used for measuring the rate of inflation.

(iii) It helps in eliminating the effect of price changes on national level aggregates such as national income, capital formation, etc.

(iv) An index number is used in calculating the purchasing power of money and real wages.

(v) Index of industrial and agricultural production gives a quantitative figure about the change in production and performance in the respective sectors.

(vi) Sensex is an index related to stock market, which serves as a useful guide for investors.

Question 8.

What are the desirable properties of the base period?

Answer:

The following are the desirable properties of the base period:

(i) The base period should be as normal as possible, that is, it should be free from wars, earthquakes, floods or any other natural calamity.

(ii) The base period should also not belong to too far in the past.

(iii) The base period for any index number should be routinely updated.

Question 9.

Why is it essential to have different CPI for different categories of consumers?

Answer:

It is essential to have different CPI for different categories of consumers because the items are not equally important for different groups of consumer. For example, the rise in the petrol price may not directly impact the living condition of the poor agricultural labourers. Therefore, the items to be included in any index have to be selected carefully. Only then a meaningful picture of the change can be obtained.

Question 10.

What does a consumer price index for industrial workers measure?

Answer:

A consumer price index for industrial workers measures their purchasing power of money and real wage. In India, the CPI for industrial workers is published by Labour Bureau, Shimla. The Weight Scheme in CPI for industrial workers (1982 = 100) is followed by major commodity groups. In this scheme, food has the largest weight. Food being the most important category, rise in the food price will have a significant impact on CPI. This also verifies the frequent statement of government that oil price hike will not be inflationary.

Question 11.

What is the difference between a price index and a quantity index?

Answer:

Price index measures and facilitates comparison of the prices of certain goods. Quantity index, on the other hand, measures the changes in the physical volume of production, construction or employment. Though price index is more widely used in comparison to quantity index, quantity index is an important indicator to measure the output level in the economy.

Question 12.

Is the change in any price reflected in a price index number?

Answer:

Change in any price is not reflected in a price index number. The prices of all goods and services do not change at the same rate. Thus, a price index only reflects the average movement.

Question 13.

Can the CPI number for urban non-manual employees represent the changes in the cost of living of the President of India?

Answer:

The CPI number for urban non-manual employees in India is constructed by assuming the year 1984-85 as base year which is routinely updated every month to analyse the impact of changes in the retail price on the cost of living of these broad categories of consumers.

The Central Statistical Organisation publishes the CPI number of urban non-manual employees. This is necessary because their typical consumption baskets contain many dissimilar items. The President of India is also a distinguished urban consumer. As a result, the CPI number for urban non-manual employees also represents the changes in the cost of living of the President of India.

Question 14.

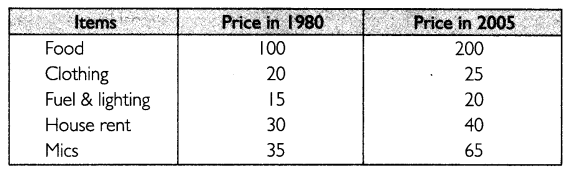

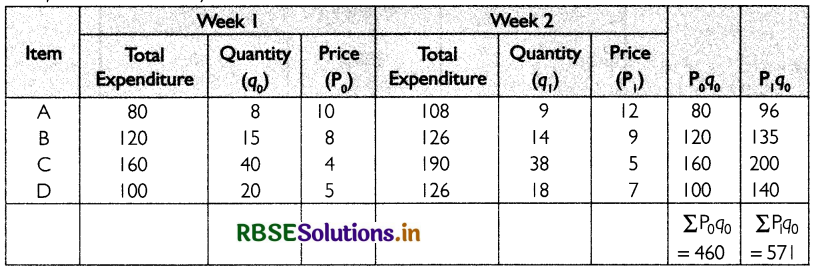

The monthly per capita expenditure incurred by workers for an industrial centre during 1980 and 2005 on the following items are given below.The weights of these items are 75, 10,5,6 and 4 respectively. Prepare a weighted index number for cost of living for 2005 with 1980 as the base.

Answer:

The table below shows the calculations to find out the weighted index number for cost of living for 2005.

Thus, the weighted index number for cost of living for 2005 with 1980 as the base is 184.59.

Question 15.

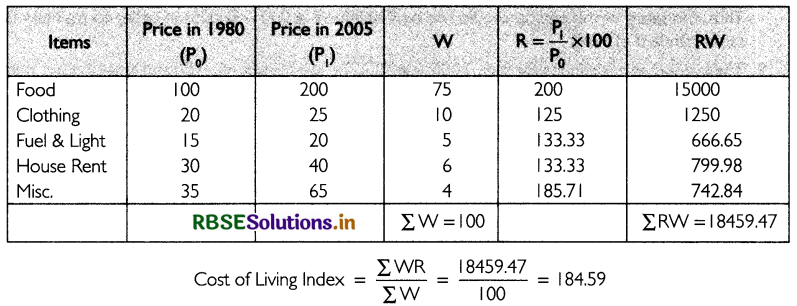

Read the following table carefully and give your comments.

Answer:

It is evident from the above table that the growth rates are different in different industries. The growth rate in manufacturing industry is highest whereas the growth rate in mining and quarrying is the lowest among all the industries. Every industry is assigned different weights. Among these industries the weight of the manufacturing is the highest while the weight of the electricity is the lowest. Growth rate of the manufacturing is more as compared to mining, quarrying and electricity.

Question 16.

Try to list the important items of consumption in your family.

Answer:

Some important items of consumption in a family are:

(i) Food

(ii) Housing

(iii) Clothing

(iv) Fuel and Light

(v) Education

(vi) Health

(vii) Transportation

(viii) Entertainment

(ix) Shoes

(x) Fees and fines

(xi) Miscellaneous items

Question 17.

If the salary of a person in the base year is ₹ 4,000 per annum and the current year salary is ₹ 6,000, by how much should his salary rise to maintain the same standard of living if the CPI is 400?

Answer:

Base Year Salary = ₹ 4,000

Current Year Salary = ₹ 6,000

Price Index of the Base Year = 100

The Consumer Price Index of the Current Year is 400.

The salary of the person in the current year can be calculated as:

\(\frac{\text { Current Year's CPI }}{\text { Base Year's CPI }} \times \) Base Year's Salary = \(\frac{400}{100}\) x 4000 = 16,000

Thus, the salary of the person should rise by ₹10,000 (₹16,000 - ₹6000) in order to maintain the same standard of living.

Question 18.

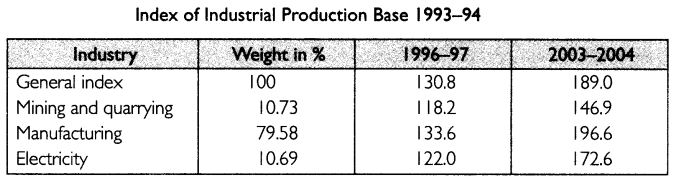

The consumer price index for June, 2005 was 125. The food index was 120 and that of other items is 135. What is the percentage of the total weight given to food?

Answer:

Suppose f be the total weight given to food. Thus, the weight given to other items would be (100 - f). The Consumer Price Index (CPI) is calculated as:

Thus, the percentage of the total weight given to food is 66.67%.

Question 19.

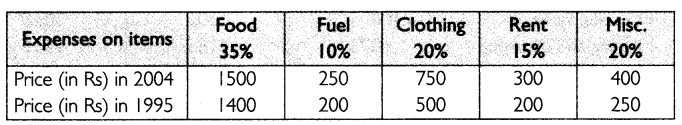

An enquiry into the budgets of the middle class families in a certain city gave the following information:

What is the cost of living index of 2004 as compared with 1995

Answer:

The table below shows the calculatons to find out the weighted index number for cost of lMng for 2004.

Cost of Living Index \(=\frac{\sum W R}{\sum W}=\frac{13449.9}{100}=134.50\)

Thus, the weighted index number for cost of living for 2004 with 1995 as the base is 134.50. That is, the cost of living index of 2004 is 34.50% higher as compared with 1995.

Question 20.

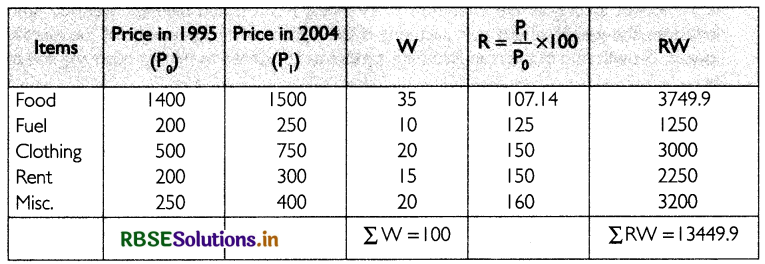

Record the daily expenditure, quantities bought and prices paid per unit of the daily purchases of your family for two weeks. How has the price change affected your family?

Answer:

The table below shows the daily expenditure, quantities bought and prices paid per unit of the daily purchases of a family for two weeks.

To find the effect of price change on the family, calculate the consumer price index as:

\(C P I=\frac{\sum P_1 q_0}{\sum P_0 q_0} \times 100=\frac{571}{460} \times 100=124.13\)

The cost of living index for Week 2 with Week I as the base is 124.13. That is, the cost of living index for Week 2 is 24.13% higher as compared with Week I.

Question 21.

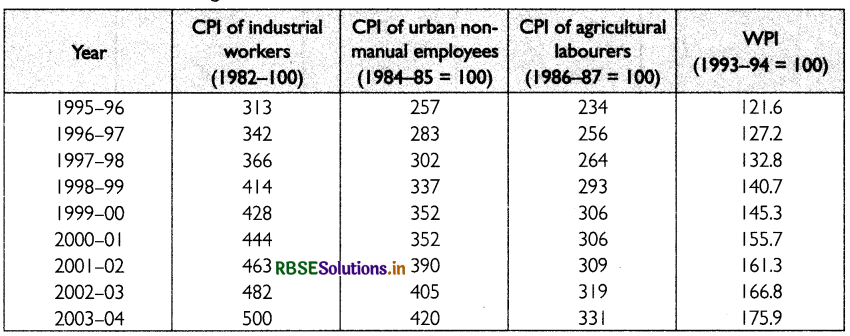

Given the following data:

Source: Economic Survey, Government of India, 2004-2005

(i) Comment on the relative values of the index numbers.

(ii) Are they comparable?

Answer:

(i) From the year 1995-96 to 2003-04, CPI of industrial workers is the highest while the wholesale price index is the lowest. It is important to mention here that different index numbers have different base years. For the industrial workers it is 1982 = 100, for agricultural labourers it is 1986-87 = 100 and for WPI it is 1993-94 = 100.

(i) Different index numbers are not comparable because they have different base year.

Question 22.

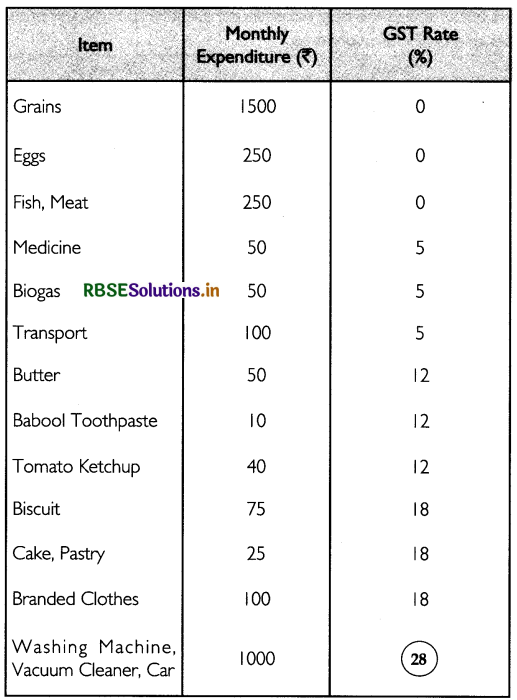

A family’s monthly expenditure on some important items and the Goods and Services Tax (GST) applicable on them is as follows:

Calculate the average tax rate for this family.

Answer:

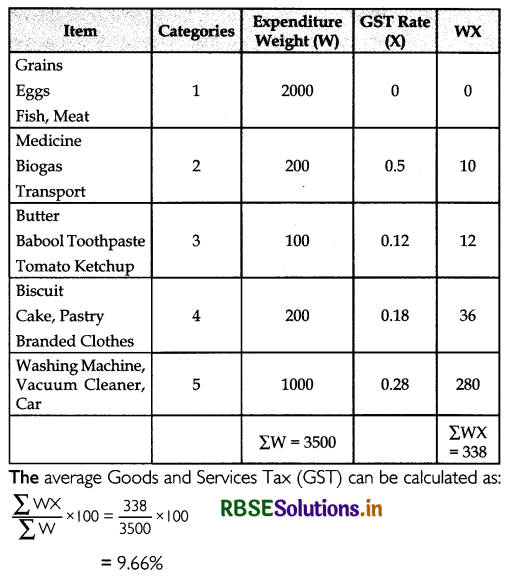

The formula for weighted mean is used to estimate the average Goods and Services Tax (GST) rate for the family. Here, the total expenditure on each category of items is the weight. And hence, the total weight is equal to the total expenditure by the family.

- RBSE Class 11 Economics Important Questions Chapter 9 पर्यावरण और धारणीय विकास

- RBSE Class 11 Economics Important Questions Chapter 3 Organisation of Data

- RBSE Class 11 Economics Important Questions Chapter 2 Collection of Data

- RBSE Class 11 Economics Important Questions Chapter 4 Presentation of Data

- RBSE Class 11 Economics Important Questions Chapter 1 Introduction to Statistics for Economics

- RBSE Class 11 Economics Important Questions Chapter 6 Measures of Dispersion

- RBSE Class 11 Economics Important Questions in Hindi & English Medium

- RBSE Class 11 Economics Important Questions Chapter 8 Index Numbers

- RBSE Class 11 Economics Important Questions Chapter 7 Correlation

- RBSE Solutions for Class 11 Economics in Hindi Medium & English Medium

- RBSE Class 11 Economics Important Questions Chapter 5 Measures of Central Tendency