RBSE Solutions for Class 11 Accountancy Chapter 4 Recording of Transactions-II

Rajasthan Board RBSE Solutions for Class 11 Accountancy Chapter 4 Recording of Transactions-II Textbook Exercise Questions and Answers.

Rajasthan Board RBSE Solutions for Class 11 Accountancy in Hindi Medium & English Medium are part of RBSE Solutions for Class 11. Students can also read RBSE Class 11 Accountancy Important Questions for exam preparation. Students can also go through RBSE Class 11 Accountancy Notes to understand and remember the concepts easily.

RBSE Class 11 Accountancy Solutions Chapter 4 Recording of Transactions-II

RBSE Class 11 Accountancy Recording of Transactions-II Textbook Questions and Answers

Simple Cash Book

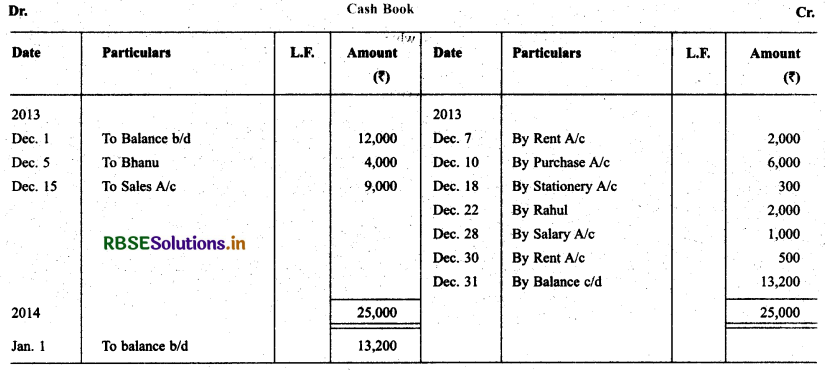

1. Enter the following transactions In a simple cash book for December 2013:

01 Cash In hand -- ₹ 12,000

05 Cash received from Bhanu -- ₹ 4,000

07 Rent Paid -- 2,000

10 Purchased goods from Miran for cash -- ₹ 6,000

15 Sold god for cash -- ₹ 9,000

18 Purchase stationary -- ₹ 300

22 Cash paid to Rahul account -- ₹ 2,000

28 Paid salary -- ₹ 1,000

30 Paid rent -- ₹ 500

Solution:

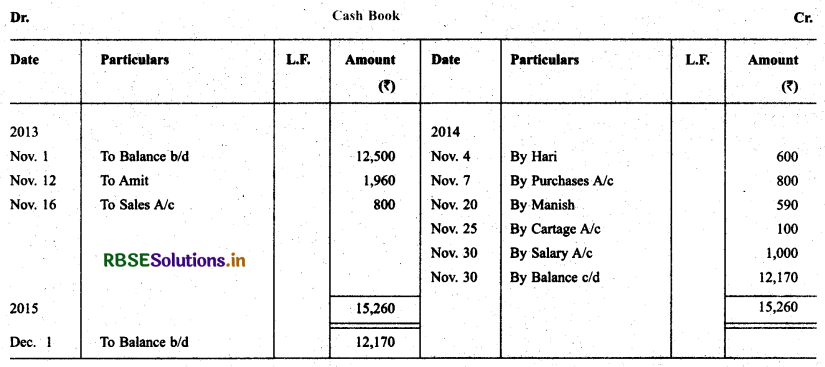

2. Record the following transactions In simple cash book for November 2014:

01 Cash in hand -- ₹ 12,500

04 Cash paid to Hail -- ₹ 600

07 Purchased goods -- ₹ 800

12 Cash received from Amit -- ₹ 1,960

16 Sold goods for cash -- ₹ 800

20 Paid to Manish -- ₹ 590

25 Paid cartage -- ₹ 100

31 Paid salary -- ₹ 1,000

Solution:

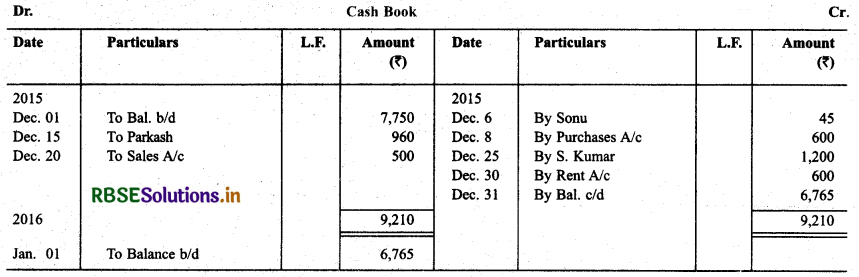

3. Enter the following transactions in Simple cash book for December 2015:

01 Cash In hand -- ₹ 7,750

06 Paid to Sonu -- ₹ 45

08 Purchased goods -- ₹ 600

15 ReceIved cash from Parkash -- ₹ 960

20 Cash saIes -- ₹ 500

25 Paid to S. Kumar -- ₹ 1,200

30 PaId rent -- ₹ 600

Solution.

Bank Column Cash Book

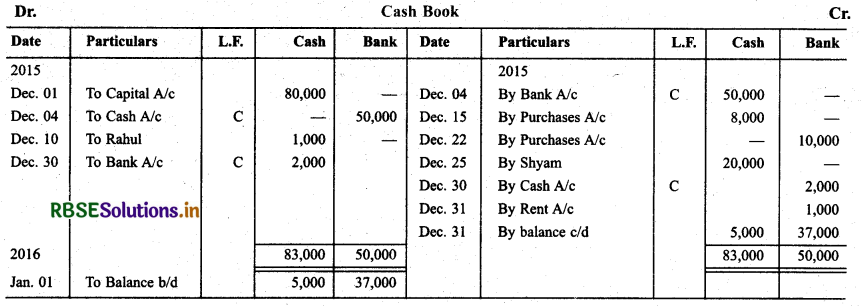

4. Record the following transactions in a bank column cash book for December 2015:

01 Started business with cash ₹ 80,000

04 Deposited in bank ₹ 50,000

10 Received cash from Rahul ₹ 1,000

15 Bought goods for cash ₹ 8,000

22 Bought goods by cheque ₹ 10,000

25 Paid to Shyam by cash ₹ 20,000

30 Drew from Bank for office use 2,000

31 Rent paid by cheque 1,000

Solution:

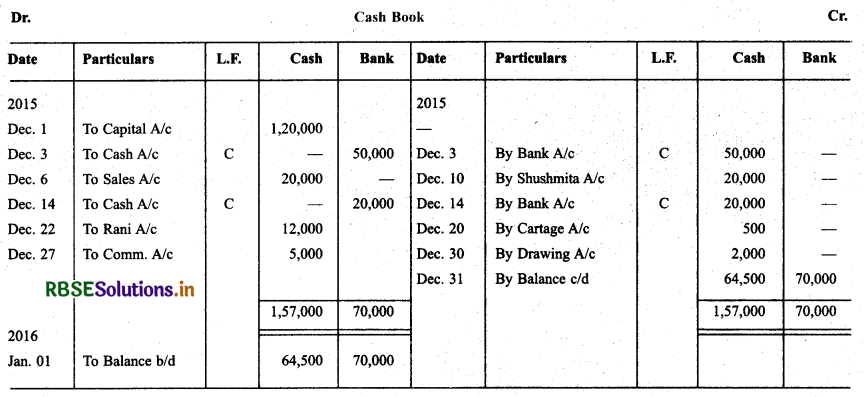

5. Prepare a double column cash book with the help of following informations for December 2015:

01 Started business with cash ₹ 1,20,000

03 Cash paid into bank ₹ 50,000

05 Purchased goods from Sushmita ₹ 20,000

06 Sold goods to Dinker and received a cheque ₹ 20,000

10 Cash Paid to Sushmita ₹ 20,000

14 Cheque received on December 06, 2015 deposited Into bank

18 Goods sold to Rani ₹ 12,000

20 Cartage paid in cash ₹ 500

22 Received cash from Rani ₹ 12,000

27 Commission received ₹ 5,000

30 Drew cash for personal use ₹ 2,000

Solution:

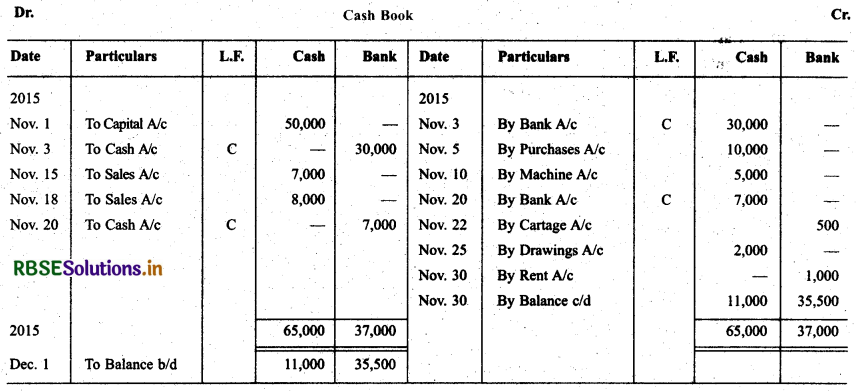

6. Enter the following transactions In a double column cash book of MIs Ambica Traders for November 2015:

01 Commenced business with cash -- ₹ 50,000

03 Opened bank account with ICICI -- ₹ 30,000

05 Purcahsed goods for cash -- ₹ 10,000

10 Purchased office machine for cash -- ₹ 5,000

15 Goods sold to Rohan and received cheque -- ₹ 7,000

18 Cash sales -- ₹ 8,000

20 Rohan’s cheque deposited Into bank -- ₹ 7,000

22 Paid cartage by cheque -- ₹ 500

25 Cash withdrawn for personal use 2,000

30 Paid rent by cheque 1,000

Solution:

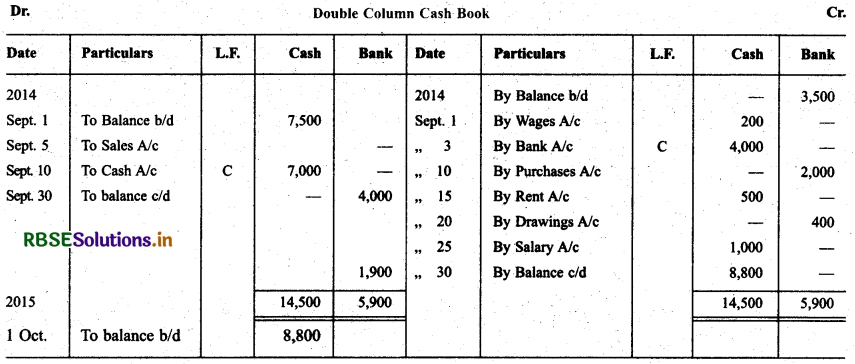

7. Prepare double column cash book from the following Informations for September 2014:

01 Cash In hand -- ₹ 7,500

01 Bank overdraft -- ₹ 3,500

03 PaId wages -- ₹ 200

05 Cash sales -- ₹ 7,000

10 Cash deposited Into bank -- ₹ 4,000

15 Goods purchased and paid by cheque -- ₹ 2,000

20 PaId rent -- ₹ 500

25 Drew cash from bank for personal use 400

30 Salary paid -- ₹ 1,000

Solution:

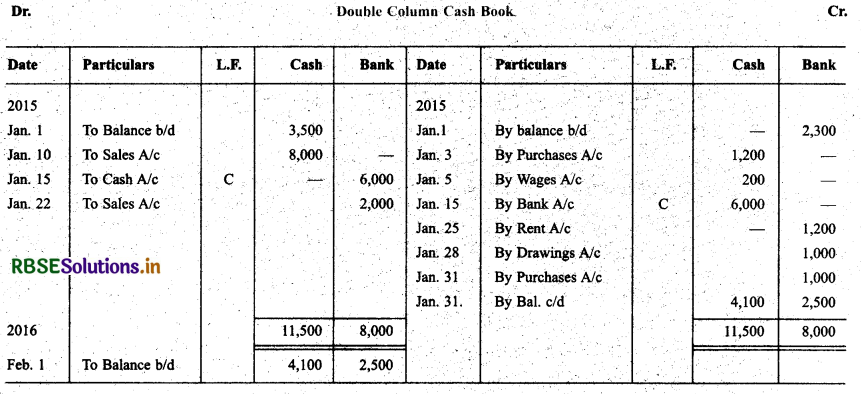

8. Enter the following transactions In a double column cash book of Mrs. Mohit Traders for January 2015:

01 Cash in hand -- ₹ 3,500

Bank overdraft -- ₹ 2,300

03 Goods purchased for cash -- ₹ 1,200

05 Paid wages -- ₹ 200

10 Cash sales -- ₹ 8,000

15 Deposited into bank -- ₹ 6,000

22 Sold goods for cheque which was deposited into bank same day -- ₹ 2,000

25 Paid rent by cheque -- ₹ 1,200

28 Drew cash from bank for personal use -- ₹1,000

31 Bought goods by cheque -- ₹ 1,000

solution:

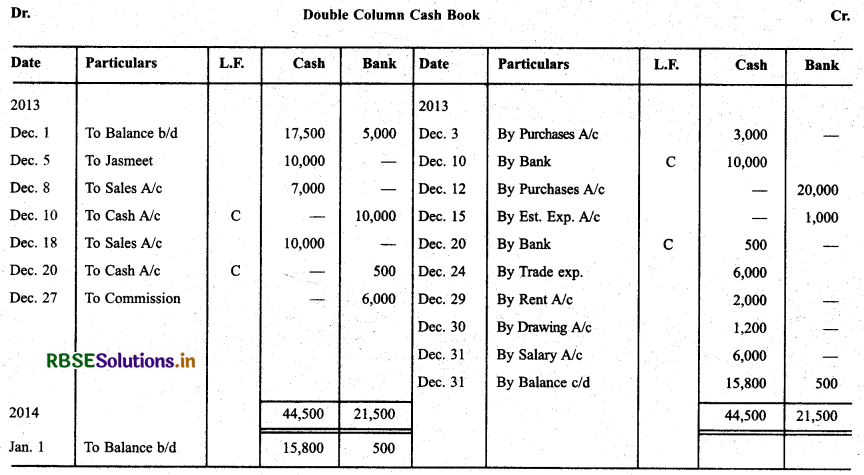

9. Prepare double column cash book from the following transactions for the year December 2013:

01 Cash in hand -- ₹ 17,500

Cash at bank -- ₹ 5,000

03 Purchased goods for cash -- ₹ 3,000

05 Received cheque from Jasmeet -- ₹ 10,000

08 Sold goods for cash -- ₹ 7,000

10 Jasmeet’s cheque deposited into bank

12 Purchased goods and paid by cheque -- ₹ 20,000

15 Paid establishment expenses through bank -- ₹ 1,000

18 Cash sales -- ₹ 10,000

20 Cash deposited Into bank -- ₹ 500

24 PaId trade expenses -- ₹ 6,000

27 Received commission by cheque -- ₹ 6,000

29 Paid rent -- ₹ 2,000

30 Withdrew cash for personal use -- ₹ 1,200

31 Salary paid -- ₹ 6,000

Solution:

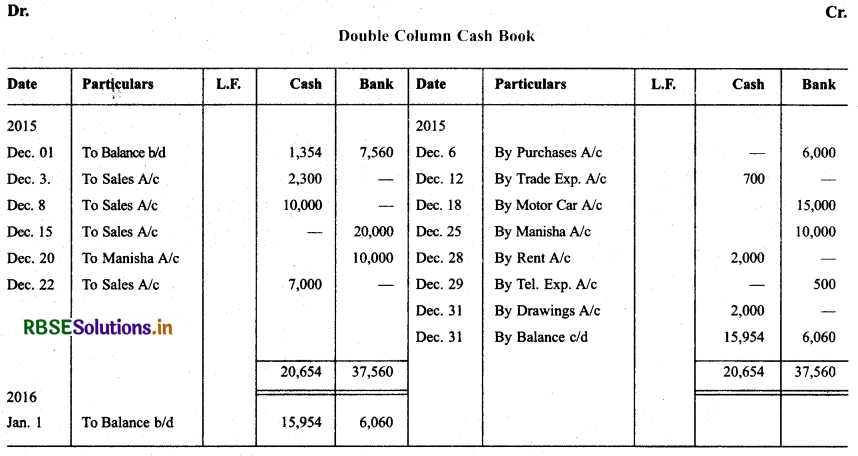

10. Mis Ruchi trader started their cash book with the following balances on Dec. 01, 2015: cash in hand 1,354 and balance In bank current account 7,560. He had the following transactions in the month of December, 2015:

03 Cash sales -- ₹ 2,300

05 Purchased goods, paid by cheque -- ₹ 6,000

08 Cash sales -- ₹ 10,000

12 Paid trade expenses -- ₹ 700

15 Sales goods, received cheque (deposited in bank on the same day) -- ₹ 20,000

18 Purchased motor car paid by cheque -- ₹ 15,000

20 Cheque received from Manisha (deposited in bank on the same day) -- ₹ 10,000

22 Cash Sales -- ₹ 7,000

25 Manisha’s cheque returned due to dishonored by bank

28 Paid Rent -- ₹ 2,000

29 Paid telephone expenses by cheque -- ₹ 500

31 Cash withdrawn for personal use

Prepare Double Column Cash Book

Solution:

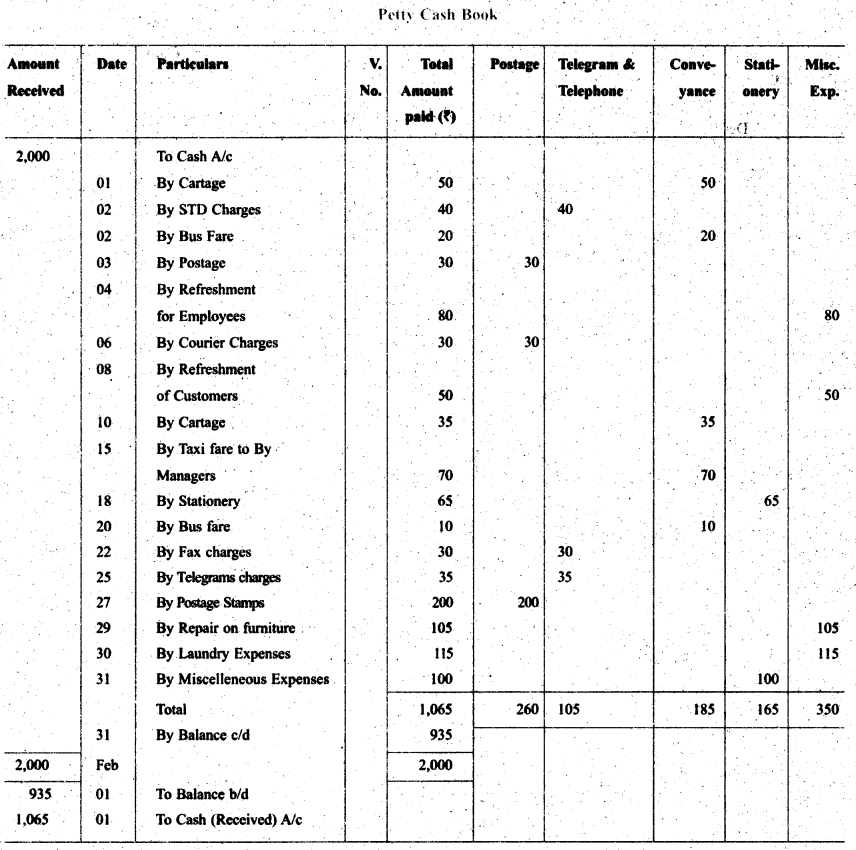

Petty Cash Book

11. Prepare petty cash book from the following transactions. The imprest amount is 2,000.

January

01 Paid cartage -- ₹ 50

02 STD charges -- ₹ 40

02 Bus fare -- ₹ 20

03 Postage -- ₹ 30

04 Refreshment for employees -- ₹ 80

06 Courier charges -- ₹ 30

08 Refreshment of customer -- ₹ 50

10 Cartage -- ₹ 35

15 Taxi fare to manager -- ₹ 70

18 Stationary -- ₹ 65

20 Bus fare -- ₹ 10

22 Fax charges -- ₹ 30

25 Telegrams charges -- ₹ 35

27 Postage stamps -- ₹ 200

29 Repair of furnIture -- ₹ 105

30 Laundry expenses -- ₹ 115

31 Miscellaneous expenses -- ₹ 100

Solution:

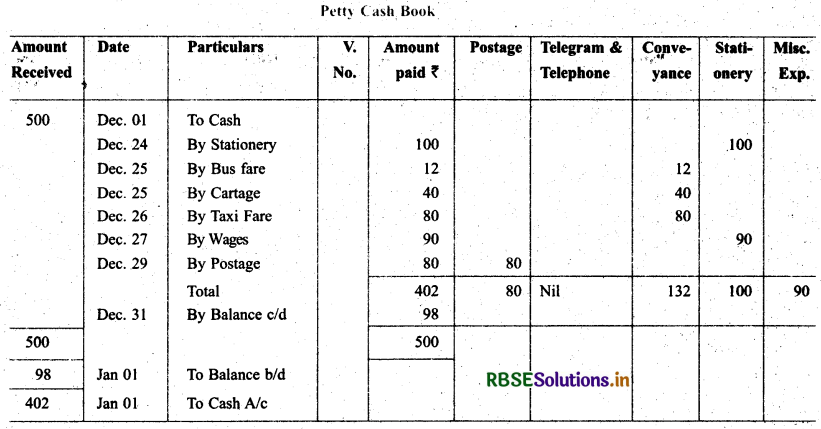

12. Record the following transactions during the week ending Dec. 2013 with a weekly Imprest ₹ 500.

24 Stationary -- ₹ 100

25 Bus fare -- ₹ 12

25 Cartage -- ₹ 40

26 Tail tare -- ₹ 80

27 Wages to casual labour -- ₹ 90

29 Postage -- ₹ 80

Solution:

Other Subsidiary Books

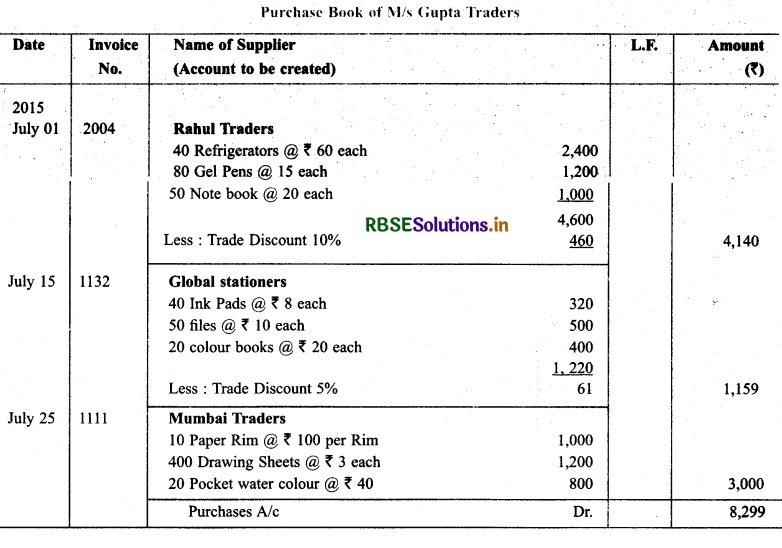

13. Enter the following transactions in the Purchase Journal (Book) of M/s Gupta Traders of July 2015:

01 Bought from Rahul Traders as per Invoke no. 2004

40 Registers @ ₹ 60 each

80 Gel Pens @ ₹ 15 each

50 note books @ ₹ 20 each

Trade Discount @ 10%

15 Bought from Global Stationers as per Invoice no. 1132

40 Ink Pads @ ₹ 8 each

50 Files @ ₹ 10 each

20 Colour Books @ ₹ 20 each

Trade Discount 5%

23 Purchased from Lambs Furniture as per invoice no. 3201

2 Chain @ 600 per chair

1 Table @1000 per table

25 Bought from Mumbai Traders as per Invoice no. 1111

10 Paper Rim @ ₹ 100 per rim

400 drawing Sheets @ ₹ 3 each

20 Packet water colour @ ₹ 40 per packet

Solution:

Note : No purchases of goods on 23 July so no journal entry will be made.

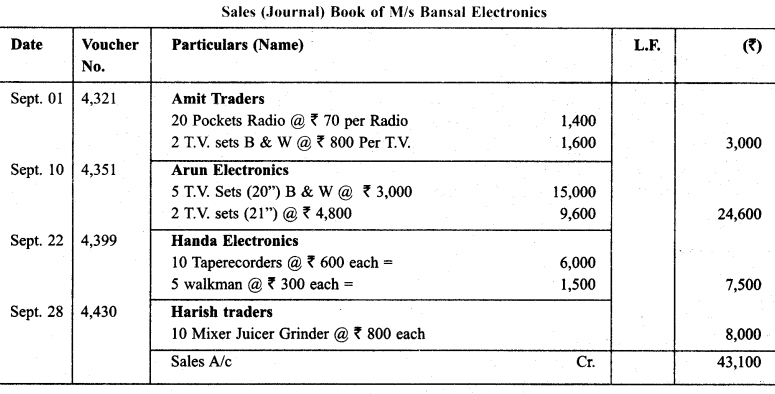

14. Enter the following transactions In sales (Journal) book of MIs. Bansal electronics:

September

01 Sold to Amit Traders as per bill no. 4321

20 Packet Radio @ 70 per Radio

2 T.V. set, B&W. @ 800 Per T.V.

10 Sold to Arun Electronics as per bill no. 4,351

5 T.V. sets (20”) B & W 3,000 per T.V.

2 T.V. sets (21”) Colour 4,800 per T.V.

22 Sold to Handa Electronics as per bill no. 4,399

10 Tape recorders @ ₹ 600 each

5 Walkman @ ₹ 300 each

28 Sold to Harish Trader as per bill no. 4,430

10 Mixer Juicer Grinder @ ₹ 800 each.

Solution:

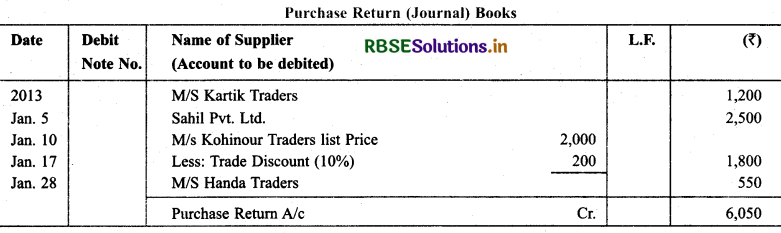

15. Prepare a purchases return (journal) book from the following transactions for January 2013:

05 Returned goods to M/s Kartik Traders -- ₹ 1,200

10 Goods returned to Sahil Pvt. Ltd. -- ₹ 2,500

17 Goods returned to MIs Kohinoor Traders for list price 2,000 less 10% trade discount.

28 Return outwards to M/s Handa Traders -- ₹ 550

Solutions:

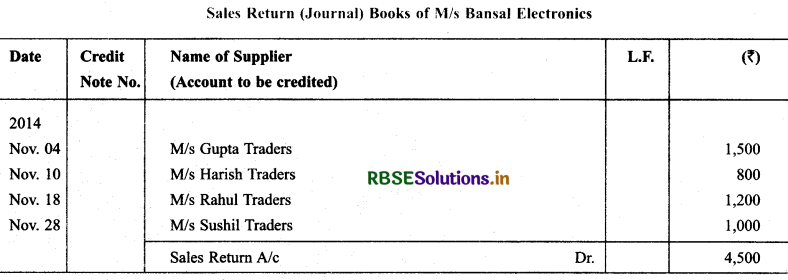

16. Prepare Return Inward Journal (Book) from the following transactions of M/s Bansal Electronics for November 2014.

04 M/s Gupta Traders returned the goods -- ₹ 1,500

10 Goods nurn from M/s Harish Traders -- ₹ 800

18 M/s Rahul Traders returned the goods not as per specifications -- ₹ 1,200

28 Goods returned from Sushil Traders -- ₹ 1,000

Solution:

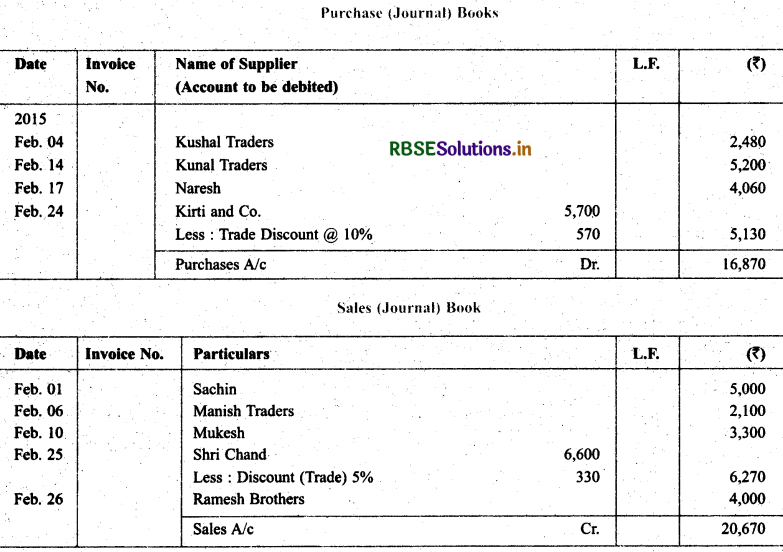

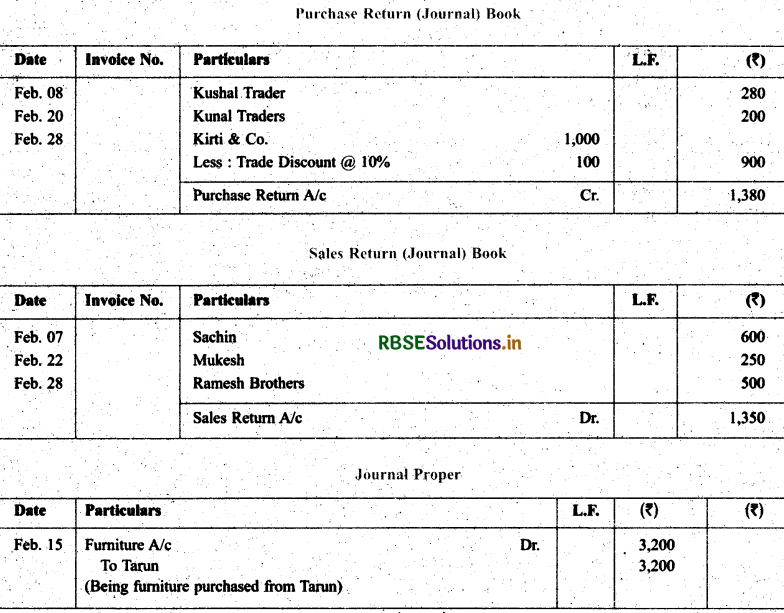

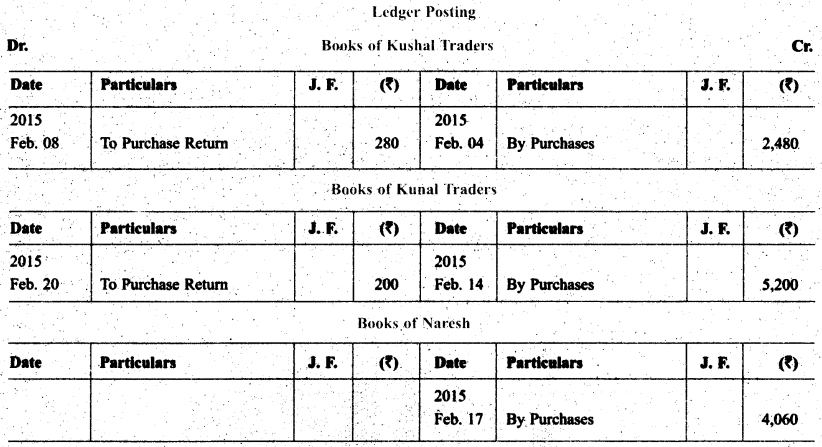

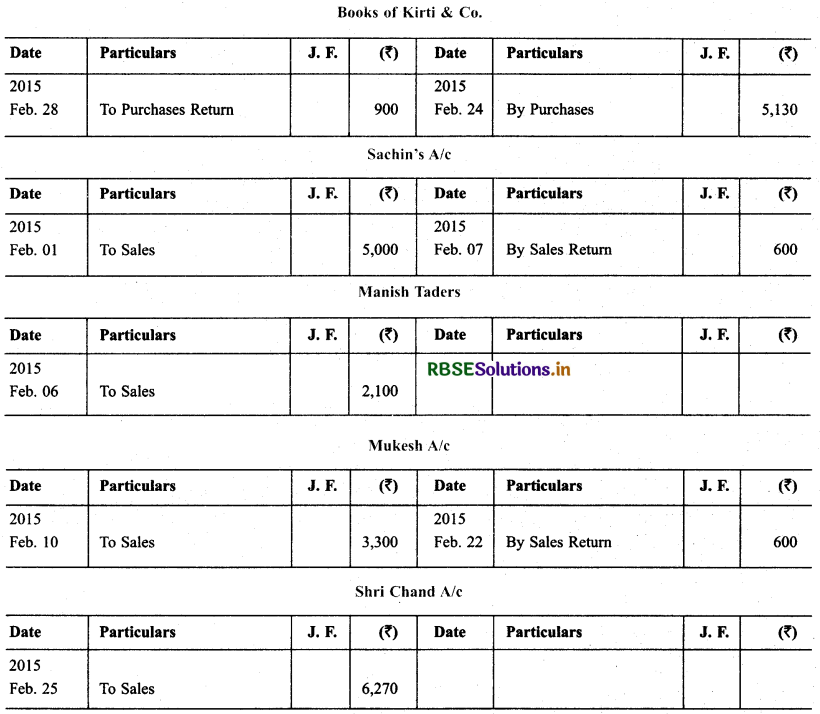

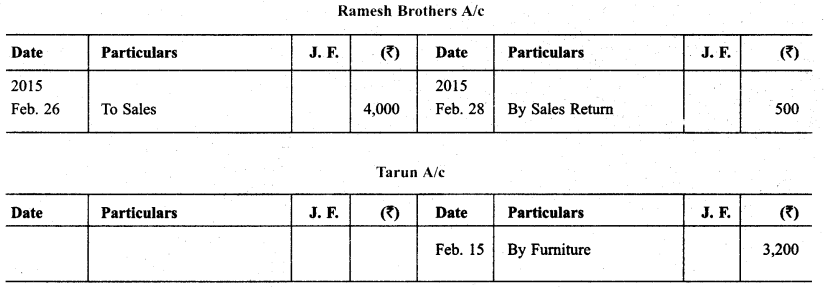

17. Prepare proper subsidiary books and post them to the ledger from the following transactions for the month of February 2015:

01 Goods sold to Sachin -- ₹ 5,000

04 Purchase from Kushal Traders -- ₹ 2,480

06 Sold goods to Manish Traders -- ₹ 2,100

07 Sachin returned goods -- ₹ 600

08 Return, to Kushal Traders -- ₹ 280

10 Sold to Mukesh -- ₹ 3,300

14 Goods Purchased from Kunat Traders -- ₹ 5,200

15 Furniture purchased from Tanin -- ₹ 3,200

17 Goods Bought from Naresh -- ₹ 4,060

20 Goods Return to Kunal Traders -- ₹ 200

22 Goods Goods Return inwards from Mukesh -- ₹ 250

24 Purchased goods from Kirti & Co. for list price of 5,700 less 10% trade discount

25 Sold to Shri Chand goods for 6,600 less 5% trade discount

26 Sold to Ramesh Brothers -- ₹ 4000

28 Return outwards to Kirti and Co. less 10% trade discount -- ₹ 1,000

28 Ramesh brothers returned goods. -- ₹ 500

Solution:

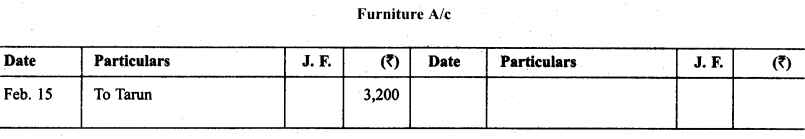

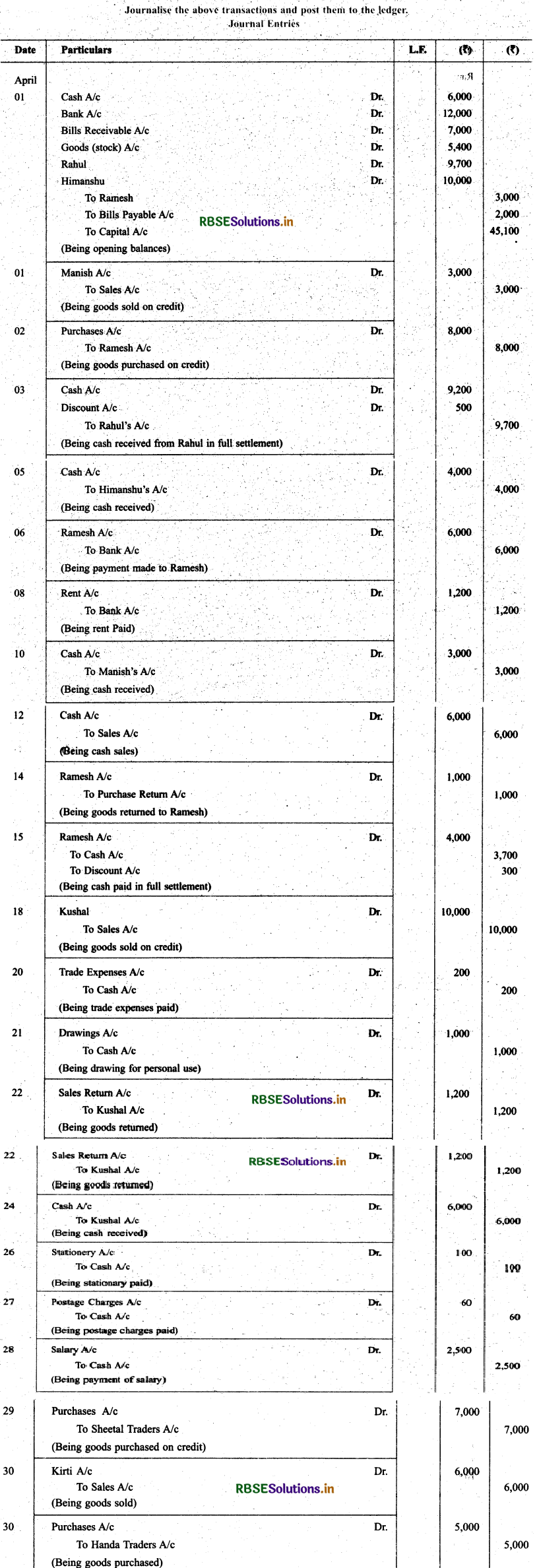

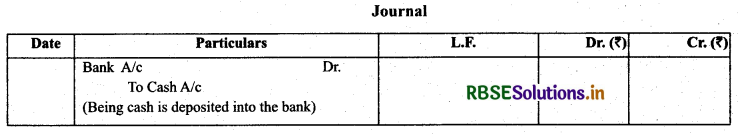

Recording, Positing and Balancing

18. The following balances of ledger of MIs Marble Traders on April 01, 2013:

Transactions during the year were: (₹)

01 Goods sold to Manish -- ₹ 3,000

02 Purchased goods from Ramesh -- ₹ 8,000

13 ReceIved cash from kabul In full settlement -- ₹ 9,200

05 Cash received from Himanshu on account -- ₹ 4,000

06 PaId to Ramesh by cheque -- ₹ 6,000

OS Rent paid by cheque -- ₹ 1,200

10 Cash received from Manish -- ₹ 3,000

12 Cash sales -- ₹ 6,000

14 Goods returned to Ramesh -- ₹ 1,000

15 Cash paid to Ramesh in full settlement -- ₹ 3,700

Discount received -- ₹ 300

18 Goods sold to Kushal -- ₹ 10,000

20 Paid trade expenses -- ₹ 200

21 Drew for personal use -- ₹ 1,000

22 goods return from Kushal -- ₹ 1,200

24 Cash received from Kushal -- ₹ 6,000

26 Paid for stationery -- ₹ 100

27 Postage charges -- ₹ 60

28 Salary Paid -- ₹ 2,500

29 Goods purchased from Sheetal Traders -- ₹ 7,000

30 Sold goods to Kirti -- ₹ 6000

Goods purchased from Handa Traders -- ₹ 5,000

Solution:

Test Your Understanding I

Select the Correct Answer

(a) When a firm maintains a cash book, it need not maintain:

(i) Journal Proper

(ii) Purchases (journal) book

(iii) Sales (journal) book

(iv) Bank and cash account in the ledger

Answer:

(iv) Bank and cash account in the ledger

(b) Double column cash book records:

(i) All transactions

(ii) Cash and bank transactions

(iii) Only cash transactions

(iv) Only credit transactions

Answer:

(ii) Cash and bank transactions

(c) Goods purchased on cash are recorded in the:

(i) Purchases (journal) book

(ii) Sales (journal) book

(iii) Cashbook

(iv) Purchases return (journal) book

Answer:

(iii) Cashbook

(d) Cash book does not record transaction of:

(i) Cash nature

(ii) Credit nature

(iii) Cash and credit nature

(iv) None of these

Answer:

(ii) Credit nature

(e) Total of these transactions is posted in purchase account:

(i) Purchase of furniture

(ii) Cash and credit purchase

(iii) Purchases return

(iv) Purchase of stationery

Answer:

(ii) Cash and credit purchase

(f) The periodic total of sales return journal is posted to:

(i) Sales account

(ii) Goods account

(iii) Purchases return account

(iv) Sales return account

Answer:

(iv) Sales return account

(g) Credit balance of bank account in cash book shows:

(i) Overdraft

(ii) Cash deposited in our bank

(iii) Cash withdrawn from bank

(v) None of these

Answer:

(ii) Cash deposited in our bank

(h) The periodic total of purchases return journal is posted to:

(i) Purchase account

(ii) Profit and loss account

(iii) Purchase returns account

(iv) Furniture account

Answer:

(iii) Purchase returns account

(l) Balancing of account means:

(i) Total of debit side

(ii) Total of credit side

(iii) Difference in total of debit & credit

(iv) None of these

Answer:

(iii) Difference in total of debit & credit

Test Your Understanding II

1. Fill in the Correct Words:

(a) Cash book is a ................... journal

(b) In Journal proper, only ...................

(c) Return of goods purchased on credit to the suppliers will be entered in ...................

(d) Assets sold on credit are entered in ...................

(e) Double column cash book records transaction relating to and....................

(f) Total of the debit side of cash book is then the credit side....................

(g) Cash book does not record the transactions....................

(h) In double column cash book ................... transactions are also recorded.

(i) Credit balance shown by a bank column in cash book is ...................

(J) The amount paid to the petty cashier at the beginning of a period is known as ...................

(k) In purchase book goods purchased on ................... are recorded.

Answers:

(d) subsidiary (b) cash (c) purchases return (d) journal proper (e) cash, bank (J) more (g) credit (h) bank (i) overdraft (j) imprest (k) credit

2. State whether the following statements are True or False:

(a) Journal is a book of secondary entry.

(b) One debit account and more than one credit account in a entry is called compound entry.

(c) Assets sold on credit are entered in sales journal.

(d) Cash and credit purchases are entered in purchase journal.

(e) Cash sales are entered in sales journal.

(f) Cash book records transactions relating to receipts and payments.

(g) Ledger is a subsidiary book.

(h) Petty cashbook is a book having record of big payments.

(i) Cash received is entered on the debit side of cash book.

(j) Transaction recorded both on debit and credit side of cash book is known as contra entry.

(k) Balancing of account means total of debit and credit side.

(l) Credit purchase of machine is entered in purchase journal.

Answers:

(a) False (b) True (c) False (d) False (e) False (f) True (g) True (h) False (i) True (j) True (k) False (l) False

Short Answer Type Questions

Question 1.

Briefly state how the cash book is both journal and a ledger.

Answer:

It is necessary for every businessman to know how much cash he has received, how many payments he has made and what the cash balance is in a particular period. For this purpose, he maintains Cash Book. Its main object is to record the transactions regarding receipt and payment of cash as well as bank. In every business cash transactions are too much and it is essential to maintain a separate book for such transactions. This book reveals the balance of cash and bank at the end of a specific period. So, there is no need to prepare separate cash account and bank account separately in the ledger.

Question 2.

What is the purpose of contra entry?

Answer:

When cash of the business is deposited in bank or cash is withdrawn from bank, then both transactions affect cash and bank column on both sides of cash book. These entries are known as contra entries. These entries are recorded to show the effect of a single entry on cash as well as on bank.

The word Contra means the other side. All Contra Entries must be denoted by letter ‘C’ in the Ledger Folio.

Question 3.

What are special purpose books?

Answer:

Every business transaction is first entered in the ‘Journal’ and then posted to the concerned Account’ in the ledger. Recording all the transactions in journal and posting them to ledger is in fact inconvenient. To avoid this inconvenience the ‘Journal’ may be sub-divided into different subsidiary books like cash book, sales book, purchase book, sales returns and purchase returns book.

Question 4.

What is petty cash book? How it is prepared?

Answer:

In big concerns, several petty expenses are made on daily basis. If these petty expenses are recorded in the main cashbook it will become too comprehensive. So, to assist the head cashier, such petty expenses are recorded in a separate book which is known as ‘Petty Cash Book’. Most of the business transactions are made by cheque but petty expenses are mostly made by cash. In the beginning of each month the petty cashier is given fixed amount to meet petty expenses.

Out of that amount the petty cashier makes payments for wages, freight, tea, rent and so on. Imprest system is used to enable the petty cashier to have a control over the payments made by him.The columns of petty cash book differ from those of the cash book. In the beginning, the amount received is entered in the column of ‘Receipts’ and we write ‘To Cash A/c’ in the column of particulars. After writing ‘By expenses’ for all the expenses made, the balance is determined at the end.

Question 5.

Explain the meaning of posting of journal entries?

Answer:

All business transactions are recorded in journal and subsidiary books as the case may be. From such journals, the transactions are transferred to their respective accounts in the ledger book. Such transfer of transactions is known as posting.

Question 6.

Define the purpose of maintaining subsidiary journal.

Answer:

The purpose of maintaining subsidiary books is served due to the following advantages:

1. Division of accounting work: As there are several subsidiary books in place of a single Journal, the work can be easily divided among many persons who can do the accounting work simultaneously.

2. Increase in efficiency: Division of work leads to specialisation, which in turn leads to increase in efficiency.

3. Prompt and accurate information: Separate registers are maintained for different types of transactions. As such information in respect of them can be easily and readily collected whenever required.

4. Saves time: From Journal each transaction is posted twice in ‘Ledger’ whereas a single entry is recorded for total of transactions from each subsidiary book. This saves time, space and labour.

Question 7.

Write the difference between return Inwards and return outwards.

Answer:

Return inwards: If goods are returned by our customers i.e., debtors, it is to be called as Return Inward or Sales Returns. It is debited in journal.

Return outward: If goods are returned by our supplier i.e., creditors to a business enterprise, it is to be called as ‘Return Outward or Purchase Return’. Return outwards is credited at the time of journal.

Question 8.

What do you understand by ledger folio?

Answer:

Ledger Folio represents the serial number of pages of original posting of transactions in books which is known as ledger.

It shows the page number of ledger where journal is transferred in the account of ledger.

Question 9.

What is difference between trade discount and cash discount?

Answer:

|

Basis |

Trade discount |

Cash discount |

|

1. Time |

It is allowed at the time of sale or purchase of goods |

It is allowed at the time actual payment if done before date of maturity |

|

2. Price |

It is allowed on the list price/marked price |

It is allowed by the receiver on the amount actual paid |

|

3. Recording |

It is recorded in the subsidiary book |

It is recorded in the journal or cash book with discount column |

Question 10.

Write the process of preparing ledger from a journal.

Answer:

Process of posting of entry from journal into ledger: Posting is the process of transferring the entries from the journal to the ledger. Posting means posting of all transactions relating to one account at a place to reach final balance at the end of a relevant period.

Steps in posting the entries

1. Open the relevant accounts in the ledger based on the transaction written in the journal.

2. Open the account debited in the journal, on the debit side of it, write ‘To (with the name of the account credited) and similarly open the account credited in the journal, on the credit side of it, write ‘By (with the name of the account debited).

3. Write the page number of journal in the folio column of ledger and similarly write the page number of ledger in the folio column of journal book.

4. Write the same amount in the account debited and account credited.

Question 11.

What do you understand by Imprest amount in petty cash book?

Answer:

Under this system, the petty cashier is reimbursed the amount he has spent for a period for which petty cash book is prepared. This helps him in maintaining the same amount for the subsequent period as he had in the beginning of such period. The fixed amount so maintained in the beginning of every fixed period remains same as originally advanced to him. Maintaining such a fixed amount in the beginning of each period is called Imprest Amount.

Long Answer-Type Questions

Question 1.

Explain the need for drawing up the special purpose books.

Answer:

The purpose of maintaining subsidiary books is served due to the following advantages:

1. Division of accounting work: As there are several subsidiary books in place of a single Journal, the work can be easily divided among many persons who can do the accounting work simultaneously.

2. Increase in efficiency: Division of work leads to specialisation, which in turn leads to increase in efficiency.

3. Prompt and accurate information: Separate registers are maintained for different types of transactions. As such information in respect of them can be easily and readily collected whenever required.

4. Saves time: From Journal each transaction is posted twice in ‘Ledger’ whereas a single entry is recorded for total of transactions from each subsidiary book. This saves time, space and labour.

Question 2.

What is cash book? Explain the types of cash book.

Answer:

Cash Book: Cash book is also known as the book of original entry. It is mainly prepared to record cash receipts and cash payments for a specific period. The cash book enables a businessman to know the balance of cash in hand and at bank at any point of time.

Types of Cash Book: Cash book is divided into two broad categories

(a) Main cash book

• Single column cash book: It is also known as simple cash book and can be prepared either for cash or bank account. Debit side records receipts of cash/cheques and credit side records payments of cash/through cheques as the case may be.

• Double column cash book: It can be prepared

(i) for cash and discount accounts,

(ii) bank and discount accounts and

(iii) cash and bank accounts.

• Three column cash book: it is prepared for cash, bank and discount account. On the debit side, cash receipts, receipts by bank and discount allowed are recorded whereas on the credit side, cash payments, payments by banks and discount receipt are recorded.

(b) Petty cash book

• Simple petty cash book: It is prepared as simple cash book. Petty cashier generally receives a fixed amount in the beginning of period which is recorded on the debit side. All small petty expenses are recorded on the credit side.

• Analytical petty cash book: In this type of petty cash book, on the payment (Credit) side, a separate column is provided for each class of most common expenses. Number of columns depends upon the nature and need of the particular business. Those expenses that are not entered in any separate column are entered in a column designated as ‘Sundry Expenses’.

Question 3.

What is contra entry? How can you deal this entry while preparing double column cash book?

Answer:

Contra Entries: Any transaction which involves cash account and bank account in which if cash account is debited then bank account is credited and vice-versa, such tranactions are called contra entries. Against such entries, the word ‘Contra’ is written in the L.F. column which indicates that these entries are recorded on the both sides of cash book and not to be recorded in the ledger. These entries are:

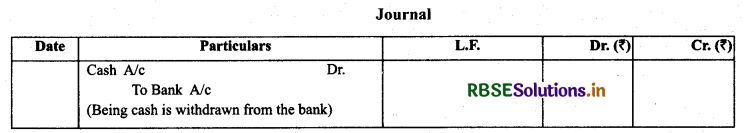

(1) When Cash is Deposited into Bank

(2) When cash is withdrawn from bank

Question 4.

What is petty cash book? Write the advantages of petty cash book.

Answer:

(a) Meaning of cash book: It is day book which is prepared to record cash receipts and cash payments. It starts with balance of cash or bank or both. It serves the purpose of journal as well as ledger means no entry of cash and bank is recorded in the journal book and no separate account is maintained for cash and bank in the ledger.

Features of cash book

1. All cash and bank transactions are recorded in cash book.

2. Receipts are recorded on debit side and payment are recorded on credit side.

3. It is based on rules of double entry system.

4. Transactions are recorded in chronological order.

5. It perform the role of both ledger and journal.

6. Format of cash book is just like ledger, cash book is balanced daily.

7. In cash book cash column must have debit balance always. It can’t have credit balance because no one can pay more than what one possesses.

Types of Cash Book

Cash book is divided into two broad categories

(a) Main cash book

Single column cash book: It can be prepared either for cash or bank account.

• Double column cash book: It can be prepared

(i) for cash and discount accounts,

(ii) bank and discount accounts and

(iii) cash and bank accounts.

• Three column cash book: it is prepared for cash, bank and discount account.

(b) Petty cash book

Simple petty cash book

• Analytical petty cash book

Note: As per syllabus, single column cash book with cash column, double column cash book with cash and bank column are being discussed.

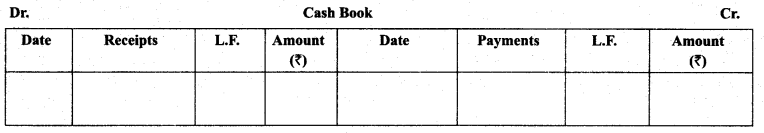

Single Column Cash Book: This book is prepared to record cash receipts and cash payments. On the debit side, all cash receipts are recorded and on the credit side, all cash payments are recorded. No, cash account is prepared in the ledger.

Format of single column cash book:

Posting in Ledger: From the debit side and credit side of it, all accounts are opened in the ledger with their respective names. When any account is opened from the debit side of it, we write ‘By Cash A/c’ on the credit side of such account and when any account is opened from the credit side of it, we write ‘To Cash A/c’ on the debit side of such account in the ledger.

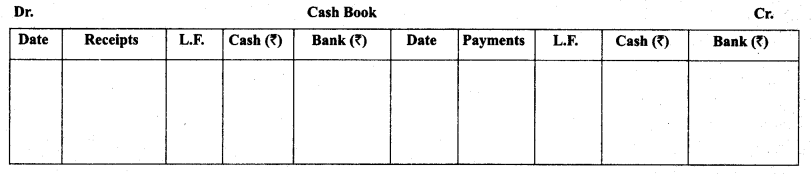

Double Column Cash Book: In double column cash book, two columns are drawn on each side of cash book, one for cash transactions and other for cheque transactions. On the debit side, cash reciepts and receipts in cheques are recorded and on the credit side cash payments and payments in cheque are recorded. This book serves the purpose of cash account, as well as bank account and no account for cash and bank, is prepared in the ledger book.

Posting in Ledger: Posting is done in the same way as is done in single column cash book. From the debit sìde, all accounts credited are opened in the ledger. On the credit side of such accounts, we write ‘By Cash A/c’ or ‘By Bank A/c’ as the cash may be. Similarly, from the credit side, all accounts debited in cash book are opened in the ledger. On the debit side of such accounts, we write ‘To Cash A/c’ or ‘To Bank A/c’ as the case may be.

Formal of Double Column Cash Rook

Question 5.

Describe the advantages of sub-dividing the Journal.

Answer:

Advantages of sub-dividing the journal:

1. It helps in detecting errors and frauds when journal is sub-divided.

2. It saves time and efforts when sub-division of journal is done.

3. Division of work among staff becomes easy.

4. It helps in increasing efficiency.

5. It details the information and make more meaningful.

6. It helps in preparing trial balance and final accounts.

Question 6.

What do you understand by balancing of account?

Answer:

Need of Balancing of an Account: At the end of each month or year it is necessary to ascertain the balance in an account. To ascertain the balance in any account, the total of two sides is ascertained and the difference is the balance.

Nature of Balance:

Dr Balance, If the credit side is greater than the debit side.

Cr Balance, If the debit side is greater than the credit side.

Steps Required to Balance any Account:

1. Total up the two sides of an account on a rough sheet.

2. Determine the difference between the two sides.

3. Put the difference as last item on the shorter side of an account.

Disclosure of Balance in Accounts:

Dr Balance: It is written on the credit side as ‘By Balance c/d’.

Cr Balance: It is written on the debit side as ‘To Balance c/d’

- RBSE Solutions for Class 11 Accountancy Chapter 5 बैंक समाधान विवरण

- RBSE Solutions for Class 11 Accountancy Chapter 4 लेन-देनों का अभिलेखन-2

- RBSE Solutions for Class 11 Accountancy Chapter 6 तलपट एवं अशुद्धियों का शोधन

- RBSE Class 11 Accountancy Important Questions in Hindi & English Medium

- RBSE Solutions for Class 11 Economics Chapter 4 Presentation of Data

- RBSE Class 11 Accountancy Important Questions Chapter 12 Applications of Computers in Accounting

- RBSE Class 11 Accountancy Important Questions Chapter 11 Accounts from Incomplete Records

- RBSE Class 11 Accountancy Important Questions Chapter 10 Financial Statements-II

- RBSE Class 11 Accountancy Important Questions Chapter 9 Financial Statements-I

- RBSE Class 11 Accountancy Important Questions Chapter 7 Depreciation, Provisions and Reserves

- RBSE Class 11 Accountancy Important Questions Chapter 6 Trial Balance and Rectification of Errors