RBSE Class 11 Accountancy Notes Chapter 3 Recording of Transactions-I

These comprehensive RBSE Class 11 Accountancy Notes Chapter 3 Recording of Transactions-I will give a brief overview of all the concepts.

Rajasthan Board RBSE Solutions for Class 11 Accountancy in Hindi Medium & English Medium are part of RBSE Solutions for Class 11. Students can also read RBSE Class 11 Accountancy Important Questions for exam preparation. Students can also go through RBSE Class 11 Accountancy Notes to understand and remember the concepts easily.

RBSE Class 11 Accountancy Chapter 3 Notes Recording of Transactions-I

Origin of Transactions:

Meaning of Business Transactions: A transaction which involves exchange of monetary consideration between buyer and seller for the goods bought or service availed.

Source documents:

Meaning of Source Document:

- An evidence which provides evidence of a transaction is called source document or voucher. Examples of source documents: Cash memo, Invoice, Sales bill, Pay-in-slip, Cheque, Salary slip etc.

- Accounting Voucher: The document which is usually based on source document and is prepared to record the business transaction in the system of accounting.

Contents of Accounting Voucher:

- It is prepared on good quality paper to preserve for longer period

- Name of the firm

- Date of transaction

- Number of voucher .

- Name of the account to be debited or credit or both as the case may be

- Description of the transaction

- Name and signature of the authorised person to approve

Types of Accounting Voucher:

There are two types of accounting vouchers. These are cash vouchers and non-cash vouchers.

Cash Voucher: A voucher which is prepared to record cash transactions is known as cash voucher. These are of two types. Debit voucher and credit voucher.

- Debit Voucher: The accounting voucher which is prepared to record cash payments. The account other than cash is debited in this voucher.

- Credit Voucher: The accounting voucher which is prepared to record cash receipts. The account other than cash is credit in this voucher.

- Non-cash Voucher: It is also known as transfer voucher. It is prepared for all those transactions which do not involve any cash or bank transaction. Examples: depreciation, credit sales. Bad debts, outstanding expenses etc. Both debit and credit accounts are mentioned in this voucher.

- Complex Voucher: It is also known as journal voucher. The voucher which multiple cash debits and cash credits is known as complex voucher.

Accounting Equation:

Meaning: It is also called as balance sheet equation as it is the equation which signifies that the sum of the assets is always equal to the sum of external liabilities and capital. This equation is based on dual aspect principle of accounting.

Assets are the resources of a business which are financed by the'Sources (claims) of proprietor and outsiders. It is read as

- Assets = Capital + Liabilities

- Capital = Assets - Liabilities

- Liabilities = Assets - Capital

Preparation of Accounting Equation: It is prepared following the principle of duality. We record the effect of a transaction in at least two accounts. The following situations may arise with different transactions:

(a) There can be increase in asset as well on the liabilities side.

(b) There can be decrease in asset as well as on the liabilities side. V

(c) There can be increase in one asset and decrease in another asset.

(d) There can increase in one liability and decrease in another liability.

(e) There can increase as well decrease in capital.

(f) There can be increase in capital and increase in asset. .

(g) There can be decease in capital and decrease in asset.

(h) There can increase in capital and decrease in liability. ,

(i) There can be decrease in capital and increase in liability.

It may be noted that in each of above transaction, the accounting equation stands balanced.

Role of Debit and Credit in Accounting:

Meaning of Debit and Credit: There are the two terms which are used to increase or decrease an account. Left side of an account is known as debit side and the right side is known as credit side. Debit is abbreviated as ‘Dr’ and credit is abbreviated as ‘Cr’. The transactions are recorded in various accounts and at the end of the financial year, closing balance of each account is known.

Rules of Debit and Credit: For the purpose of recording transactions in the system of accountancy, the accounts have been classified into two broad categories:

(a) Traditional Approach: Under this approach, the accounts have been classified into three categories. ,

(1) Personal Accounts: The accounts which are opened in the name of a person are called personal accounts. These can be classified into three main categories:

- Natural Personal Accounts: These are Ram Account, Shyam Account, Seeta Account etc.

- Artificial Personal Accounts: These are in the name of business organisations like, sole proprietorship firms, partnership firms, cooperative societies, companies etc.

- Representative Personal Accounts: These relate to outstanding expenses, prepaid expenses, accrued incomes and incomes received in advance.

Accounting Rule

Dr - The receiver

Cr - The giver

This rule implies the account of any person should be debited who receives anything from the business firm and account of any person should be credited who pays anything to the business firm.

Example: Ram sells goods to Shyam, here Shyam’s Account will be debited in the accounts books of Ram as he is the receiver.

Shaym buys gods from Sita, here Sita’s account will be credited in the accounts books of Shyam as Sita is the giver.

(2) Real Accounts: All assets accounts come under real accounts, these are mainly classified into two categories:

- Tangible Real Accounts: Land, building, plant, furniture, fittings etc.

- Intangible Real Accounts: Patents, trademarks, goodwill etc.

Accounting Rule

Dr - What comes in

Cr - What goes out

This rule implies when any asset is bought, its account should be debited and when any asset is sold, its account should be credited.

Example: Religate Limited bought machine for ₹ 20 lacs, here machine account will be debited. Cilpa Limited sold furniture for ₹ 2 lacs, here furniture account will be credited.

(3) Nominal Accounts: These accounts relate to expenses, incomes, losses and gains.

Accounting rule:

Dr-All expenses and Losses

Cr-All incomes and gains

Example: Ram paid ₹ 20,000 as salaries and received rent for ₹ 10,000. Here Salaries account will be debited as it is expense and Rent Account will be credited as it is income for the business of Ram.

(b) Modern Approach: Under this approach, accounts have been classified into five broad categories. Such categorization is also known as modem approach of classification of accounts.

Types of Accounts: Asset, Liability, Capital, Expenses/Losses, Revenue/Gains.

- For Assets/Expenses/Losses: These accounts are increased from the debit side and decreased from the credit side.

- For Liability/Capital/Revenue (Gains): These accounts are increased from the credit side and decreased from the debit side.

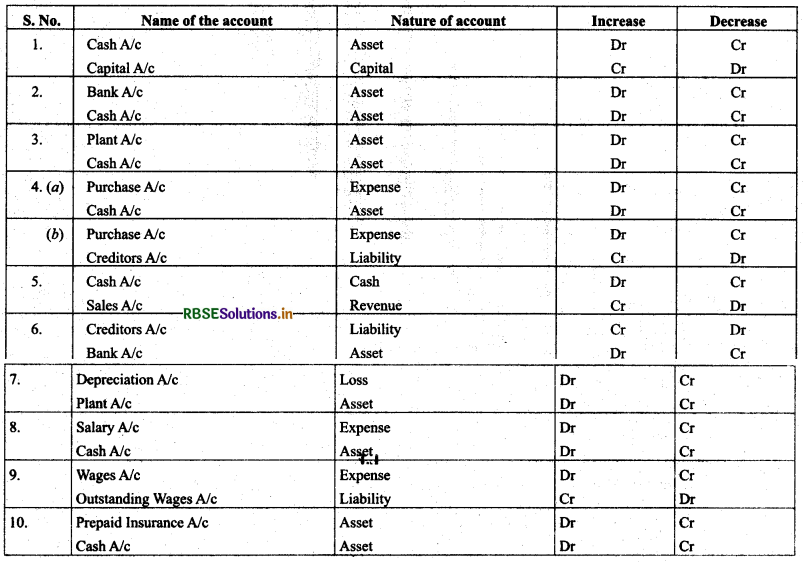

Example: Identify the accounts from the following transactions, show how they will increase and decrease.

(1) Business started with cash ₹ 5,00,000.

(2) ₹ 3,00,000 were deposited into bank account.

(3) Purchased plant for ₹ 50,000.

(4) Purchased goods for ₹ 20,000 for cash and ₹ 30,000 on account.

(5) Good costing ₹ 10,000 were sold for ₹ 15,000.

(6) ₹ 10,000 were paid to creditors through Cheque.

(7) Charge depreciation on plant @ 10 %.

(8) Paid salary for ₹ 8,000.

(9) Wages outstanding for ₹ 2,000.

(10) Insurance prepaid for ₹ 3,000.

Solution:

Books of Original Entry (Journal):

Books of Original Entry (Journal):

Meaning of journal: The book where the accounting transactions are recorded in chorological order for the first time is called journal or book of original entry. This place is known as ‘ Journal Book’ or ‘book of original entry’. From this book, the transactions are posted in various accounts.

At the end of each page, the total is carried forward (c/f) to the next page where such sum is written as ‘balance brought forward’(b/f) on the next page.

Journal is subdivided into number of books or original entry. These are cash book, other subsidiary books and journal proper.

Features of Journal

- Journal is book of original entry.

- Journal record both debit and credit aspect.

- Journal record day-to-day transaction.

- Journal is based on rules of double entry system.

- Information regarding different accounts are shown at one place.

- Journal is the basis of preparing Ledger.

- Transactions are recorded chronologically i.e. date wise.

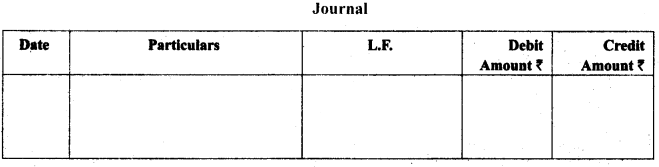

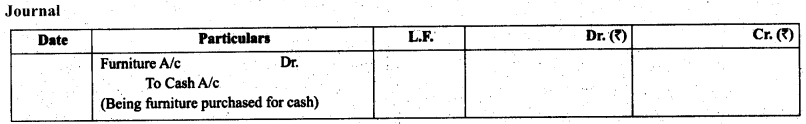

Format of Journal Journal

Parts of a journal:

- Bate: In this column, transaction in written date wise.

- Particulars: The name of the account to be debited is written in the first line and the abbreviation for Debit ‘Dr is written against it at the end in the particulars column. In the next line, the account to be credited is written preceded by the word ‘To’ after leaving some space on the left hand side in the particulars column. However, word Credit (Cr.) is not written against it. An explanation of the entry known a ‘Narration’ is also given in this column in the brackets to explain in brief this accounting journal entry.

- L.F. This column stands for Ledger Folio, which means the page number in the Ledger on which this entry is posted.

- Dr, Amount: In this column, the amount to be debited is entered against the‘Dr’. Account.

- Cr. Account: In this column, the amount to be credited is entered against the‘Cr’. Account.

Journalizing: The process of recording the transactions in this books is known as journalizing.

Journal Entry: The transaction recorded in the journal book is called journal entry. It gives complete picture of all accounts involved in a transaction with brief description known as narration.

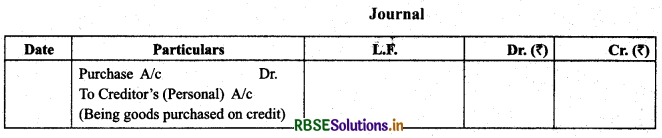

Posting: The process of transferring journal entry to various accounts is known as posting.

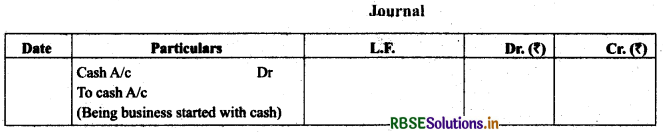

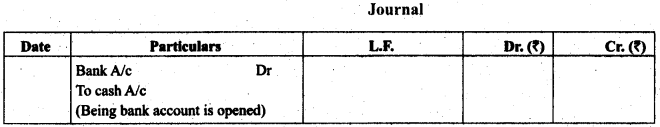

Specific entries and their treatment

(1) Starting business with cash

(2) Bank account is opened

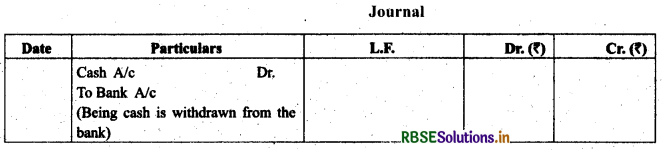

(3) Cash is withdrawn from bank for office use

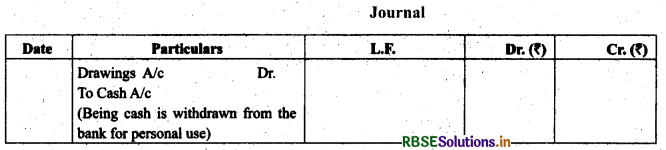

(4) Cash withdrawn from office for personal use

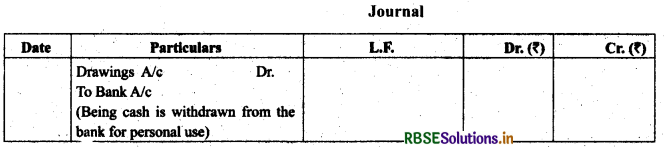

(5) Cash withdrawn for personal use through cheque

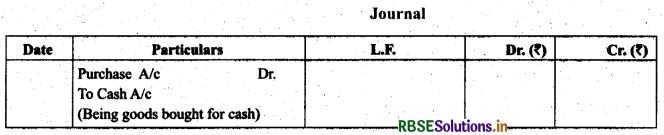

(6) Purchase of goods for cash

(7) Purchase of goods on account (credit)

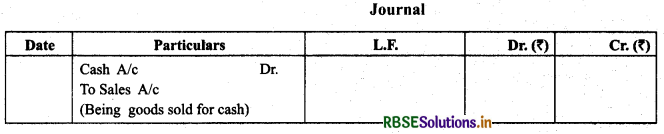

(8) Sale of goods for cash

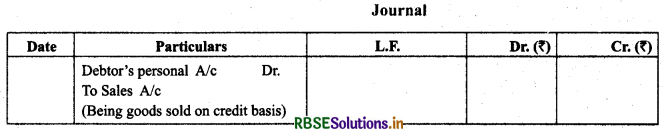

(9) Sale of goods on credit

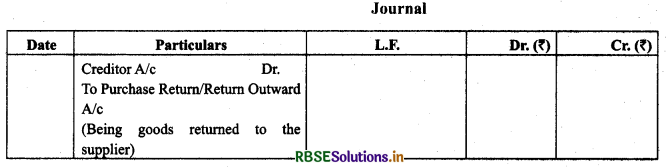

(10) Goods return to creditors

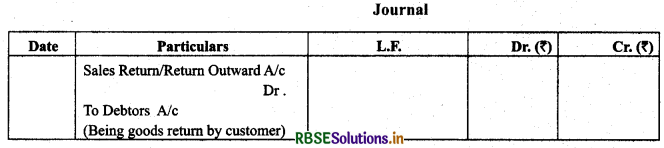

(11) Goods return by customers

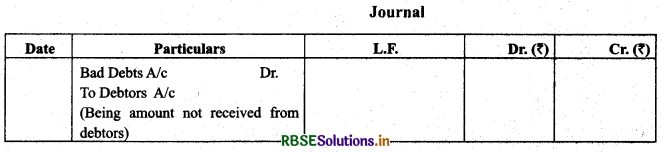

(12) When there are bad debts

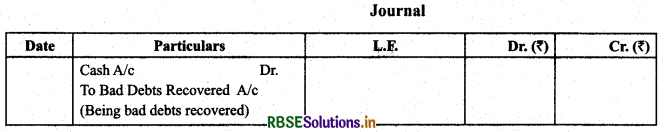

(13) When there is recovery of bad debts

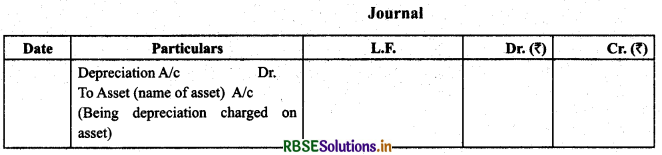

(14) When depreciation is provided on assets

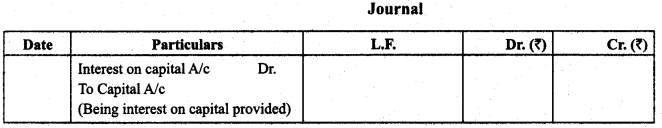

(15) Interest on capital

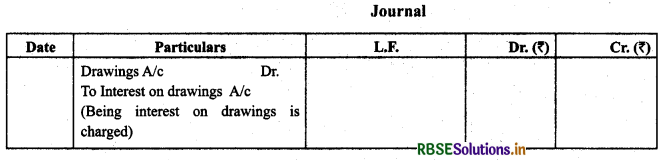

(16) Interest on drawings

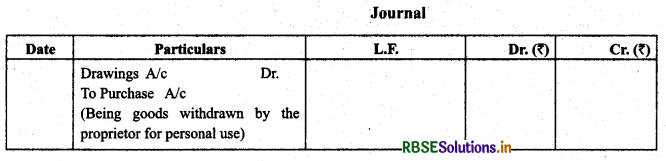

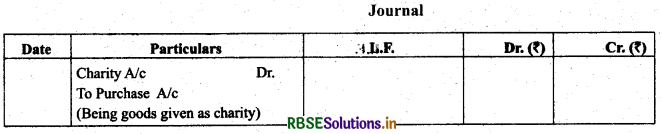

(17) Goods taken by proprietor for his personal use

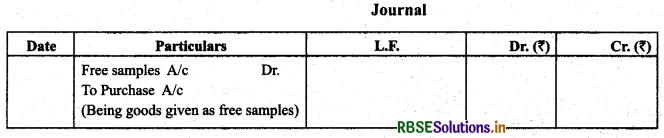

(18) Goods used as free samples

(20) Loss of goods by fire/theft

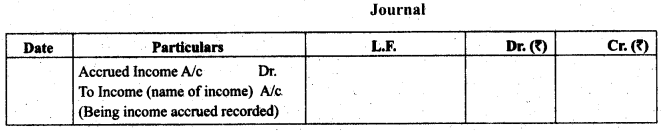

(21) Income accrued

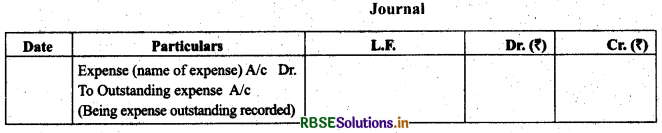

(22) Outstanding expenses

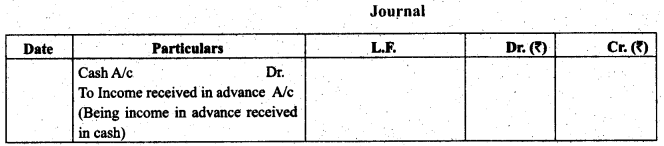

(23) Income received in advance

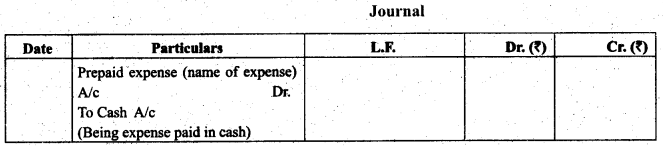

(24) Prepaid expenses

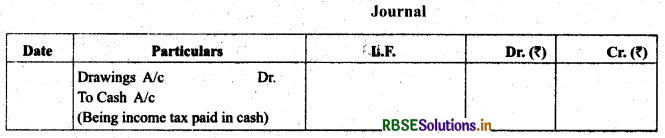

(25) Income tax paid

Transactions Related to Goods and Services Tax (GST):

GST means Goods and Service Tax. It is an indirect tax levied on sale of goods and services. This system of tax has removed earlier Central Sales Tax and Value Added Tax and others except a few. It has come into effect from July 01, 2017. The important aspect of this tax system is that it is Destination Based Tax against Origin Based Tax earlier. It means becomes the income of the government when goods or services are consumed/ availed by the ultimate consumer/user. Every payment attracts Input Tax (expense for the payer) and every receipt attracts Output Tax (liability for the recipient and income of the government). Input Tax are set off against Output Tax and balance if any is either paid off in the government treasury. The burden of tax is borne by the ultimate buyer/user of goods or services.

Tax System under GST

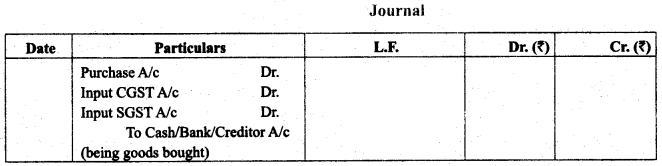

(a) Central Goods and Services Tax (CGST):It is levied by the seller/service provider on the Intra-state (within a state) sale of goods and services. It is the part of income of central government.

(b) State Goods and Services Tax (SGST): It is also levied by the seller/service provider on the Intra-state (within a state) sale of goods and services. It is part of income of the state concerned in which sales takes place.

Note: Center and State will share the tax equally on the Intra sale of goods and services.

(c) Union Territory Goods and Services Tax (UTGST)’.It is levied in place of SGST in the Union Territories.

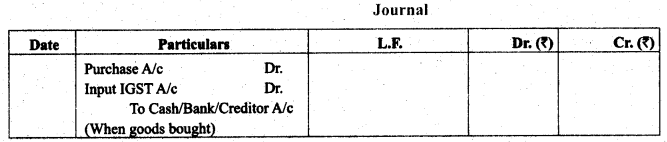

(d) I ntegrated Goods and Services Tax (IGST): It is levied on the inter-state sale of goods and services.

Rates of GST

The government has prescribed four types of rates of taxes under GST. These are 5%, 12%, 18% and 28%. There are certain goods and services have been kept under 0% Tax.

Some Items Related Items to Purchase

- Input CGST: It is paid on the intra-state purchase of goods and services. It is paid as half of the tax rate and is the income of the central government. It is subject to adjust against Output CGST or IGST.

- Input SGST: it is also paid on the intra-state purchase of goods and services. It is also paid as half of the tax rate and is the income of the state government concerned in which goods have been sold. It is subject to adjust against Output SGST.

- Input IGST: it is paid on the inter-state purchase of goods and services. It is subject to adjust against Output IGST or CGST.

Some Items Related to Sales

- 1. Output CGST: it is charged on the intra-state sale of goods and services. It is charged as half the tax rate and is the income for the central government. It is used to set off Input CGST and the balance is paid to the government.

- 2. Output SGST: ft is also charged on the intra-state sale of goods and services. It is charged as half of the tax rate and is the income for the state government in which sales takes place. It is used to set off Input SGST.

- 3. Output IGST: it is charged on the inter-state sale of goods and services. It is used to set off Input IGST, CGST and SGST.

Accounting Entries:

(1) When the goods are Purchased locally within state:

(2) When the goods are Purchased from other state

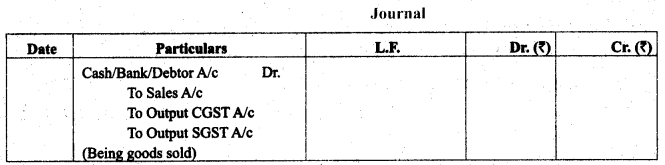

(3) When the goods are sold locally within state

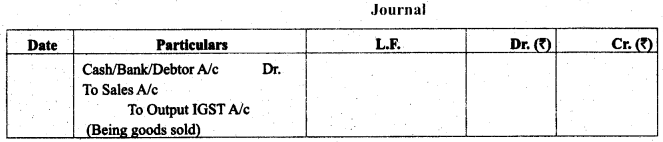

(4) When the goods are sold outside the state

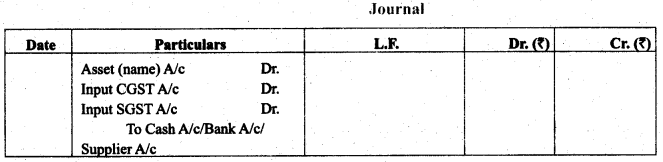

(5) When the any asset is purchased locally

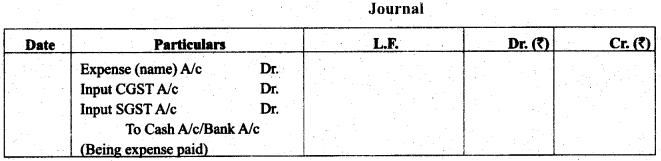

(6) When any expense is paid

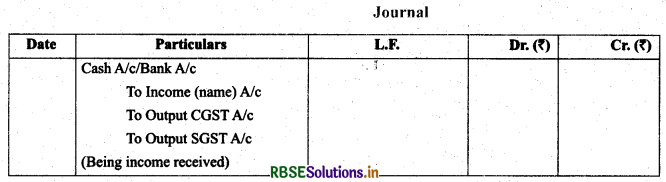

(7) When any income is received

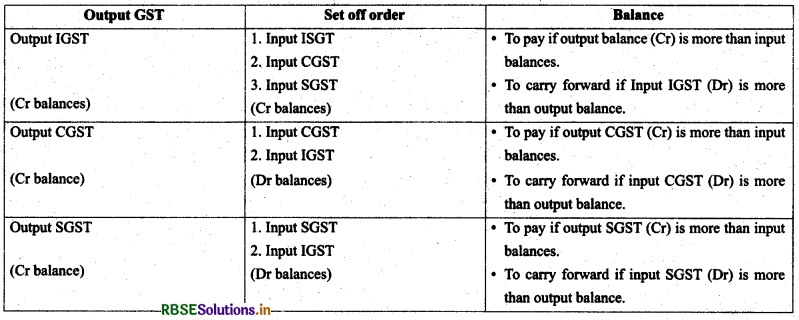

How to set off GST Paid (Input) with GST Received (Output)

GST Paid → Input GST (IGST/CGST/SGST)

GST Collected → Output GST (IGST/CGST/SGST)

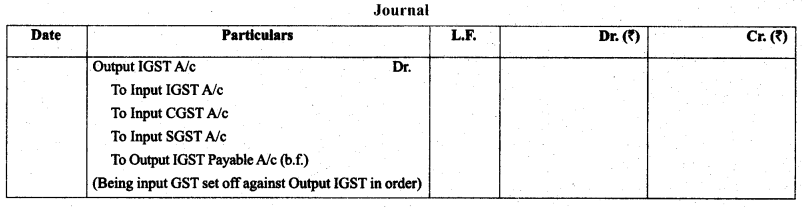

(8) When Input GST is set off in order against Output IGST

(8) When Input GST is set off in order against Output IGST

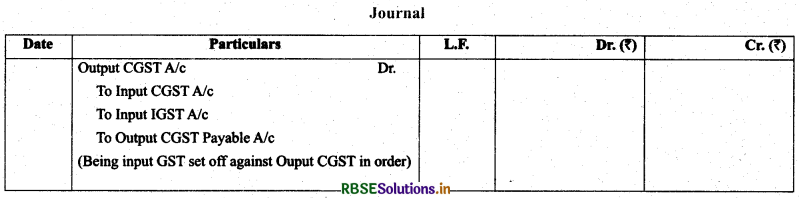

(9) When Input GST is set off in order against Output CGST

(9) When Input GST is set off in order against Output CGST

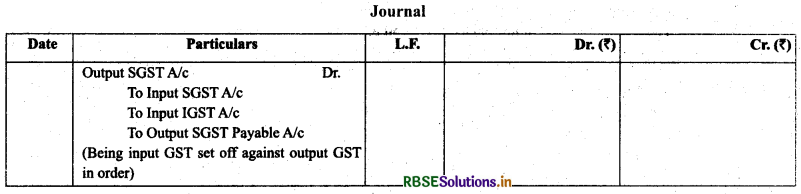

(10) When Input GST is set off against Output SGST

(10) When Input GST is set off against Output SGST

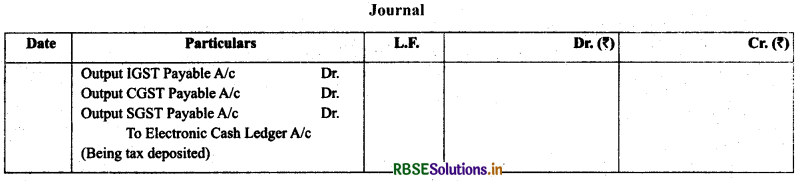

(11) When Output GST payable is transferred to electronic ledger

(11) When Output GST payable is transferred to electronic ledger

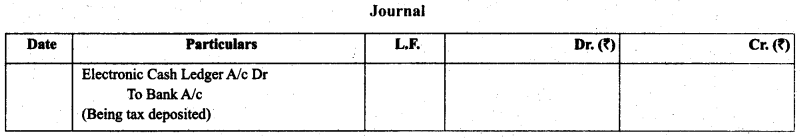

(12) When the GST Payable is paid into government treasury.

(12) When the GST Payable is paid into government treasury.

Principal Book of Entry (Ledger)

Principal Book of Entry (Ledger)

Meaning of Ledger: It contains several accounts debited or credited in the journal and in other special purpose subsidiary books. It is known as principal book of entry.

It should be noted that the transactions are recorded first in journal book or in other subsidiary books and therefrom all accounts are opened in the ledger book. The final balance of each account in the ledger is taken for further accounting process.

Features of Ledger

- It is principal book of account.

- It is classified into various account heads i.e. Asset, Liability, Expense, Income, Revenue, Capital.

- It is basis for preparing trial balance.

- It is permanent store house of all transactions.

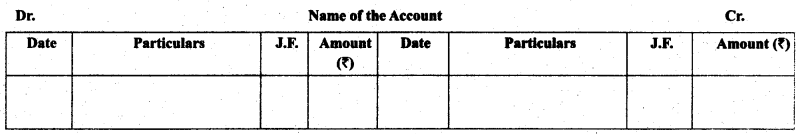

Format of ledger (Account)

Contents of an Account

- Title of the Account: It is written in the mid of the account. Title ends with suffix ‘account’.

- Date: This column recorded year, month and date on which transaction has taken place.

- Particulars: On debit side of column ‘To’ is prefixed and on credit side of column ‘By’ is prefixed.

- Journal Folio: It is relevant page number of journal from the relevant account is taken.

- Amount: The amount written in journal against debit and credit.

Posting of Entry into Ledger :

Posting is the process of transferring the entries from the journal to the ledger. Posting means posting of all transactions relating to one account at a place to reach final balance at the end of a relevant period.

Steps in Posting the Entries

- Open the relevant accounts in the ledger based on the transaction written in the journal.

- Open the account debited in the journal, on the debit side of it, write ‘To (with the name of the account credited) and similarly open the account credited in the journal, on the credit side of it, write ‘By (with the name of the account debited).

- Write the page number of journal in the folio column of ledger and similarly write the page number of ledger in the folio column of journal book.

- Write the same amount in the account debited and account credited.

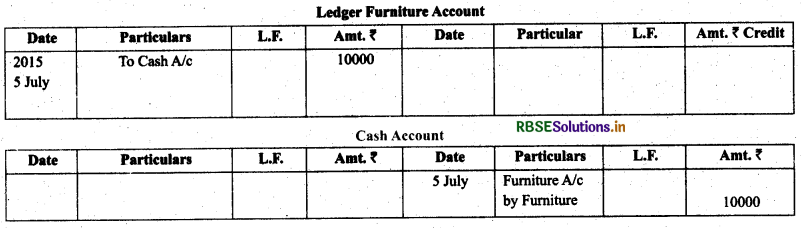

Example: Furniture costing ₹ 10,000 was purchased for cash.

The entry in the journal will be shown as follow:

Now posting in the ledger will be done as:

Now posting in the ledger will be done as:

Closing of Ledger:

At the end of a specific period, all accounts are closed. Sum of the greater side is written on both side of the account and balance on the shorter side is written as ‘Balance carried down’ or ‘Balance c/d’. If balance falls on the debit side, it means credit side is greater than the debit side and the balance in hand is known as ‘Cr Balance’ and vice-versa.

Distinguish between Journal and Ledger

|

Journal |

Ledger |

|

1. It is a Book of Original Entry |

It is Book of Final Entry. |

|

2. Each transaction is recorded in journal |

Every transaction is posted in ledger |

|

3. Narration is written with every transaction |

Narration is not written with every transaction |

|

4. Ledger folio column is performa of journal |

Journal folio column is in performa of ledger |

|

5. Journal has two columns one for debit an another for credit account |

Ledger has two sidesleft side is debit side and right side is credit side |

|

6. Journal is not balanced |

Ledger is Balanced |

|

7. Accuracy of books cannot be tested. |

Accuracy of books can be tested easily. |

- RBSE Solutions for Class 11 Accountancy Chapter 5 बैंक समाधान विवरण

- RBSE Solutions for Class 11 Accountancy Chapter 4 लेन-देनों का अभिलेखन-2

- RBSE Solutions for Class 11 Accountancy Chapter 6 तलपट एवं अशुद्धियों का शोधन

- RBSE Class 11 Accountancy Important Questions in Hindi & English Medium

- RBSE Solutions for Class 11 Economics Chapter 4 Presentation of Data

- RBSE Class 11 Accountancy Important Questions Chapter 12 Applications of Computers in Accounting

- RBSE Class 11 Accountancy Important Questions Chapter 11 Accounts from Incomplete Records

- RBSE Class 11 Accountancy Important Questions Chapter 10 Financial Statements-II

- RBSE Class 11 Accountancy Important Questions Chapter 9 Financial Statements-I

- RBSE Class 11 Accountancy Important Questions Chapter 7 Depreciation, Provisions and Reserves

- RBSE Class 11 Accountancy Important Questions Chapter 6 Trial Balance and Rectification of Errors