RBSE Class 11 Accountancy Important Questions Chapter 4 Recording of Transactions-II

Rajasthan Board RBSE Class 11 Accountancy Important Questions Chapter 4 Recording of Transactions-II Important Questions and Answers.

Rajasthan Board RBSE Solutions for Class 11 Accountancy in Hindi Medium & English Medium are part of RBSE Solutions for Class 11. Students can also read RBSE Class 11 Accountancy Important Questions for exam preparation. Students can also go through RBSE Class 11 Accountancy Notes to understand and remember the concepts easily.

RBSE Class 11 Accountancy Important Questions Chapter 4 Recording of Transactions-II

Very Short Answer Type Questions

Question 1.

What are the special journals?

Answer:

Special journals are prepared to record transactions of repetitive nature. These are also called subsidiary books.

Question 2.

How you can classify subsidiary books?

Answer:

The subsidiary books can be classified into two categories:

(a) cashbook

(b) other subsidiary books

Question 3.

why other subsidiary books are prepared?

Answer:

These are prepared to record credit transactions of goods a business organisation deals in. Example, credit sale, credit purchase, credit sales returns and credit purchase returns.

Question 4.

What is compound entry?

Answer:

The journal entry which has two or more accounts is known as journal entry.

Question 5.

what is opening entry? When it is passed?

Answer:

The balances of accounts pertaining to personal and real accounts are brought down in the various accounts in the beginning of new accounting year. For this purpose, all assets accounts are debited and all liabilities accounts including capital are credited. Such entry is known as opening entry.

Question 6.

What is trade discount?

Answer:

Trade discount is the discount which is offered when goods are purchased either for resale or purchase in large quantity.

Question 7.

What is cash discount?

Answer:

When the payment for the goods bought or sold is made before the due date, the amount waived, out of the total amount due by the recipient is known as cash discount. It is of two types:

(a) Discount allowed : It is allowed to the customer by the business firm. It is loss for the business firm.

(b) Discount received : It is allowed by the buyer to the business firm. It is gain for the business firm.

Question 8.

What is cash book?

Answer:

Cash book is a book in which all the transactions related to cash receipts and cash payments are recorded.

Question 9.

State petty cash book.

Answer:

Petty Cash Book is the book which is used for the purpose of recording expenses involving petty amounts.

Question 10.

How cash book is different from the petty cash book?

Answer:

In cash book, major amount of transactions are recorded whereas in the petty cash book, small amount of transactions are recorded.

Short Answer Type Questions

Question 1.

Name the subsidiary book in which following transactions will be recorded along with the reason thereof:

(a) Sale of goods for cash

(b) Purchase of stock on credit

(c) Purchase of furniture on credit

Answer:

(a) It will be recorded in the cash book as cash book is prepared to record cash and Cheque transactions.

(b) It will be recorded in the purchase book as it is prepared to record goods bought on credit basis.

(c) It will be recorded in the journal proper as it is prepared to record those entries which cannot be posted in any subsidiary books.

Question 2.

Differentiate between trade discount and cash discount.

Answer:

Difference between trade discount and cash discount

|

Basis |

Trade discount |

Cash discount |

|

(a) Nature |

It is offered on the list price |

It is offered on the sales price |

|

(b) Purpose |

Its purpose is to boost sales |

Its purpose is to attract early payment |

|

(c) Basis of discount |

It varies on the quantity. Huge quantity attracts higher rate. |

It varies on time period, early the period, more the rate of discount. |

Question 3.

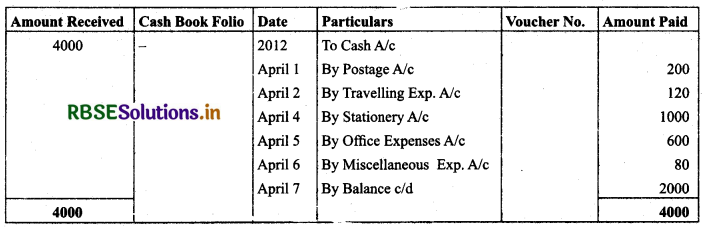

Illustration: From the following information, write up a Simple Petty Cash Book for the first week of April 2012:

|

Date |

Particulars |

(₹) |

|

2012 April 1 |

Received ₹ 4,000 from Chief Cashier for Petty Cash |

|

|

April 2 |

Bought Postage stamps |

200 |

|

April 4 |

Paid bus fare |

120 |

|

April 5 |

Purchased stationery for office use |

1000 |

|

April 6 |

Paid for milk and sugar for office tea |

600 |

|

April 7 |

Paid for window cleaner |

80 |

Solution:

Long Answer Type Questions

Cash Book Involving GST

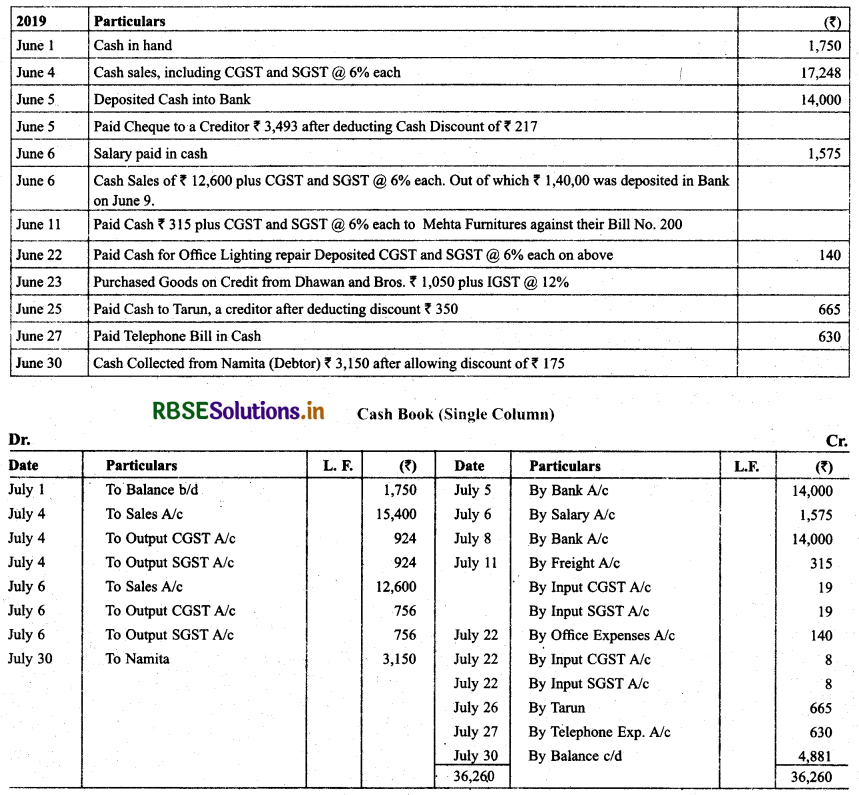

Question 1.

Prepare Single Column Cash Book for the month of June 2019, from the following transactions:

Answer:

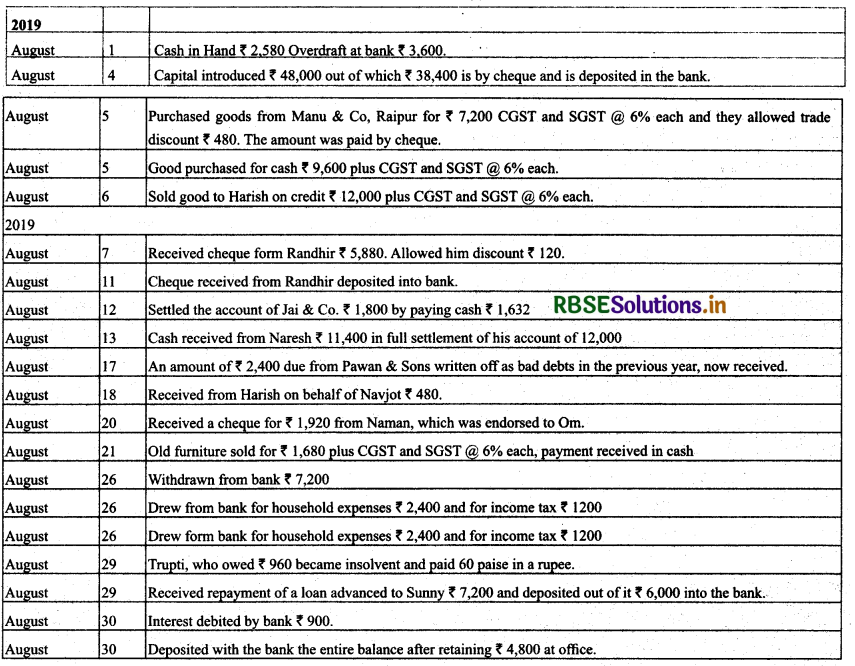

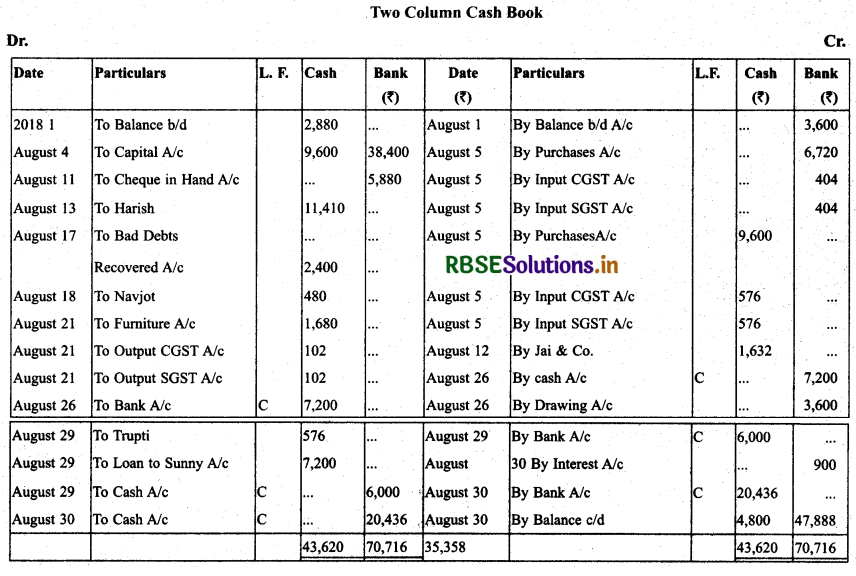

Question 2.

Prepare Double Column Cash Book for the month of June 2019, from the following transactions.

Answer:

Questions based on Other Subsidiary Books under GST

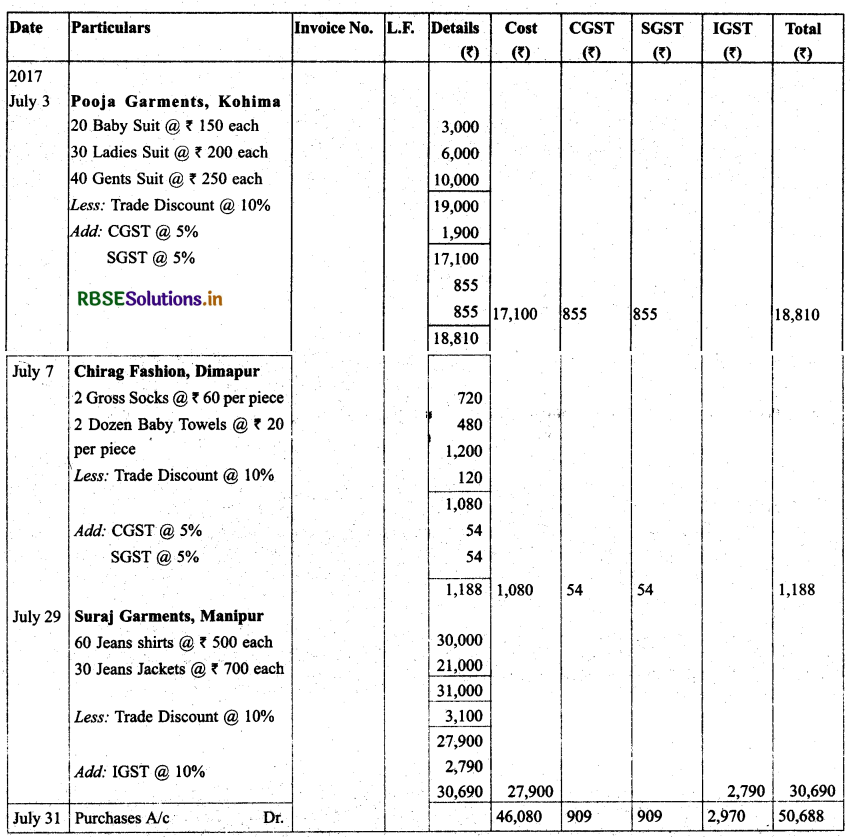

Q. Enter the following transactions in Purchases Book of M/S Fashion House Kohima for July 2017.

July 3 Purchased goods from Pooja Garments, Kohima

20 Suits (Baby) @ ₹ 150 each

30 Suits (Ladies) @ ₹ 200 each

40 Suits (Gents) @ ₹ 250 each

Trade Discount 10%

July 7 Purchased goods from Chirag Fashion, Dimapur

12 Gross Socks @ ₹ 60 per piece

2 Dozen Baby Towels @ ₹ 20 per piece

Trade Discount 20%;

July 16 Purchased goods from Mehta Stationery House, Parem

12 dozen Pencils @ ₹ 20 per dozen

1 dozen Rubber @ ₹ 3 per piece

July 29 Purchased goods from Suraj Garments, Manipur

60 Jeans Shirts @ ₹ 500 each

30 Jeans Jackets @ ₹ 700 each

Trade Discount 10%

Note : Applicable GST rates are: CGST @ 5%, SGST @ 5% and IGST @10%

Solution:

Note: Purchase made on Jan 16 has not been recorded in Purchases Book because it is not the purchase of goods.

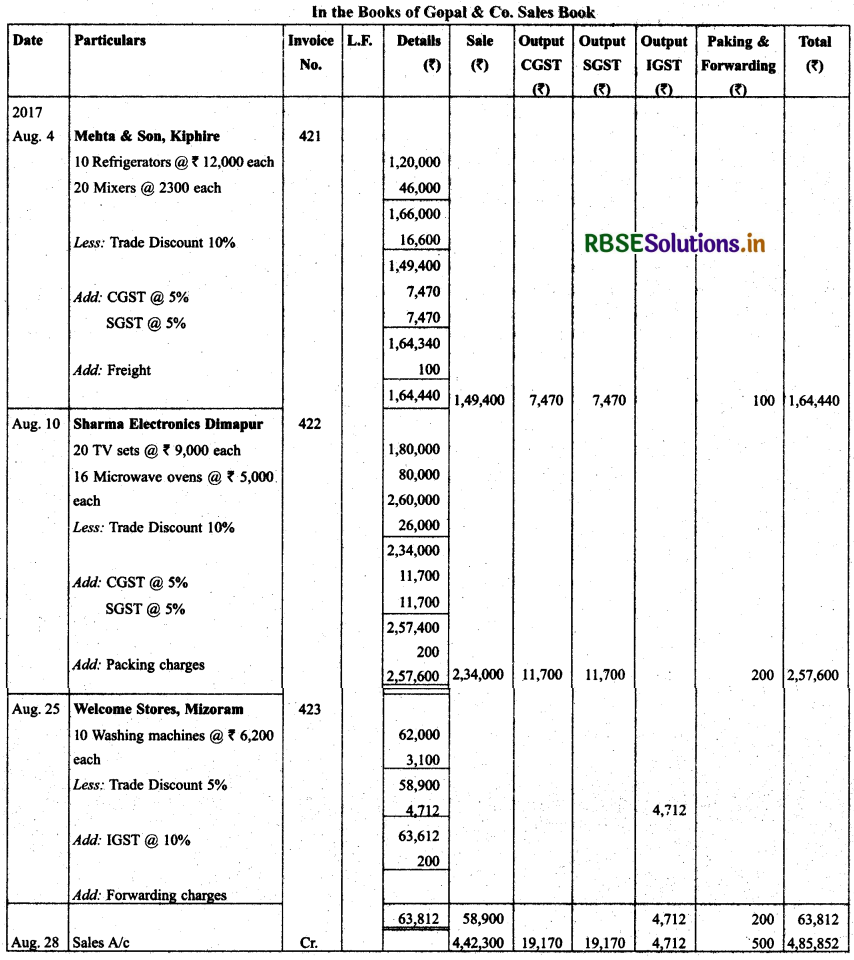

Q. From the following transactions of MIs Gopal & Co. of Nokha for the month of August 2017. Prepare Sales Book:

Aug 4 Sold to M/s Mehta & Sons, Kiphire vide Invoice No. 421:

10 refrigerators @ 12,000 per refrigerator

20 mixers @ ₹ 2,300 per mixer

Trade discount @ 10%

Freight ₹ 100

Aug. 10 10 Sold to M/s Sharma, Dimapur Electronics vide Invoice No. 422:

20 TV sets @ 9,000 per set .

16 Microwave ovens @ ₹ 5,000 per oven

Trade discount @ 10%

Packing charges ₹ 200

Aug. 15 15 Sold to M/s Gupta Stores, Mon vide Cash Memo No. 1101

10 heaters @ 150 per heater

Trade discount @ 10%

Aug. 25 25 Sold to M/s Welcome Stores, Mozoram vide Invoice No. 423

10 washing machines @ 6,200 per machine

Trade discount @ 5%, @ 8%, forwarding charges ₹ 200.

Note: Applicable GST rates are: CGST @ 5%, SGST @ 5% and IGST @ 10%

Answer:

Note: Transaction dated Feb 15 is a cash transaction. Therefore, it has not been recorded in Sales Book. It will be recorded in Cash Book.

Higher Order Thinking Skills Questions

Question 1.

What is closing entry?

Answer:

Closing entry is the journal entry which is passed attljqgfld of every accounting year to carry forward the balances of accounts.

Question 2.

Why the transactions are recorded in the journal though these are posted in the ledger later?

Answer:

All transactions are not written in the journal. The purpose of recording the transactions in the journal is to have proper summary of such accounts which cannot be recorded in any subsidiary book.

Question 3.

Rahul purchased goods worth ₹ 50,000 and received 20% trade discount and 5% cash discount. Rahul paid the due amount immediately. Find out the amount which Mohan paid.

Answer:

Mohan paid ₹ 38,000.

Question 4.

An amount is received from a debtor which was written off as bad debt in the previous year. As per rules, we credit bad debt recovered account, why we should not credit debtor’s account? State the reason.

Answer:

It is not recorded on the credit of debtor account as this amount had already been credited when the bad debt took place.

Question 5.

Shreedharan received a postdated cheque of ₹ 40,000 from Shreedevi for full payment of credit sale. Shreedharan got the cheque discounted from the bank by paying 2,000 discounting charges. The cheque was dishonoured with penalty’ of ₹1,000 because of insolvency of Shreedevi. Shreedharan got only 40% of due amount. Find out amount of loss that Shreedharan sustained.

Answer:

Amount of loss sustained by Shreedharan is ₹ 24,400.

I. Multiple Choice Questions

Question 1.

A written document in support of a transaction is called ...................

(a) receipt

(b) credit note

(c) voucher

(d) debit note

Answer:

(c) voucher

Question 2.

Purchase of machinery on credit will be recorded in ...................

(a) sales book

(b) journal proper

(c) purchases book

(d) purchase account

Answer:

(b) journal proper

Question 3.

The accounts arc prepared in which of the following book?

(a) Ledger

(b) Journal

(c) Cash Book

(d) Subsidiary Books

Answer:

(a) Ledger

Question 4.

Cash book contails ...................

(a) all cash transactions

(b) all cash and bank transactions

(c) cash as well as non cash transactions

(d) none of the above

Answer:

(b) all cash and bank transactions

Question 5.

Which of the following transactions will be considered as contra entry?

1. cash deposited into bank

2. cash withdrawal from bank

3. cash withdrawn by the proprietor from office for personal use

4. personal cash deposited by the proprietor in the office

The correct option would be

(a) 1 only

(b) 1 & 2 only

(c) 3 & 4 only

(d) None of the above

Answer:

(b) 1 & 2 only

Question 6.

Credit balance in the bank means ..............

(a) amount payable to the bank

(b) amount payable by the bank

(c) balance at bank

(d) None of the above

Answer:

(a) amount payable to the bank

Question 7.

Sales books is a ..............

(a) invoice book

(b) Journal

(c) neither invoice book nor journal

(d) with invoice book or journal

Answer:

(a) invoice book

Question 8.

Posting takes place from ..............

(a) a subsidiary book to another subsidiary book

(b) ledger to ledger

(c) from subsidiary book to ledger

(d) ledger to subsidiary books

Answer:

(c) from subsidiary book to ledger

Question 9.

Credit purchase of fixed asset would primarily be recorded in ..............

(a) cash book

(b) subsidiary book

(c) ledger book

(d) journal book

Answer:

(d) journal book

Question 10.

In order to find the total purchases of goods, one should consider

1. purchase book

2. purchase account

3. ledger

4. journal

The correct option would be ...................

(a) 1 only

(b) 1 & 2 only

(c) 3 & 4only

(d) None of the above

Answer:

(b) 1 & 2 only

II. State whether the following statements are true or false.

1. Ledger is a book that contains a permanent record of all transactions in a summarized and classified firm.

2. Journal is sub-divided into a number of special journals. These journals are called special purpose subsidiary books.

3. When a cheque is endorsed, it is entered in the cash column of cash book.

4. The sales book is prepared to record all sales.

5. When the petty cash is issued, petty cashier is debited.

6. All entries which cannot be recorded in the subsidiary books, are recorded in the journal proper.

7. GST is added in the value of purchase and sales value.

8. Under imprest system of petty cash book, petty cashier get the expenses incurred reimbursed.

9. Balances of other subsidiary books are transferred to their respective accounts.

10. Sales account includes cash as well non cash sales.

Answer:

1. True

2. True

3. False

4. False

5. False

6. True

7. False

8. True

9.True

10.True

Ill. Fill in the blanks with correct answer.

1. An account is the ______ of financial transactions of a particular head.

2. Receipt is the acknowledgement of_____ received.

3. Sub division of the journals into various books for recording transactions of similar nature are called

4. The total of purchase books is taken on the____ side of account

5. Outstanding expenses are recorded in the .

6. The balance of purchase book is taken to the _____ of purchase account.

7. Entries recorded in the ______ are not shown in the subsidiary books.

8. The returns books are prepared on the basis of_____ or _____ note.

9. Depreciation and bad debts would be recorded in the _____

10. The balance of sales return book is transferred to the _____ of_____ account.

Answers:

1. Summary

2. Cash

3. Subsidiary books

4. Debit/purchase

5. Journal proper

6. debit side

7. Journal proper

8. Debit/Credit

9. Journal proper

10. Debit/sales return

- RBSE Solutions for Class 11 Accountancy Chapter 5 बैंक समाधान विवरण

- RBSE Solutions for Class 11 Accountancy Chapter 4 लेन-देनों का अभिलेखन-2

- RBSE Solutions for Class 11 Accountancy Chapter 6 तलपट एवं अशुद्धियों का शोधन

- RBSE Class 11 Accountancy Important Questions in Hindi & English Medium

- RBSE Solutions for Class 11 Economics Chapter 4 Presentation of Data

- RBSE Class 11 Accountancy Important Questions Chapter 12 Applications of Computers in Accounting

- RBSE Class 11 Accountancy Important Questions Chapter 11 Accounts from Incomplete Records

- RBSE Class 11 Accountancy Important Questions Chapter 10 Financial Statements-II

- RBSE Class 11 Accountancy Important Questions Chapter 9 Financial Statements-I

- RBSE Class 11 Accountancy Important Questions Chapter 7 Depreciation, Provisions and Reserves

- RBSE Class 11 Accountancy Important Questions Chapter 6 Trial Balance and Rectification of Errors